-

SOLUTIONS

MANUFACTURER

NETWORKPERFORMANCEProactive network management to connect today’s consumers with automotive more efficiently.

SALESPERFORMANCEUncover what really impacts daily performance to grow market share.

AFTERSALESPERFORMANCEBring customers back to increase service retention and build long-term loyalty.

MARKETINGPERFORMANCEScientific precision to make every marketing dollar work harder.

- INSIGHT LAB

FEATURED

10 月 20th, 2025Urban Science To Relocate Global Headquarters To One Campus Martius10 月 14th, 2025Q3 EV Retail Sales Report10 月 9th, 2025Urban Science Discusses Why EV Demand Won’t Collapse Despite End of Federal Tax Credits - NEWSROOM

- ABOUT US

- CAREERS

- EVENTS

11 月 1st, 2023

How dealerships and OEMs can

leverage the power of vehicle connectivity

Vehicles are becoming smarter, and more connected, every day. Although Original Equipment Manufacturers (OEM’s) are expected to generate billions of dollars in revenue from the sales of connected-vehicle subscriptions, they might – in certain instances – be better off providing some services at no cost to their customers. In this article, we will explore how keeping vehicles connected is a strategic win for customers, dealers and OEMs.

Tap into service alerts to build both customer trust and service revenue

The availability of over-the-air services in connected vehicles runs the gamut, from remote location and control, to entertainment and navigation; from usage-based insurance, to mobile payment and concierge support. Many of these services are of high value to vehicle owners (for example, being able to remotely lock and unlock doors or finding the nearest gas station). However, some services – such as remote diagnostics and maintenance reminders/scheduling – provide significant benefits to OEMs and dealers and, one might argue, are of even greater value to them.

From the day of delivery, modern vehicles are designed to provide ongoing information about the status of key vehicle elements. This information is delivered either via email or dedicated apps. It is a win-win-win scenario for owners, dealers and OEMs.

Owners enjoy a greater feeling of control and sense of trust from the higher visibility on the health of their vehicles. OEMs and dealers benefit from these services, in at least two ways. The first is that they are able to keep their lines of communication open with their customers. The possibility to continue building relationships and keep owners engaged cannot be overstated. That’s especially true in light of the expected reduction of service visits from the traditional, more personal way of building loyalty to the brand and the dealer during the ownership period. The second is that service alerts provide invaluable information on the status of key vehicle conditions and become essential to achieving marketing’s ultimate goal of reaching the right customer, at the right time, with the right message.

When a service alert is triggered, indicating the need for maintenance work or a mechanical issue, the vehicle sends messages to both the owner and the OEM. Most OEMs have an infrastructure that relays these messages to dealers in near real-time.

Dealers who proactively reach out to vehicle owners during service-alert events let their customers know that they’re aware and concerned about:

- Maintaining their safety and flagging immediate issues that require attention

- The health and optimal performance of their vehicle, empowering proactive attention

- Improving convenience by offering to schedule the necessary maintenance and/or repairs on their vehicle

- Maximizing vehicle and equipment life through preventative maintenance

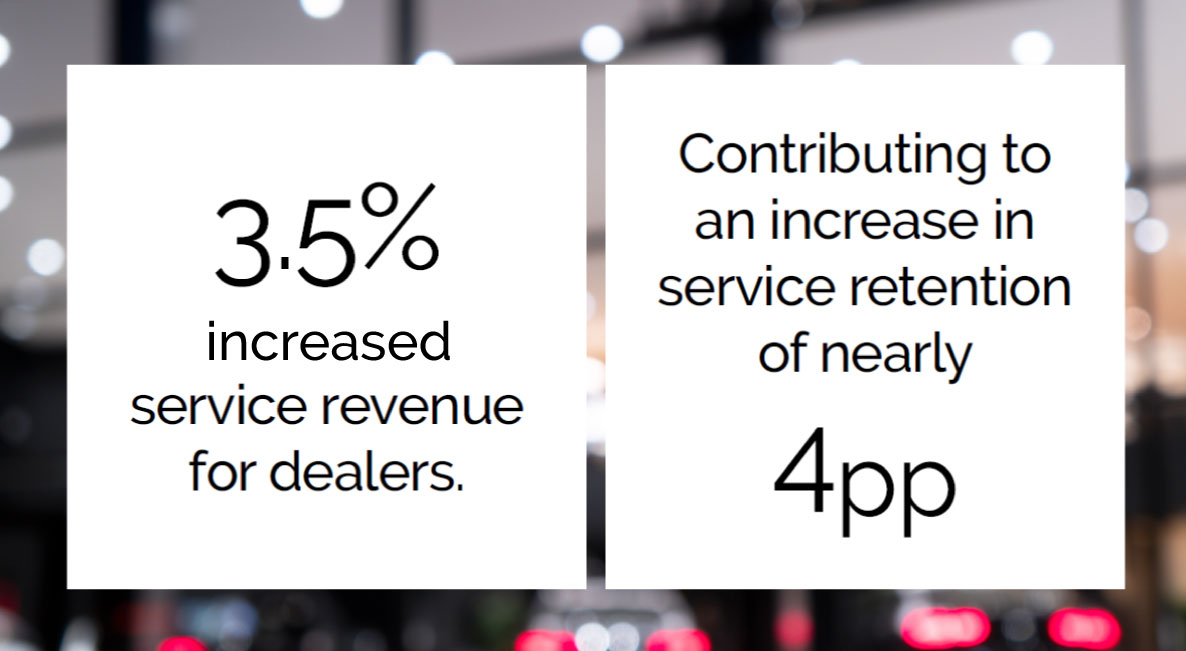

In fact, a recent Urban Science analysis revealed that reaching out to customers at telematics-triggered intervals delivers, on average, a 3.5% increase in service revenue for dealers and it contributes to nearly a 4-percentage point improvement in service retention. When translated into revenue, these improvements represent hundreds of millions of dollars in gains for the average-sized OEM.

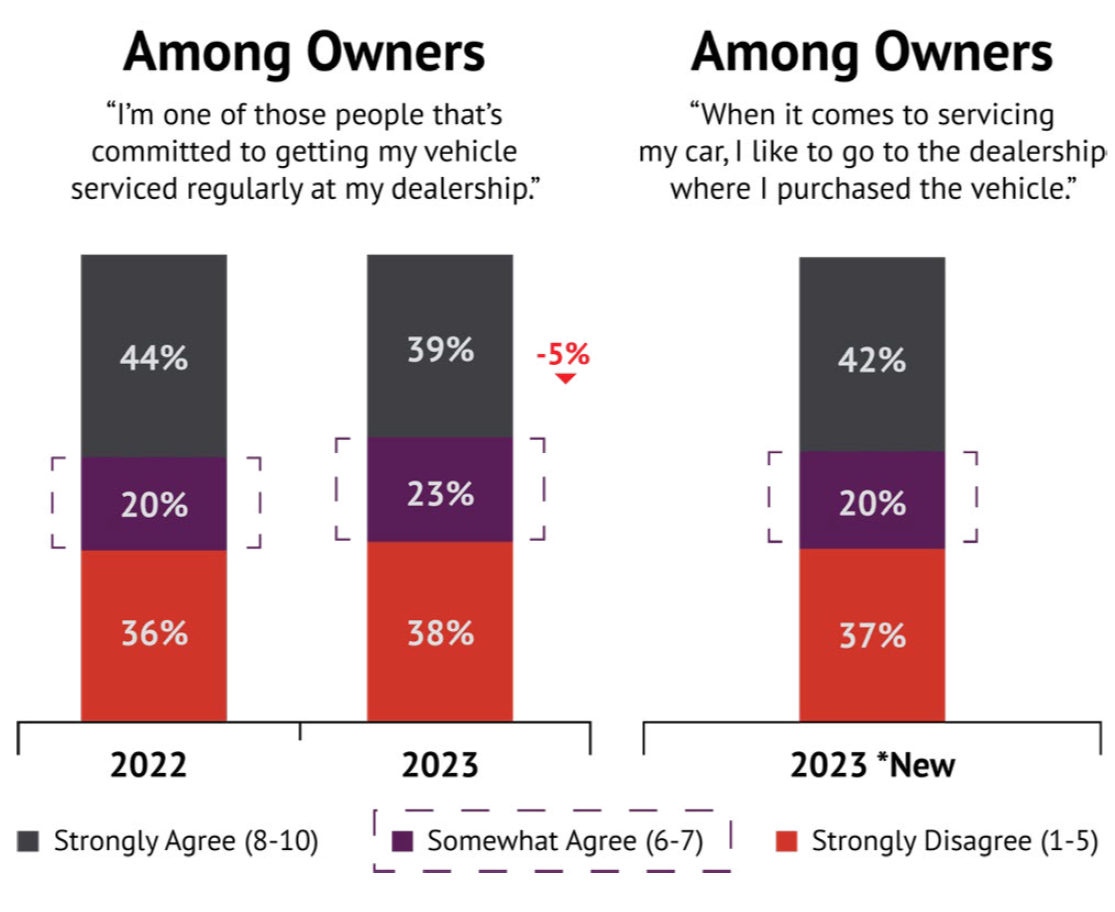

These service alerts provide welcomed wins in a sector with ample margins for improvement, as indicated by our research. In fact, in a recent Harris Poll1 survey commissioned by Urban Science:

- Only 39% of auto buyers strongly agreed that they are “one of those people that’s committed to getting my vehicle serviced regularly at my dealership.” (23% were neutral)

- Only 42% of auto buyers strongly agreed that “when it comes to servicing my car, I like to go to the dealership where I purchased the vehicle.” (20% were neutral)

Clearly, two opportunities stand out: 1) getting customers accustomed and committed to the idea of regular/preventative maintenance; and 2) making sure it happens at your store.

Leverage service alerts to drive profits

Many connected-vehicle services are offered through free trial periods that start immediately after the vehicle purchase. At the end of the trial period, many OEMs implement an all-or-nothing strategy, focusing on short-term gains but missing out on the larger opportunity to strengthen the relationship with their customers and generate higher revenue and profits in the long term.

What OEMs and retailers can do RIGHT NOW

Both OEMs and dealers can significantly benefit by proactively planning and executing strategies and tactics that meaningfully engage auto buyers throughout the ownership cycle.

For OEMs, that means executing an articulated strategy that provide owners with the opportunity to experience the benefits of the entire gamut of connected vehicle services during the free trial period, but then have a more nuanced approach when transitioning customers to a pay-for-service model. They can do this by segmenting their offering between services that primarily benefit customers – charging a subscription after the free trial period – and those that provide more benefit to the OEM and dealers (e.g., service alerts) by providing them at no cost to their customers.

Many OEMs implement an all-or-nothing strategy, missing out on the larger opportunity to generate higher revenue and profits in the long term.

For dealers, it means not only turning their attention toward collecting and harnessing connected-vehicle data, but also leveraging its power though prompt follow-ups and timely reminders. In that way, they can nurture relationships and build customer trust – and it starts at delivery. According to our research, only 32% of auto buyers currently rely on salespeople at dealerships to learn about new-vehicle features and specifications.

That presents both a challenge and an opportunity: a challenge, given everything a salesperson is required to do at delivery; and an opportunity to point out the many service, safety, convenience and infotainment advantages built-in to their connected vehicles.

Across all industries, customers are increasingly becoming accustomed to life in a digitally connected world. If manufacturers and dealers fail to inform and convince customers of the value of connected-vehicle services and trade away long-term opportunities in exchange for short-term gains, they risk missing the mark on building valuable customer loyalty and not delivering on their billion-dollar revenue promise.

Science as a solution

Since our founding over 45 years ago, our proven, scientific approach to dealership planning has continued to improve and evolve. It’s an approach that stays ahead of the technological curve to help improve the performance of dealership networks – and it continues to be the industry standard.

If you’d like to talk to someone at Urban Science about the topics discussed in this article – including learning about ServiceView™ – our aftersales performance tool that optimizes the service alert handling process and helps identify and quantify incremental revenue opportunity delivered via telematics – email me.

Let us show you how we can apply the power of science to your challenges. Email me.

Piermichele Robazza

Piermichele Robazza

Global Practice Director

Aftersales Performance

PMRobazza@urbanscience.com

1. This survey was conducted online by The Harris Poll on behalf of Urban Science among 3,022 U.S. adults aged 18+ who currently own or lease or plan to purchase or lease a new or used vehicle in the next 12 months (referred to in this report as “auto-buyers” or “auto-buying public”), and 250 U.S. OEM automotive dealers, whose titles were Sales Manager, General Manager, or Principal/VP/Owner. The auto-buying public survey was conducted from January 26 to February 15, 2023. Population. The dealer survey was conducted January 26 to February 17, 2023.