针对多样化和不断变化的市场的战略规划

欧洲电动汽车采用率的增长没有任何放缓的迹象,随着大众市场的接受,电动汽车的发展势头更加强劲。到 2023 年,欧洲电动汽车市场份额总计将达到 21%,大大超过 15% 的早期采用基准。随着电动汽车格局的发展和竞争的加剧,今天做出的战略决策对于占领未来市场份额和确保长期成功至关重要。为了应对这种动态环境,企业必须优先考虑了解市场趋势,培养全渠道购物体验,并通过教育打破电动汽车采用的障碍。

最优规划的重要性

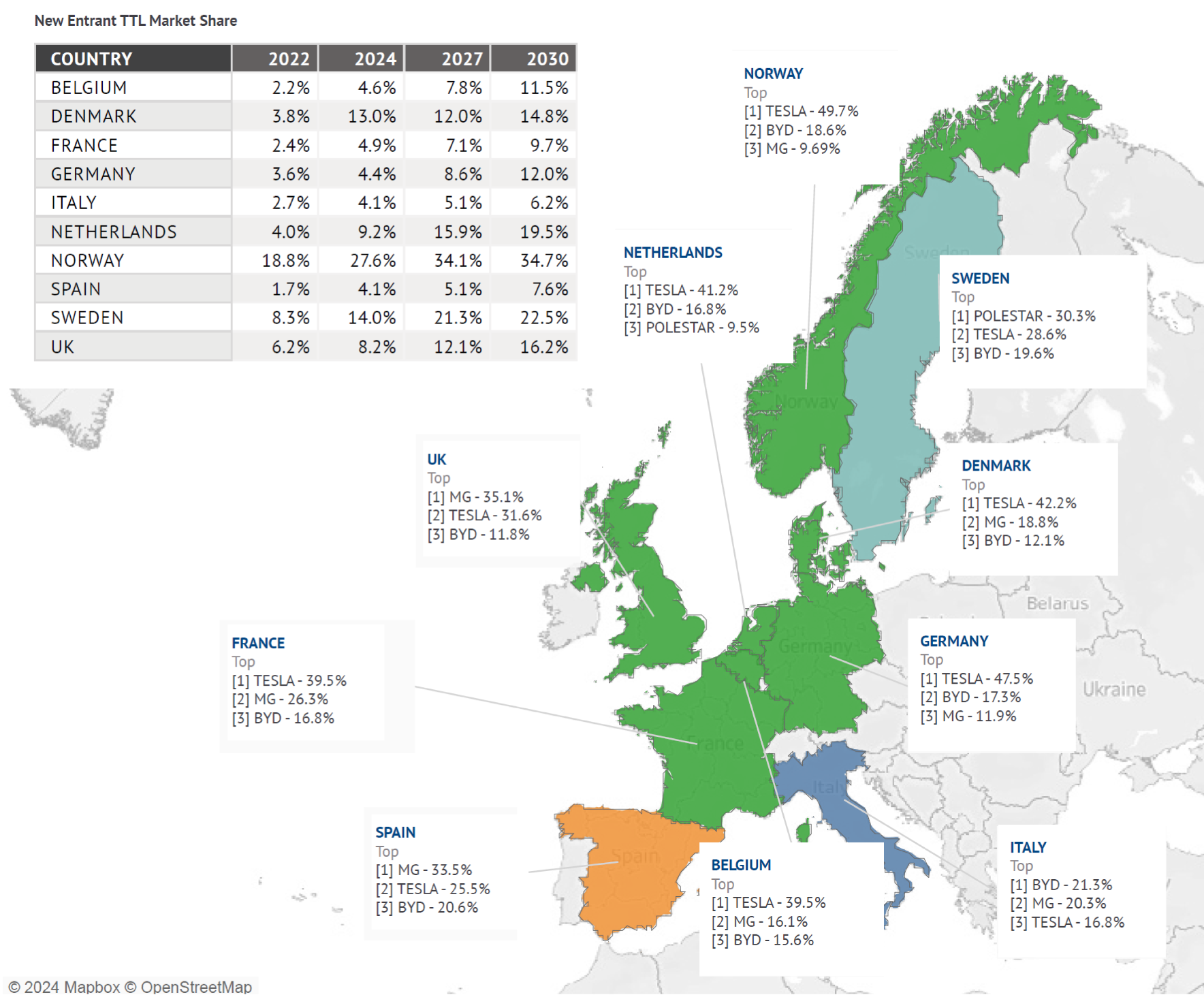

A pillar for future EV success is accurate sales forecasting, which is essential for identifying current hotspots and future growth areas. This involves not only understanding where the market is thriving but also recognizing areas with the potential for expansion. Given that EV sales are expected to remain geographically clustered, retailers will experience diverse market conditions depending on their locations. Successful planning hinges on strong forecasting to determine the specific types and quantities of EVs, along with related services, necessary to meet consumer demands effectively. Manufacturers must confidently navigate the complexities of the EV market, making informed decisions on allocation, inventory and marketing to balance current sales with future opportunities. By employing detailed and adaptable sales forecasting, they can proactively address consumer needs, tailor strategies to each market’s unique dynamics and ensure success in the rapidly evolving EV landscape.

到 2023 年,欧洲电动汽车市场份额总计将达到 21%,大大超过 15% 的早期采用基准。

平衡面对面和数字偏好

为了满足消费者的多样化需求,制造商必须建立强大的全渠道购物网络。根据我们的研究,在德国,51% 的汽车购买者认为传统零售商针对未来进行了优化,而在英国,40% 的汽车购买者也有同样的看法。此外,传统的面对面零售商体验仍然是 87% 的德国汽车购买者和 89% 的英国汽车购买者的首选。

然而,在整个车辆购买过程中,面对面互动的重要性各不相同。例如,德国和英国超过 80% 的汽车购买者更喜欢亲自进行车辆设置和指导。此外,很大一部分人(71% 的英国汽车购买者和近 80% 的德国汽车购买者)倾向于亲自协商汽车价格。尽管有这些偏好,数字平台仍具有相当大的影响力,大约 29% 的英国汽车购买者和 32% 的德国汽车购买者更喜欢在线选车。此外,45% 的英国汽车买家更喜欢通过在线途径了解车辆功能和规格。面对面和数字偏好之间的微妙相互作用强调了企业必须采用全渠道方法来有效满足并超越消费者的期望。

传统的面对面经销商体验仍然是 87% 的德国汽车购买者和 89% 的英国汽车购买者的首选。

教育克服了电动汽车采用障碍

Lastly, education is crucial in overcoming barriers to EV adoption. 46% of auto buyers in both countries strongly agree that retailers should offer individualized guidance for customers transitioning to EVs. The primary barrier to EV adoption in key markets is the concern about the distance that can be traveled on a single charge, with 38% of auto buyers in the UK and 35% in Germany citing this as a top concern. Other major concerns include the time it takes to recharge, the high initial cost, a lack of charging infrastructure and the necessity of installing a home charging station. Safety concerns are particularly prominent in Germany at 21%, compared to the UK’s 12%, highlighting regional differences in perceived barriers to EV adoption. Addressing these concerns through targeted education and personalized customer service can help ease the transition to EVs and foster greater market penetration.

46% of auto buyers strongly agree that dealerships should offer individualized guidance for customers transitioning to EVs.