-

SOLUTIONS

MANUFACTURER

NETWORKPERFORMANCEProactive network management to connect today’s consumers with automotive more efficiently.

SALESPERFORMANCEUncover what really impacts daily performance to grow market share.

AFTERSALESPERFORMANCEBring customers back to increase service retention and build long-term loyalty.

MARKETINGPERFORMANCEScientific precision to make every marketing dollar work harder.

- INSIGHT LAB

FEATURED

10月 20th, 2025Urban Science To Relocate Global Headquarters To One Campus Martius10月 14th, 2025Q3 EV Retail Sales Report10月 9th, 2025Urban Science Discusses Why EV Demand Won’t Collapse Despite End of Federal Tax Credits - NEWSROOM

- ABOUT US

- CAREERS

- EVENTS

7月 31st, 2024

Hybrid vehicles in the aftersales future:

What the OEM shift to building more hybrid vehicles can mean for service departments

Download PDF

It’s no secret – hybrid vehicles are gaining traction in markets around the globe. Manufacturers are jumping off the battery-electric vehicle (BEV) bandwagon to give customers the hybrid vehicles that they want while balancing their new-vehicle portfolios with BEVs to meet tighter standards for carbon emissions.

The “all-EV” dominoes began to fall in January of this year, when GM announced it was changing its product lineup to include more plug-in hybrid electric vehicles (PHEVs).1 Shortly after, Ford announced it was significantly increasing its production and sales of hybrid vehicles. Mercedes-Benz, Volkswagen, Jaguar Land Rover and Aston Martin2 followed suit, scaling back or delaying their electric vehicle plans. And in May, Stellantis – citing “uncertain electrification trends,” committed to building a gas-hybrid version of its battery-electric Fiat 500e, while also announcing allocation of a new gas-hybrid version of the Jeep Compass.

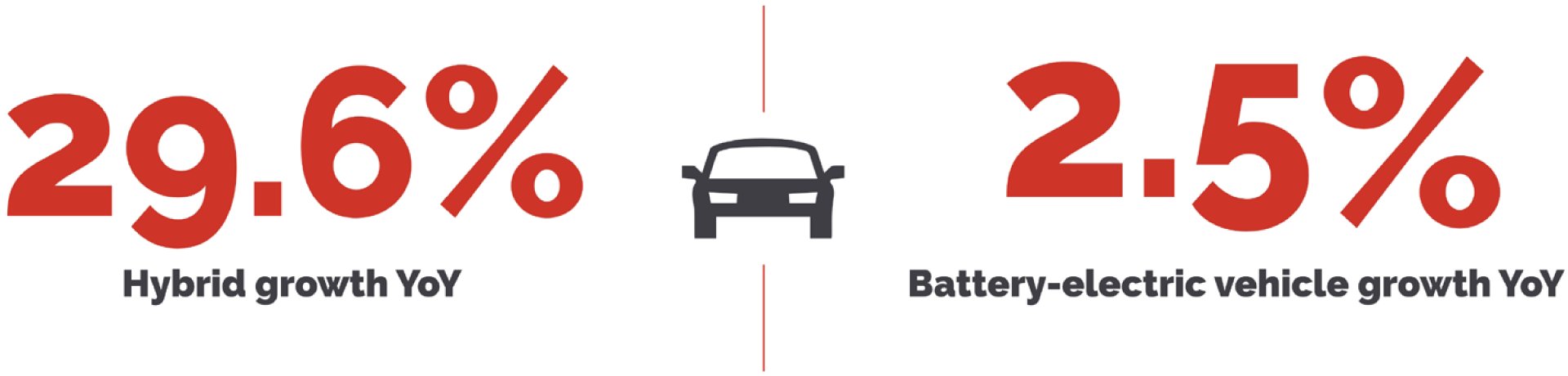

Market data has confirmed this shift. According to Urban Science’s industry-leading sales volume data, through June 2024, U.S. sales of hybrid vehicles, inclusive of both plug-in and regular versions, have increased 29.6% YoY vs only 2.5% for BEVs. Overall, hybrids accounted for 12.2% of the market vs. 7.9% for BEVs.3

This shift to hybrids is being driven by continued demand for efficient and practical alternatives to traditional vehicles, combined, however, with consumers’ hesitancy to adopt an all-electric technology without a reliable and prevalent charging infrastructure. In fact, according to a recent study by Urban Science conducted alongside the Harris Poll, 56% of auto buyers believe that the current EV charging infrastructure is unable to meet the anticipated needs of consumers in the next three years.

Pricewise, although BEV prices have steadily declined, ICE and hybrid vehicles are still more affordable, especially for consumers seeking a higher BEV range.

Good news for dealerships on many fronts

As we reported in an earlier study, with fewer parts and lower maintenance requirements, an all-BEV future was projected to generate 40% – 60% less customer-pay service revenue for retailers and OEMs compared to servicing ICE vehicles.

In contrast, hybrids represent a significant opportunity for dealership service departments in two critical ways: Length of Service, and Type of Service.

The service-retention rate for hybrid vehicles is markedly better than that for ICE vehicles.

Length of service

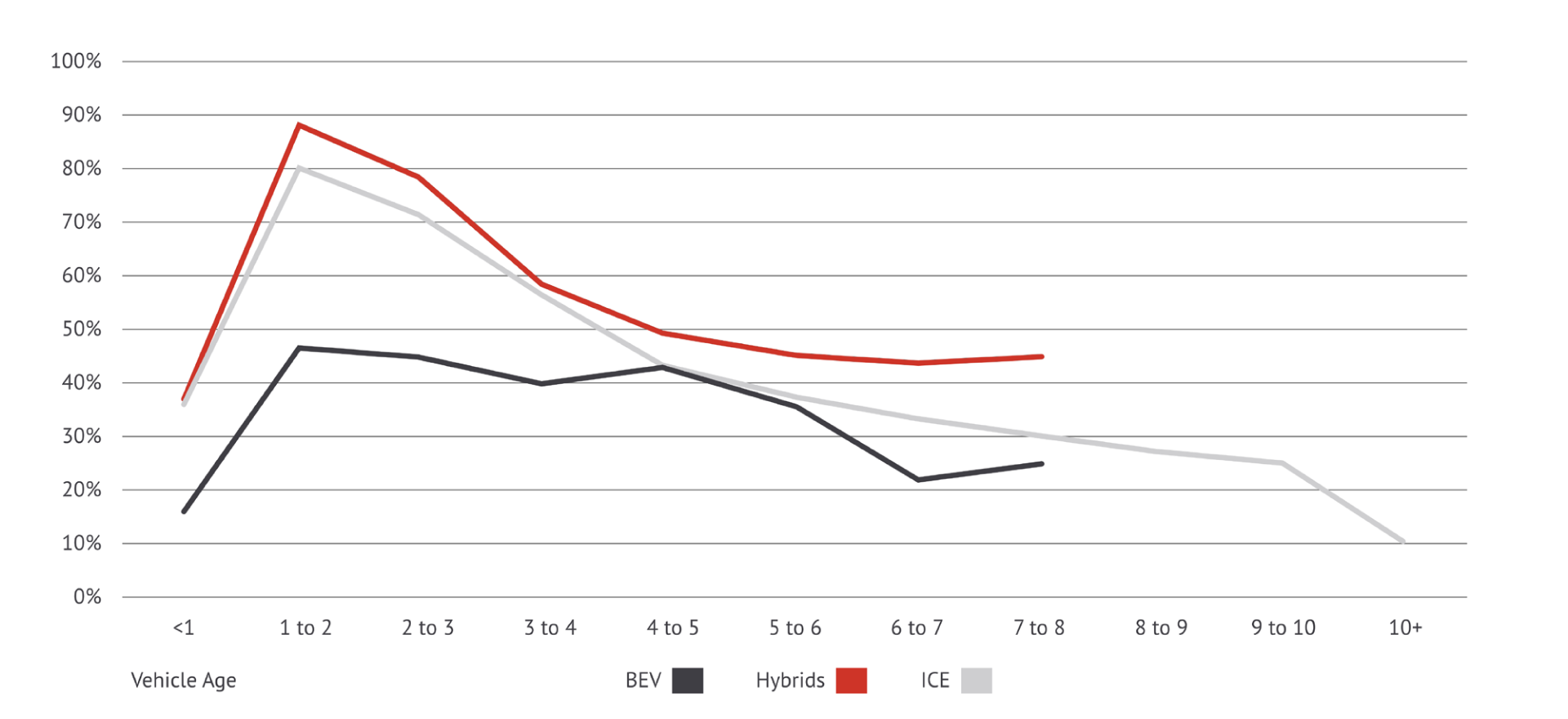

Service retention for ICE vehicles (defined as the percent of vehicles which are serviced within a franchised network for customer pay work) traditionally dramatically drops after the 3- to 4-year mark, where warranties tend to expire and leased vehicle ownership changes hands.

Analyzing service retention for hybrid vehicles instead, we see both markedly higher rates in the early years of ownership, due to regular maintenance schedule needs of the ICE components, and later, as vehicles age, a more gradual decline compared to both ICE and BEVs. The reason behind stronger loyalty in older hybrid vehicles can be attributed to the higher technology contents compared to ICE, as well as a greater reluctance by hybrid owners to have their vehicle serviced by independent repairers.

Type of service

Better still are the service requirements of hybrid vehicles. While hybrids require much of the traditional service that ICE vehicles do, including oil changes, engine air filters, spark plugs, transmissions, and more, they also need service on battery/EV-components guaranteeing increased potential service revenue.

Hybrids benefit dealership service departments in two critical ways: length of service and type of service.

Hybrid vehicle owners value dealership service departments more than ICE vehicle owners

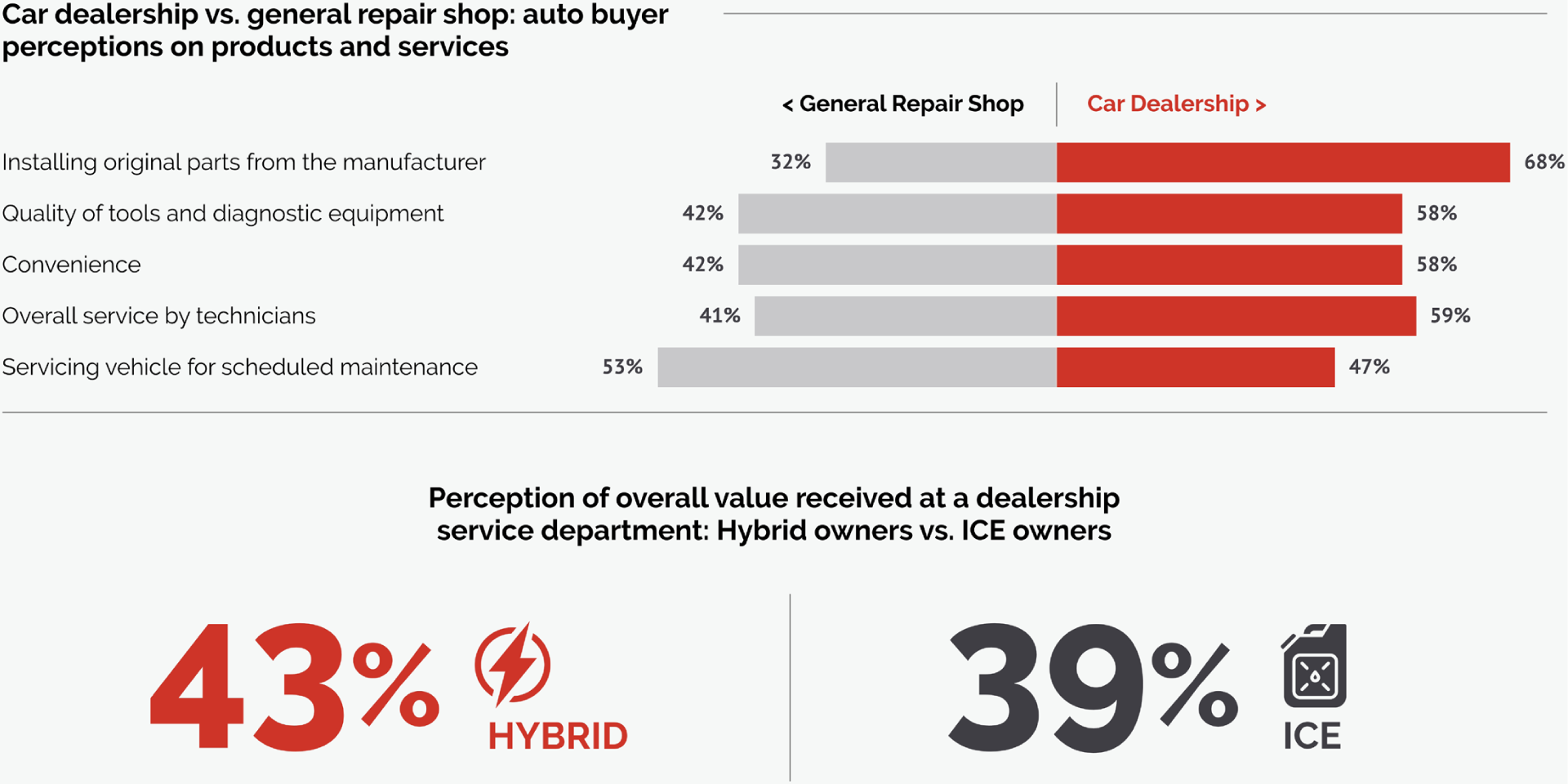

Our research validates these findings. In the same recent Harris study, hybrid drivers rated franchise dealerships higher than general repair shops on a number of metrics. Those include installing OEM parts, the quality of tools and diagnostic equipment, convenience, overall service by technicians and the ability to service the vehicle for scheduled maintenance. Plus, overall, hybrid drivers rated the value for service received 4 percentage points higher than ICE drivers.

Considerations for capturing the Hybrid service opportunity of today and in the future

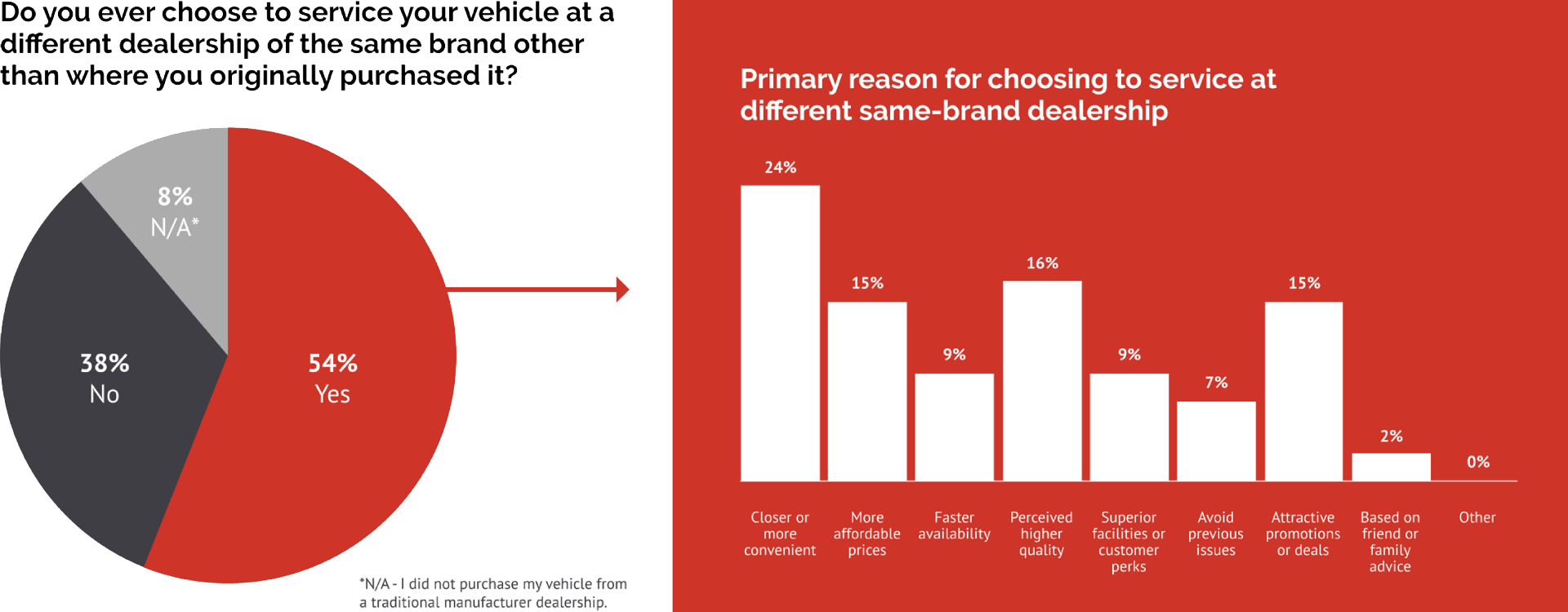

For dealers, however, there are still areas of concern and potential opportunity because although hybrid vehicle owners are clearly demonstrating greater loyalty to their brand, our research does not point to the same degree of loyalty to the dealer where they purchased their vehicle.

Over half of hybrid owners said they would consider servicing their vehicles at another dealership of the same brand, rather than from where they originally purchased their vehicles. Outside of another dealership providing “a closer or more-convenient location,” 15% of auto buyers say attractive promotions or deals would provide them a reason to switch. In fact, incentives are even more impactful on hybrid drivers – with 96% of hybrid owners (vs. 80% of ICE vehicle ones), reporting that an incentive of as little as $35 dollars would motivate them to bring their car in for service.

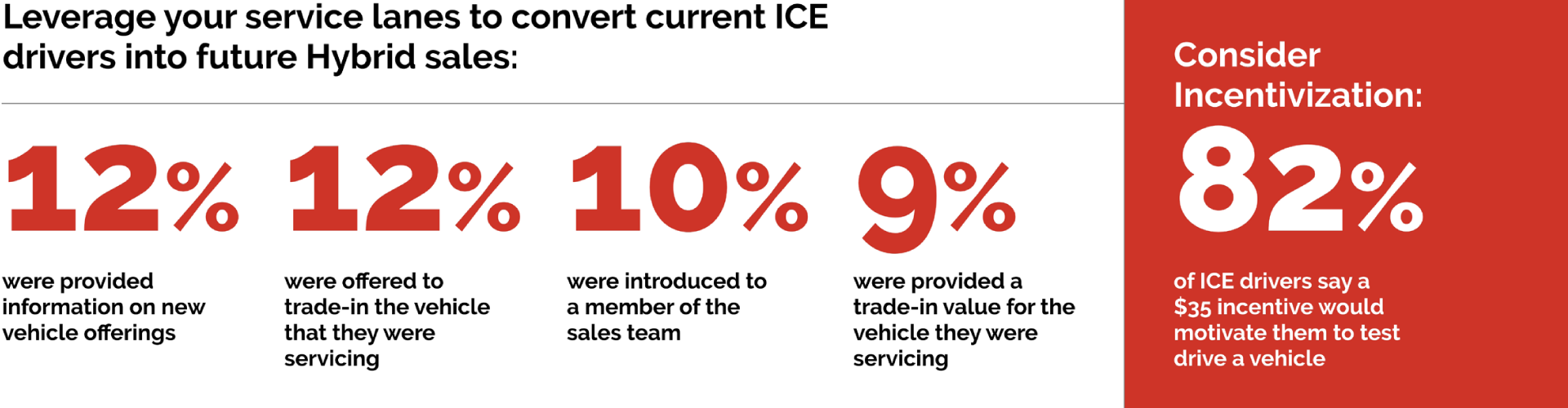

Finally, as manufacturers extend their timelines for going all-electric and consumers show greater openness to hybrid technology, dealers need to expand their options by incorporating hybrid vehicles into their sales efforts in the service lane. Our survey indicates significant room for improvement in this area. Currently, only 12% of ICE drivers receive information on new vehicle offerings during their service visits, and just 10% are provided with a trade-in value for the vehicle they are servicing.

These numbers represent an incredible opportunity – in hybrid sales for the short-term, and hybrid service for the long-term – for those dealerships who embrace the new hybrid reality.

Science as a solution

Since our founding over four decades ago, our proven, scientific approach to dealership planning has continued to improve and evolve. It’s an approach that stays ahead of the technological curve to help improve the performance of dealership networks – and it continues to be the industry standard.

If you’d like to talk to someone at Urban Science about how you can create a service strategy to better help your dealership capture hybrid-vehicle owners, call or email me. Let us show you how we can leverage the power of science to your challenges.

Piermichele Robazza

Piermichele Robazza

Global Practice Director, Aftersales

Urban Science, Inc.

pmdillamore@urbanscience.com

+44 7770 605982

1. “GM to Release Plug-in Hybrid Vehicles, Backtracking on Product Plans,”

2. “EV Euphoria is Dead. Automakers are Scaling Back or Delaying their Electric Vehicle Plans,”

3. Urban Science® DataHub™ | Sales