-

SOLUTIONS

MANUFACTURER

NETWORKPERFORMANCEProactive network management to connect today’s consumers with automotive more efficiently.

SALESPERFORMANCEUncover what really impacts daily performance to grow market share.

AFTERSALESPERFORMANCEBring customers back to increase service retention and build long-term loyalty.

MARKETINGPERFORMANCEScientific precision to make every marketing dollar work harder.

- INSIGHT LAB

FEATURED

April 22nd, 2024Shades of Change: How Color Preferences could influence EV adoption.March 12th, 2024Charging ahead: navigating the dynamic evolution of the UK’s electric vehicle market in 2024February 21st, 2024Urban Science: U.S. automotive dealer count held steady as throughput hits post-pandemic high in 2023 - NEWSROOM

- ABOUT US

- CAREERS

- EVENTS

April 16th, 2021

AfterSales After COVID-19: A One-Year Snapshot

The rough road that was 2020.

The changes that occurred over the past 12 months in the aftersales market were unprecedented. Seemingly overnight, federal and state governments either shuttered the doors of many dealerships or forced skeleton crews to operate with greatly reduced hours and services.

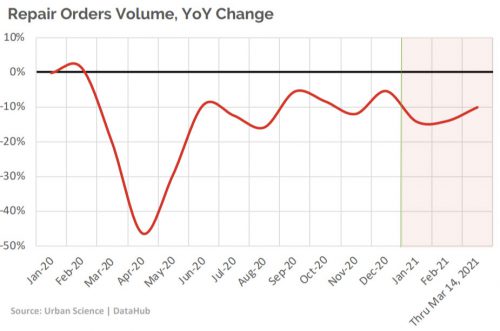

Vehicle miles traveled dropped to the lowest level in 19 years; repair orders volumes followed suit.

Although Vehicle Miles Traveled (VMT) numbers have rebounded since the 60% drop we experienced in April of last year, we are still 15% lower than where we would have been, absent a pandemic.

A similar pattern was observed in the volume of Repair Orders (RO). After hitting bottom in April 2020 (-47% year-over-year), RO volumes rebounded over the summer but still are 10-15 percent below pre-pandemic levels.

Amidst the hardships brought about by COVID-19, auto manufacturers and their dealership partners learned a number of valuable lessons, as highlighted in the recent Automotive News Fixed Ops Journal Forum. Mobile service, which before the pandemic was in a nascent stage at many dealerships, suddenly became an avenue for growing both customer relationships and profits. Better internal communications through dealership apps and increased community involvement were also cited as changes worth making permanent for the long term, as was streamlined, contactless pickup and delivery.

80% of company leaders plan to allow at least part-time remote work post-pandemic, and 47% will allow work from home full time.

The new driving divide.

Within these shifts, dealership teams came together even as the customers they served became split along what became a new driving divide: those who can work remotely, and those who can’t. Understanding how to serve both of these customer segments may be the most important lesson to be learned, coming out of the pandemic.

CUSTOMER SEGMENT #1:

THOSE WHO CAN WORK REMOTELY

Of all the workforce changes motivated by the pandemic, remote work is, arguably, the most notable. It was adopted primarily by white-collar workers who, pre-pandemic, worked in offices and commuted to work. Now, one year later, a Gartner survey of company leaders found that 80% plan to allow remote work (at least part time), and 47% will allow work from home full time.1

Furthermore, in a recent FlexJobs survey, 65% of respondents report wanting to be full-time remote post-pandemic, and 31% want a hybrid remote work environment2. If so many companies are planning such a significant change to the structure and nature of the workforce that comprise their businesses, why are VMT numbers climbing back up? The reasons are many, including the changing dynamics of who is driving – and where.

CUSTOMER SEGMENT #2:

THOSE WHO CAN’T WORK REMOTELY.

Many workers deemed “essential” faced a double setback during the pandemic: 1) they had to put themselves at risk by going to work; and 2) they often didn’t have public transportation to get them to-and-from work. The pandemic also caused a spike in goods being ordered online, which put a strain on delivery – especially on what’s deemed the “last-mile” challenge, where goods go from distribution centers to individual addresses. For example, one of Amazon’s roughly 75,000 delivery drivers, who prepandemic, made 180 deliveries in a 10-hour shift, suddenly found his quota leap to more than 300 deliveries per shift3. Although these “hidden” additional miles driven won’t show up as line items on a spreadsheet, their impact should not be underestimated.

The aftersales implications for dealership service departments are significant and, in many cases, disruptive. It means re-evaluating how to best serve those who drive the most. Dealerships’ service hours are frequently aligned with their sales departments. True, most service departments open an hour or two before the showroom – and on one or two nights offer extended hours – but for the most part, dealership service has been a daytime operation. Creating evening drop-off with morning pickup has the potential to capture the service business for those whose daylight hours must be spent driving. This includes fleets as well as ride-hailing companies and their contract workers. The question for dealerships considering this change in how they service vehicles shouldn’t be if they should do it, but whether they want to be proactive rather than being on the outside looking in.

By serving both customer segments, service departments can retain their status as the backbone of any successful dealership.

SERVICING BOTH CUSTOMER SEGMENTS.

Remote workers have grown accustomed to the new work-from-home dynamic. Regarding dealerships, many customers have tasted the new, more efficient way of doing business and they don’t want to go back4. Workers who can’t work remotely have become exhausted with the additional pressures on their workday lives. The good news for both groups: It’s been estimated that there are roughly between 300 and 600 repair jobs that techs can perform in a customer’s driveway or at a business instead of taking the vehicle back to the store5. Offering pickup and delivery is another way dealerships have taken to servicing these groups, with servicing outside of traditional working hours becoming even more common.

THE AFTERSALES UPSIDE MOVING FORWARD.

Some of the nation’s biggest dealership groups expect the service and parts business to recover in the second half of 20216.

As the vaccine rolls out and people become more comfortable with traveling, we’re going to have people back on the road again – and vehicles back in service lanes.

On the auto manufacturers’ part, they can help dealerships in their network reach their full service potential by augmenting the ways they interact with customers in three important ways:

Encouraging customer use of dealership digital tools – from scheduling to remote service. Sending a customer a text or video that shows the problem that needs attention provides the detail needed to remove doubt and build trust.7

Creating or expanding a dedicated, service-only Business Development Center. This person-to-person outreach approach can go a long way in replacing the one-to-one personal contact that was a casualty of stay-in-place orders enacted during the pandemic. It is also an excellent way to build loyalty.

Supporting dealerships in finding ways to increase service absorption levels by reviewing service cost structure, promotion, and pricing, since too many of them are still well below ideal. Today, more than ever, customers understand that dealerships9 offer a level of service above what they can get at independent repair shops – and they’re willing to pay for that expertise. The effort to continue adding value while driving efficiency must not stop.

The many lessons learned during the pandemic need to be viewed as enhancements, rather than replacements, to the tenets of sound dealership management. Despite the dramatic changes dealership aftersales encountered over the past year, service departments can – with just a few changes to their operations and a renewed dedication to their customers – retain their status as the backbone of any successful dealership operation.

The objective power of science.

It all comes back to the science. Since our founding, we’ve been a force for change. Our process of looking beyond what we know to what we discover through science continues to serve us and our clients very well. At Urban Science, we pioneered a proven, scientific approach to planning, and have continued to advance and innovate our methodology for over 40 years of automotive-industry changes and advances. It’s an approach that has stayed ahead of the technological curve to help OEMs improve the performance of their dealership networks, and continues to be the industry standard.

To learn more about optimizing your Aftersales Solutions, call or email me.

Piermichele Robazza

Solution Lead – Aftersales Solutions, Urban Science

pmrobazza@urbanscience.com

+1-313-262-3034

- Gartner: Over 80% of Company Leaders Plan to Permit Remote Work After Pandemic, HRDive, July 16, 2020, https://www.hrdive.com/news/gartner-over-80-of-company-leaders-plan-to-permitremote-work-after-pande/581744/

- Remote Work Statistics: Navigating the New Normal, FlexJobs, December 21, 2020, https://www.flexjobs.com/blog/post/remote-work-statistics/

- Amazon Delivery Drivers Are Overwhelmed and Overworked by Covid-19 Surge, July 1, 2020, https://www.vice.com/en/article/m7j7mb/amazon-delivery-drivers-are-overwhelmed-andoverworked-by-covid-19-surge

- What Will the Post-Pandemic Auto World Look Like? Motor Trend, June 22, 2020, https://www.motortrend.com/news/post-pandemic-auto-world/

- Automakers, Dealerships See Mobile Service as Investment in Customer Loyalty, Automotive News, June 14, 2020, https://www.autonews.com/fixed-ops-journal/automakers-dealerships-seemobile-service-investment-customer-loyalty

- Service Ops Revenue Down, But 2nd Half Looking Better, Wards Auto, Feb. 25, 2021, https://www.wardsauto.com/dealers/service-ops-revenue-down2nd-half-looking-better

- Dealerships Can Boost Key Fixed Absorption Metric to Survive and Thrive, Rick Popely, Feb 7, 2021, Automotive News, https://www.autonews.com/fixed-ops-journal/dealerships-can-boost-key-fixed-absorption-metric-survive-and-thrive

- Service-Only BDC Aims to Grow Business Via Outreach, Efficiency, Jim Henry, Feb 7, 2021, Automotive News, https://www.autonews.com/fixed-ops-journal/service-only-bdc-aims-grow-business-outreach-efficiency

- Don’t Leave Money on the Table; Here’s How, Ken Wysocky, Feb 7, 2021, Automotive News, https://www.autonews.com/fixed-ops-journal/dont-leave-money-table-heres-how