-

SOLUTIONS

MANUFACTURER

NETWORKPERFORMANCEProactive network management to connect today’s consumers with automotive more efficiently.

SALESPERFORMANCEUncover what really impacts daily performance to grow market share.

AFTERSALESPERFORMANCEBring customers back to increase service retention and build long-term loyalty.

MARKETINGPERFORMANCEScientific precision to make every marketing dollar work harder.

- INSIGHT LAB

FEATURED

10月 20th, 2025Urban Science To Relocate Global Headquarters To One Campus Martius10月 14th, 2025Q3 EV Retail Sales Report10月 9th, 2025Urban Science Discusses Why EV Demand Won’t Collapse Despite End of Federal Tax Credits - NEWSROOM

- ABOUT US

- CAREERS

- EVENTS

8月 26th, 2021

Vehicle Sales and Profitability: What OEMs Need to Do to Make the Numbers Work

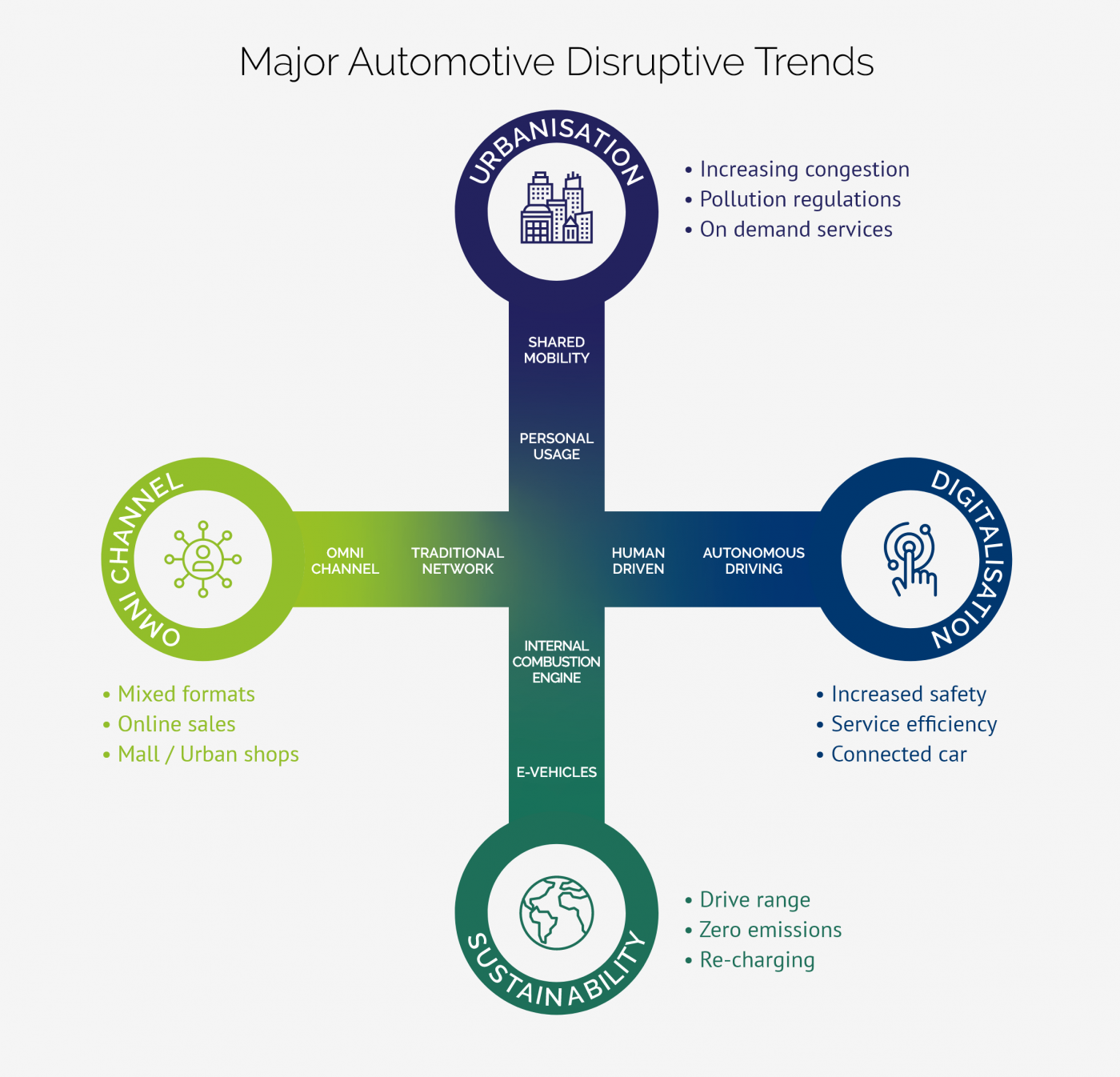

Disruptive forces of urbanisation, digitilisation, sustainability and omni-channel retail sales points were already beginning to seriously impact the automotive landscape pre-pandemic. The pandemic forced changes – including remote work, distance learning, and online everything – that motivated a re-thinking of the want vs. need dynamic. Post-pandemic, those forces have only gained momentum, creating an atmosphere of significant challenges – and opportunities – depending upon the lens through which they are viewed.

Between chip shortages for vehicles and the Delta variant of COVID-19, uncertainty in the automotive sector is high. Still, forecasters now see a solid recovery as the year progresses. Among these disruptive forces and their accompanying uncertainty, who is best positioned and prepared to profit? What strategies need to be employed to mitigate their risk?

Differentiated Business Models Offer Promise of Profitability.

One factor in the profitability equation has reached elevated prominence: flexibility. The days of creating a “one size fits all” dealership network model is in decline. The pandemic may not have caused a change in the how and where people choose to shop, buy and service their vehicles, but it certainly accelerated critical aspects of it. The financial concept of a diversified stock portfolio has suddenly found new applicability in the idea of a diversified retail-point portfolio, where OEMs, dealers or other interested parties can invest in a manner that helps mitigate the risk.

Location + Flexibility = Opportunity.

There are other factors at work in addition to the four disruptive forces already mentioned above. The move to an electrification future is accelerating at a pace beyond the projections of just 18 months ago. Government regulations are motivating change, whether by rewarding EV actions or putting in place policies designed to financially impact companies and individuals who are slow to adapt.

Location – once defined only by geographic boundaries — now encompasses online “locations” that offer automotive sales and service in which customers have very little, or no, interaction with physical retail points. Finding the right balance between optimal market representation and alternative retail formats is critical. To achieve more pragmatic results requires a holistic look at profitability over an entire investor market. Going forward, manufacturers, dealers, and investors willing to buy into a business model with that level of flexibility may very well usher in a new automotive buying, selling, and servicing dynamic designed to weather the storm of unknown disruptive forces.

Financial Viability:

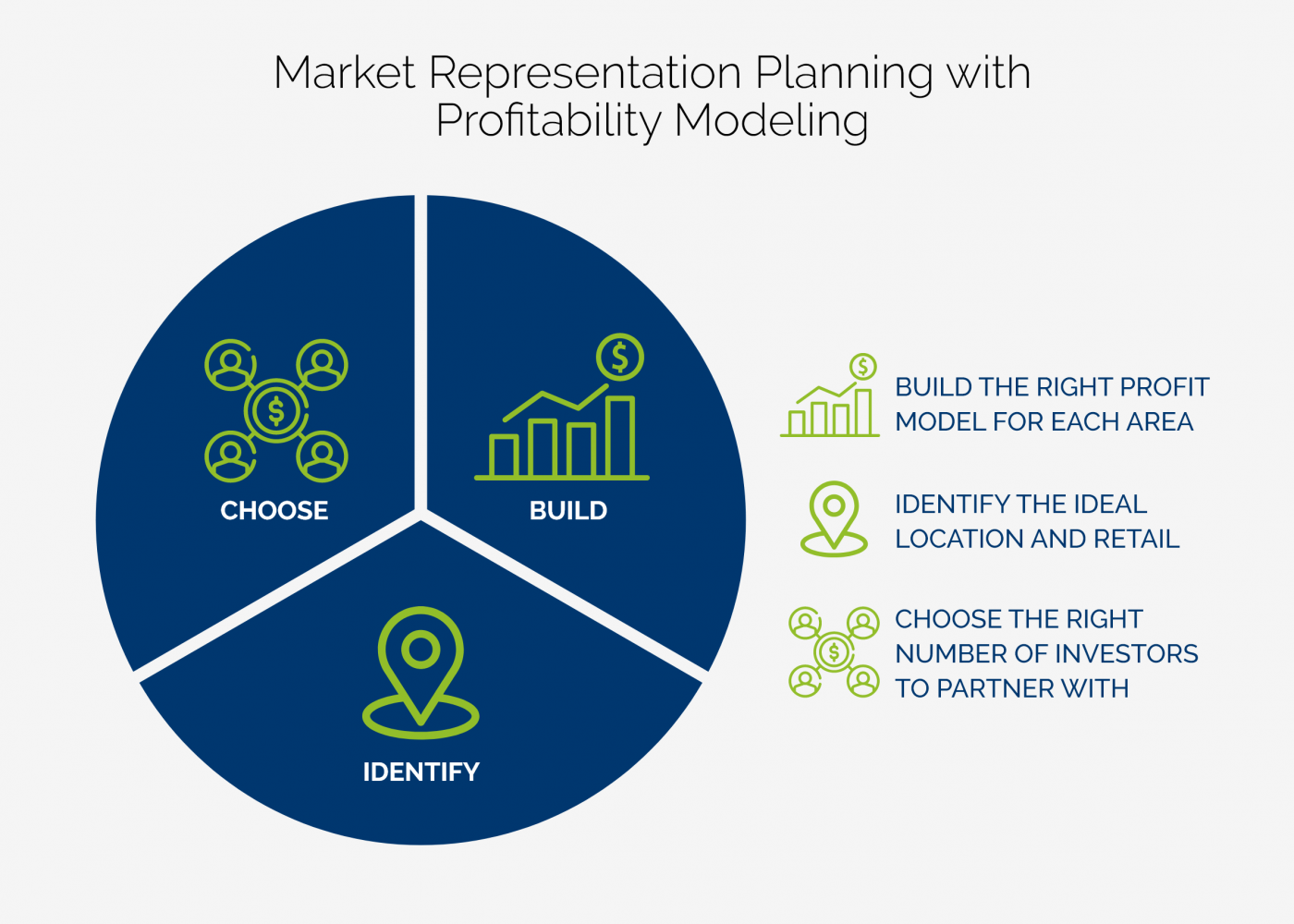

Define the right network configuration to support viable Return on Sales in the future — taking into account disruptive changes and their impact on demand and profitability.

Profitability Modelling – the Key to Future Financial Viability.

Profitability modelling opens the door for new, collaborative efforts between an automotive manufacturer and its dealers. By defining viability thresholds, analysing detailed profit and loss projections per retail point, and configuring networks with new levels of flexibility, there exists the potential for significant mutual success.

No one can predict the future, but proactive scenario planning has the potential to deliver a competitive advantage. For a number of reasons, financially viable dealers are in the best position to seize the opportunity (and move product for their manufacturers). They often already have the real estate through their network of retail points, and so – through profitability modelling – can more easily reconfigure their networks in ways that take into account future disruptive changes and their impact on demand and profitability. These dealers realize the traditional world is over. The real world is coming – and they are determined to be a part of it.

Leveraging Science to Reveal a Better Solution.

Since our founding over four decades ago, our proven, scientific approach to planning has continued to improve and evolve. It’s an approach that stays ahead of the technological curve to help manufacturers improve the performance of their dealership networks and continues to be the proven, industry standard. It’s a standard based on what science reveals so that actions can be made with confidence, not conjecture.

If you’d like to talk to someone at Urban Science about creating a viable path to bolster your vehicle sales, efficiency and profitability, call or email me. And let us show you how we can apply the power of science to your challenges.

Carlo Antolini

Senior Manager

cantolini@urbanscience.com

+39 34 098 97 132