Urban Science Data and efficient marketing campaign using off-lease consumer data drives positive returns for dealers during lean inventory environment.

The problem

A lean inventory environment caused by the pandemic and supply chain issues challenged car dealers who still needed to find, win, and retain customers.

The goal

- Help dealers efficiently drive demand, keeping gross margins and turnover rates high while additionally winning the long-term inventory game

- Target consumers with the highest statistical probability of transacting (off-lease consumers) that will also feed the used car department (late model, low mileage used car acquisition) as well as the service department (internal ROs)

The approach

- Leveraged consumer data through an agency partnership with Equifax, one of the largest consumer credit bureaus in the nation

- Engaged Urban Science for analytics, sales attribution, and trends

- Expanded strategy to include a digital focus, integrating QR codes and prominent touchpoints such as social, OTT, and display ads

- Increased urgency of marketing messages driving customers to dealerships to secure their vehicles before their lease expires

The results

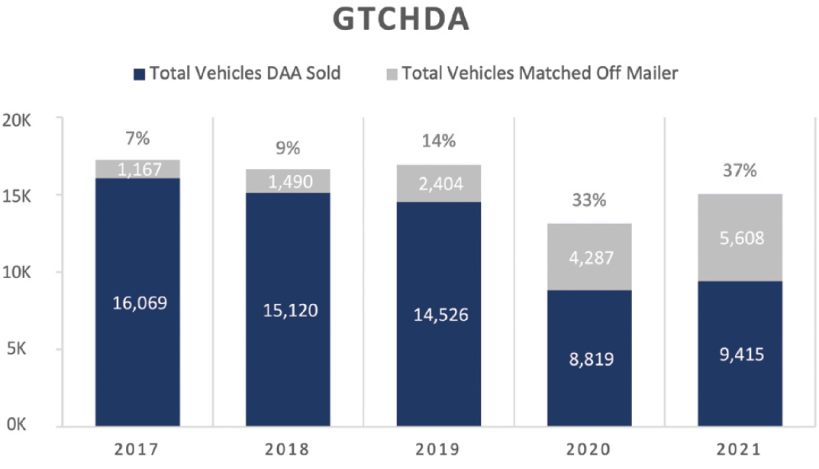

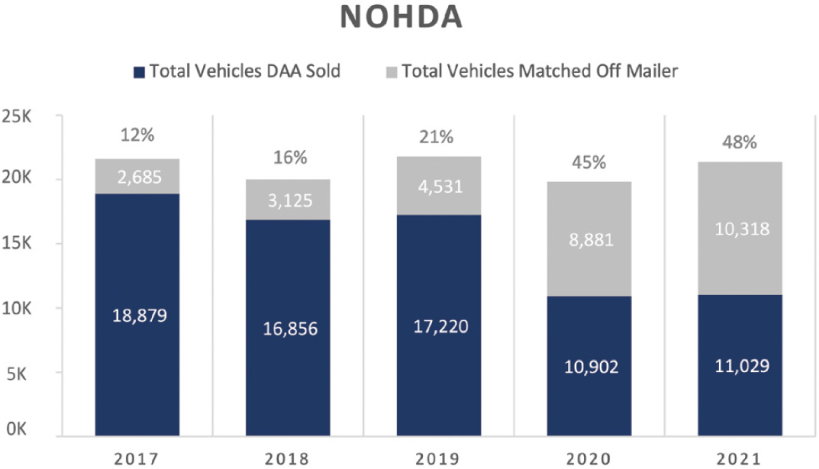

- Advertising to a customer with limited time on their lease proved to be the most efficient use of advertising dollars in the lean market, accounting for almost 48% of sales in NOHDA in 2021

- Increase of +21.85% Hondas sold from expiring lease campaign in 2021 vs. 2020

- Clients recorded growth in 2021 despite state declines reported by Urban Science

- GTCHDA +14.16%

- NOHDA +7.91%

The story

The pandemic and supply chain issues, most notably the global shortage of semiconductor chips, continued to wreak havoc on new vehicle inventory throughout 2021. Dealers had to be more strategic with their marketing and targeting in 2021 due to decreased wholesale, which led to higher demand with less supply.

Many dealers opted to forgo marketing because of supply imbalances, yet still reaped the rewards. According to the National Automobile Dealers Association (NADA), the net profit before tax at the average new car dealership was up 128.2% Q1 through Q3 2021 over the same period in 2020.

However, the industry’s leading dealers remained focused on finding new customers and retaining existing ones. Understanding that inventory had become the new currency and that many OEMs support turn-and-earn wholesale models, these aggressive dealers recognized the importance of marketing and creating demand. With Tier10’s support, these dealers have remained omnipresent and relevant, leading to record sales and increased per vehicle retail while earning additional inventory to win in the back half of 2022.

The solution

Tier10 recognized that the environment of 2021 had significantly impacted the marketing efforts of dealers at all levels, with its own clients experiencing decreases between 4% and 22%. As Tier 1 and Tier 3 marketing budgets decreased, Tier10 found it crucial to maintain Honda’s presence on the Tier 2 level while improving efficiency. The agency saw this as a great opportunity for Honda dealers to increase their share of voice in the marketplace and generate more interest and intenders for the brand. Increased interest would allow dealers to match customers to cars as soon as inventory became available and to establish a positive customer experience.

With the pandemic’s continued impact on budgets and inventory, it was clear that Tier10 needed to leverage its tried-and-true expiring lease strategy, which originated in 2017 and evolved into Qualified Customer through its success. The campaign – a blended mail and digital strategy – capitalized on the increased lease-return rate and captured the off-lease audience through coordinated communication served as early as 12 months before lease-end. With 50% of lessees re-leasing their current vehicle and 90% leasing new vehicles, the off-lease customer pool turned into the perfect target audience.

Tier10 continued to leverage its partnership with Equifax to create audience models and to identify conquest and same brand off-lease consumers with the highest statistical probability of upgrading to a new car. Recognizing that every dollar counts, Tier10 also enhanced the strategy by prioritizing suppression data and purging consumers lacking brand loyalty. This ensured Tier10’s clients had the most refined list of qualified customers to target.

As market conditions evolved, the strategy did too. Lease audiences were communicated with three to eight months in advance instead of 12. Due to its resurgence during the pandemic, Tier10 included QR codes on mailers to enhance target audience engagement. The campaign’s messaging shifted to emphasize customer service, tapping into the belief that consumers look to brands for support during uncertain times and reward those who meet their needs. Tier10 tapped into its expertise in data and digital to add additional frequency to its target audience. It also matched offline data to target consumers online through prominent touchpoints like OTT, Social, and Display.

*Source: Urban Science

The results

Although the pandemic continued to wreak havoc, these issues didn’t lead to a decline in overall sales. Sales increased 6% in 2021 compared to 2020, according to the Daily Sales Pulse powered by Urban Science. Tier10’s strategy contributed to this 6%.

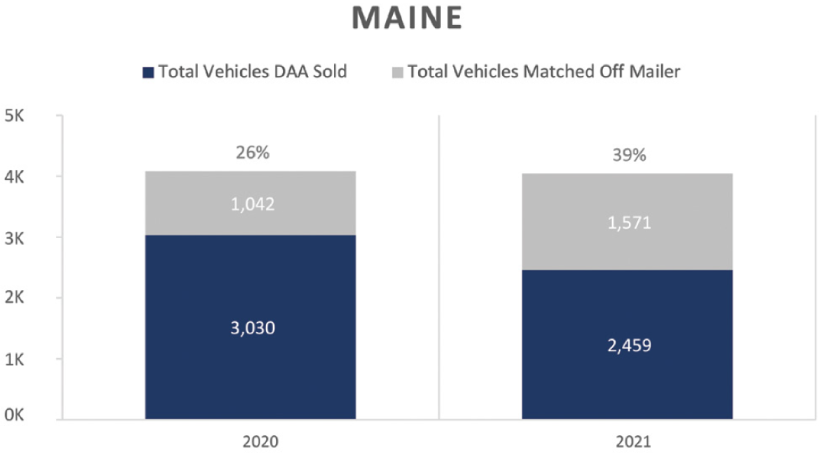

In its second year of execution during a lean environment, Tier10’s enhanced strategy contributed to a 21.85% increase in sales for its clients compared to the previous year. The campaign accounted for 7% and 10% of the workable budget, respectively, in 2019 and 2020. All clients (GTCHDA +14.16%, NOHDA +7.91%) reported positive YOY growth in 2021. This is despite trends in their respective states (ME +2%, MN +3% and OH +1%) as reported by Urban Science. In addition, the increase in returned lease vehicles replenished used/CPO lots, increased internal sales, and allowed dealers to reap the benefits of the increased value of used vehicles.

Sales throughout 2022 will continue to be impacted by vehicle production as OEMs work to build back inventories amid the ongoing semiconductor microchip shortage. Tier10’s interchange with Qualified Customer, Equifax, and Urban Science with their off-lease strategy has proven to be efficient and effective both in normal markets and particularly in the current market.