-

SOLUTIONS

MANUFACTURER

NETWORKPERFORMANCEProactive network management to connect today’s consumers with automotive more efficiently.

SALESPERFORMANCEUncover what really impacts daily performance to grow market share.

AFTERSALESPERFORMANCEBring customers back to increase service retention and build long-term loyalty.

MARKETINGPERFORMANCEScientific precision to make every marketing dollar work harder.

- INSIGHT LAB

FEATURED

10 月 14th, 2025Q3 EV Retail Sales Report10 月 9th, 2025Urban Science Discusses Why EV Demand Won’t Collapse Despite End of Federal Tax Credits10 月 3rd, 2025Urban Science Outlines What’s Next For the EV Market Following The Removal of Federal Tax Credits - NEWSROOM

- ABOUT US

- CAREERS

- EVENTS

9 月 8th, 2023

Aftersales in the EV future:

plan now to realize tomorrow’s potential

In a recent Harris Poll study commissioned by Urban Science, global auto buyers revealed how they view the future and their relationships to personal transportation.1 They clearly understand that EVs are a rapidly approaching reality and rank it number one as having the largest potential to change the future of the automotive industry. Additionally, a large percentage of poll respondents (69% in the UK, 62% in Germany and 65% in the U.S.) still see the value in owning a personal vehicle.

Worldwide, governments are pushing hard to make the EV future a reality sooner rather than later. In fact, the European Union will ban all new sales of internal combustion engine (ICE) vehicles by 2035,2 and the UK is acting even more aggressively, with a 2030 ICE ban.3 Partly due to these actions, EVs are expected to represent 71% of the European market by 2032.4

Manufacturers are responding by ramping up EV production and creating new, more affordable models. The International Energy Association projects 14 million EV sales globally by the end of this year, representing a 35% YoY increase.5

EV aftersales facts: lower maintenance, lower revenue

With a smaller number of parts and lower regular maintenance requirements, less EVs are coming in for customer pay service. And although the average revenue per repair order of EVs is in line with ICE models (with the exception of warranty work, which is significantly higher than EVs) EVs are expected to generate 40% to 60% less service revenue for retailers and OEMs. This requires service networks to be even more proactive to stay viable and offset this potential loss of revenue.

Evolving aftersales networks will include both ICE and EV vehicles for the foreseeable future.

Although EV market share will continue to grow, service revenue opportunities from ICE vehicles on the road will remain strong for years to come. According to the European Automobile Manufacturers’ Association, Europeans keep their vehicles an average of 12 years. In other words, a new vehicle added to the “family fleet” in 2023 may provide retailer service potential through 2035, on average!

EVs also present unique opportunities for service departments, such as adding services for optimum battery-pack maintenance, and new features through connectivity. A higher number of sophisticated technology components are needed for over-the-air (OTA) connectivity, which means they will experience obsolescence sooner and require software and hardware upgrades to stay on pace with newer models.

Altogether, this indicates that service departments need to prepare by assessing and diversifying their offerings, training their personnel on the new technology and services, and taking any necessary steps to develop action plans for meeting the demands of their EV service customers.

Over time, and as the shift towards EVs continues, service-department data will become even more important to manage and find opportunities in the mix of:

- New types of service required at the retailer – like selling service packages – and service-center levels

- Types of service performed at both retailers and their alternative retail format offerings

- “Right-sizing” service departments for both ICE and EV service traffic

- Tracking when customers are most likely to need service

- Targeting high-potential customers through multichannel service marketing communications

Three critical actions retailers can take for maintaining

a healthy aftersales network

Incorporate:

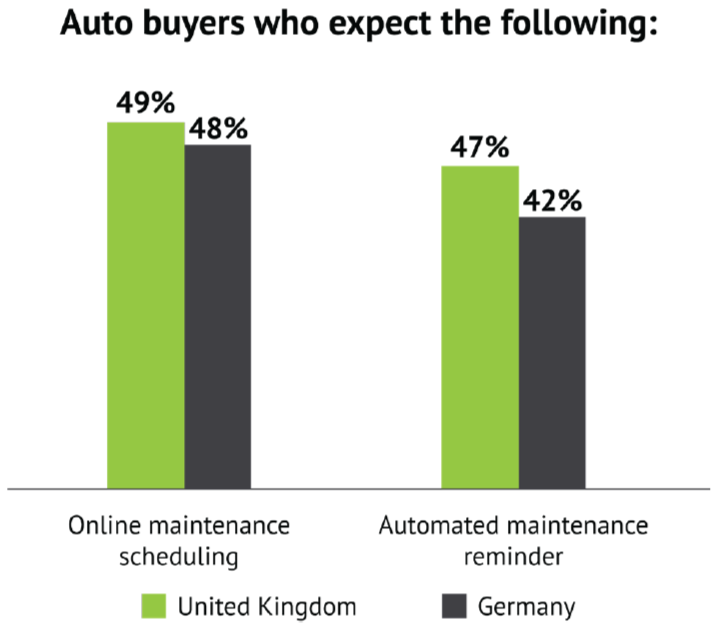

Customers are embracing the idea of online connectivity at the service level for both their ICE and electric vehicles. In fact, almost half of customers in the recent Harris Poll study expect dealers to offer online maintenance scheduling (at 49% in the UK and 48% in Germany) and automated maintenance reminders (at 47% in the UK and 42% in Germany).

Incorporating connectivity technology to develop more targeted campaigns and scheduling more timely service reminders is crucial. The increasingly connected technology in EVs presents a good opportunity for online maintenance scheduling and automated service reminders.

Additionally, tyres represent an excellent opportunity for aftersales revenue in the EV future. That’s because:

- EVs are heavier, produce more torque and rely more heavily on alignment to maintain range and performance

- EV tyres are more expensive, due to the presence of low-rolling characteristics – like specialized rubber, thinner walls and shallower tread blocks that together require less force to make and keep them rolling – and noise reduction features

And add-on services will become crucial for aftersales department success. For example, storage and winter tyre swaps could be revenue generators. Additionally, franchised retailers who are proactive can establish themselves as tyre safety and service experts. Aggressively pursuing EV tyre business will become progressively more important, especially as specialized tyre shops – which don’t require a retailer or service center for sales and installation – jump on the opportunity.

A number of opportunities for retailers exist, as well. One such opportunity is, with EVs in Europe more likely to be bought on lease or through a Salary Sacrifice Scheme (where payments for vehicles, servicing and insurance are bundled together), retailers can seize the opportunity to become the default service provider at the time of purchase to create guaranteed regular revenue streams.

A strategy that embraces online maintenance scheduling, building service and/or tyre packages into ownership bundles and automated reminders for hardware/software upgrades throughout the life of the vehicle could go a long way to ensure that aftersales continues to be a cornerstone of retailer revenue.

EVs offer more opportunities for revenue and higher profit margins through subscriptions and the purchase of services and features using over-the-air technology.

Innovate:

By thinking outside the traditional service department, retailers can create new offerings for their EV service customers. Embracing remote, mobile and pick & delivery services offers the kind of flexibility and convenience this more demanding customers base is looking for.

Mobile service and Over-the-Air (OTA) services are particularly appropriate to servicing electric vehicles since EVs have fewer parts, more electronics components and a higher proportion of software and diagnostic work that can be done remotely. In that respect, EVs offer more opportunities for revenue and higher profit margins through subscriptions and the purchase of services and features using OTA technology.

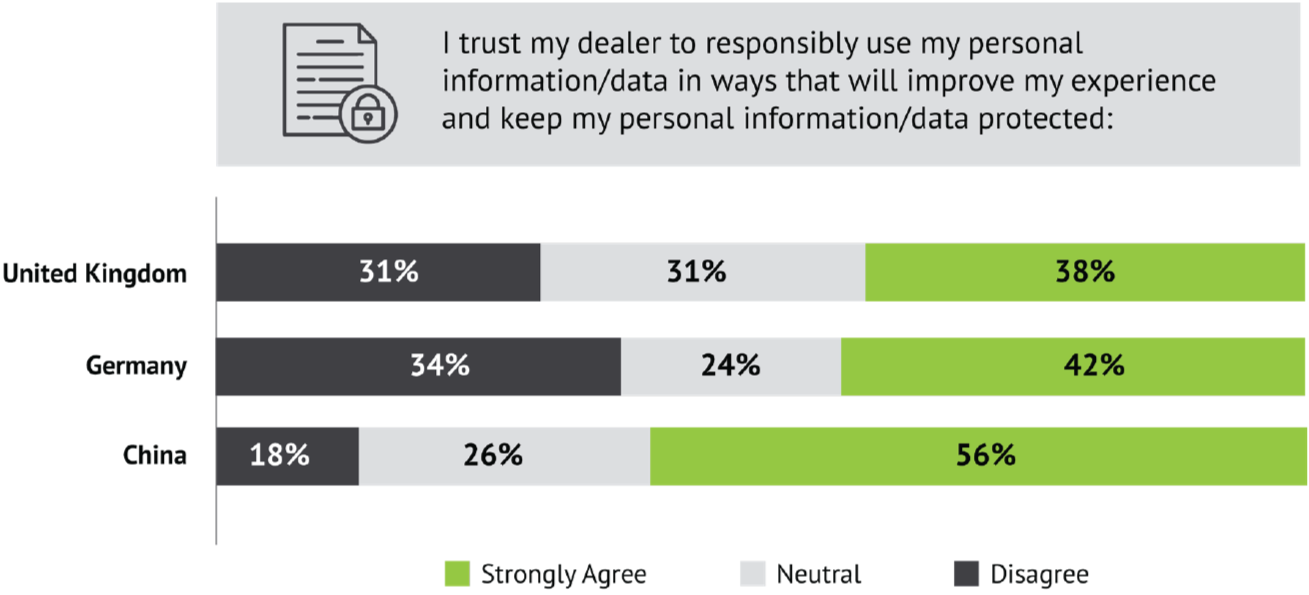

Jumping on the proverbial EV bandwagon represents a multibillion-dollar source of revenue for both the industry and aftersales departments. However, to fully realize this opportunity, retailers must gain and maintain customers’ trust, especially as it relates to usage of personal information. This is an area in clear need of improvement, as the Harris Poll revealed:

- Trust in retailers to responsibly use auto-buyers’ personal information/data is weaker in the UK and Germany than in China

- Only 38% of consumers in the UK – and 42% of consumers in Germany – trust retailers with their personal information/data

- That compares to 56% of consumers in China who strongly trust retailers

Finding new ways to connect with customers and proving that service departments can make their lives easier as they make the switch to EVs is critical. Retailers who follow that path can gain the kind of customer trust that makes new servicing options revenue generators for retailer aftersales departments.

Invest:

To create new opportunities for service departments as customers switch to EVs, retailers need to invest in physical equipment (such as chargers), customer experience processes and specialized tools. Working with a partner who has access to timely and relevant data – and one who can separate the data signal from the noise – will provide the critical insights of where to invest, how to better understand and meet evolving EV customer wants and needs and uncover the greatest potential opportunities for growth.

Retailers should also be aware of strong, independent competition – in the U.S., only 35% of auto buyers agree that retailers have a unique value over independent repair shops. By acting with a sense of urgency, retailers can change that. Those who have the ability to invest can increase visits and revenue by becoming a destination point for their fast-charging capabilities while offering waiting customers amenities similar to – or better than – those at petrol stations today, such as coffee shops and entertainment or food establishments in addition to traditional displays of vehicles and accessories.

By understanding forecasted EV service demand (and how to balance that with ongoing ICE service demand) they can right-size their service department both for today’s business and tomorrow’s challenges.

Science as a Solution.

Aftersales departments need to get ahead of the incoming EV influx to remain profitable. Consumers are getting ready to make the switch. What retailers do today can help ensure they won’t be left behind.

Retailers can demonstrate the value of their offer not only by competing on price, but also by offering customers more than the average repair shop. They shouldn’t guess on the right path to take; but go with a partner who understands – and can leverage – the power of data to their advantage.

Since our founding over 45 years ago, Urban Science’s unrivaled near-real-time industry sales data and consulting and technology offerings have driven innovation, efficiency and profitability into every corner of the automotive industry. Our capabilities and solutions help OEMs and retailers stay ahead of industry trends and achieve business certainty in even the most chaotic market conditions.

If you’d like to talk to someone at Urban Science about how you can better position yourself to succeed in the EV future – or if you have any questions about the information included in this article – please contact us now.

Paul Dillamore

Regional managing director, Europe

pmdillamore@urbanscience.com

1. “Global Auto Buyer Pulse,” This survey was conducted online by The Harris Poll on behalf of Urban Science between December 9-13, 2022, among 4,730 adults ages 18+ who currently own or lease or plan to purchase or lease a vehicle in the next 12 months (referred to in this report as “auto-buyers”) in the United Kingdom (n=811), Germany (n=847), China (n=931), Mexico (n=1,185), and Australia (n=956). The sampling precision of Harris online polls is measured by using a Bayesian credible interval. For this study, the sample data is accurate to within ±3.6 percentage points for United Kingdom, ±3.6 percentage points for Germany, ±4.2 percentage points for China, ±3.2 percentage points for Australia, and ±3.5 percentage points for Mexico, using a 95% confidence level. For complete survey methodology, including weighting variables and subgroup sample sizes, please contact Amy Reed Bowering (arbowering@urbanscience.com).

2. “EU Formally Bans New ICE Vehicles, Aims to Slash Emissions from Trucks and Buses,”

https://electrek.co/2023/02/15/eu-bans-new-ice-vehicles-aims-to-slash-emissions-from-trucks-and-buses/

3. “Everything You Need to Know About the UK’s Switch to Electric,”

https://electriccar.guide/transition-to-electric

4. “European New-Car Market Could Need Decade to Recover, But Electric Cars Will Dominate,”

https://autovista24.autovistagroup.com/news/european-new-car-market-recover-but-electric-cars-will-dominate/

5. “Global EV Outlook 2023: Trends in Electric Light-Duty Vehicles,”

https://www.iea.org/reports/global-ev-outlook-2023/trends-in-electric-light-duty-vehicles

6. “Average Age of the EU Vehicle Fleet, by Country,”

https://www.acea.auto/figure/average-age-of-eu-vehicle-fleet-by-country/