-

SOLUTIONS

MANUFACTURER

NETWORKPERFORMANCEProactive network management to connect today’s consumers with automotive more efficiently.

SALESPERFORMANCEUncover what really impacts daily performance to grow market share.

AFTERSALESPERFORMANCEBring customers back to increase service retention and build long-term loyalty.

MARKETINGPERFORMANCEScientific precision to make every marketing dollar work harder.

- INSIGHT LAB

FEATURED

October 20th, 2025Urban Science To Relocate Global Headquarters To One Campus MartiusOctober 14th, 2025Q3 EV Retail Sales ReportOctober 9th, 2025Urban Science Discusses Why EV Demand Won’t Collapse Despite End of Federal Tax Credits - NEWSROOM

- ABOUT US

- CAREERS

- EVENTS

Measuring dealer-consumer alignment across continued industry evolution

Urban Science® has teamed up with the Harris Poll to conduct ongoing, comprehensive research on the state of the automotive industry through the eyes of dealers and auto buyers. This page includes ongoing highlights of our findings.

April 25th, 2022

Introducing the Urban Science® Dealership Transformation Index™

Through our research and findings we created a new, science-based methodology for capturing and analyzing the evolving views of the auto-buying public as they relate to the traditional automotive dealership network regarding sales and service, specifically.

These findings provide actionable insights to OEMs and dealers to help them elevate their brand experiences for auto buyers and enhance efficiency and profitability across their operations.

55

Dealership Transformation Index® score

![]()

63

Dealer Relevance

How consumers feel about the role of dealers, the expertise of salespeople and other aspects of the increasingly complex vehicle-buying journey

![]()

48

Cultural Resilience

How open consumers are to buying a vehicle fully online, and their overall views about dealers and their understanding/ability to advise the marketplace on EVs

![]()

53

Actions

What consumers are doing – or considering – regarding their vehicle purchases, from visiting a dealership to submitting online quotes

Dealer Relevance

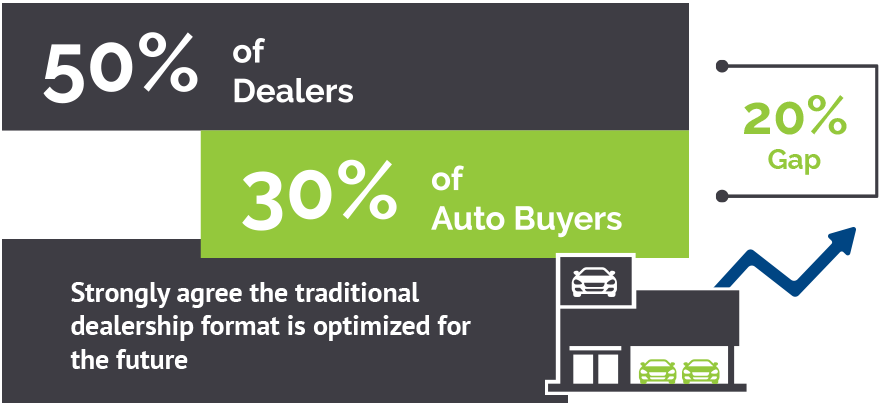

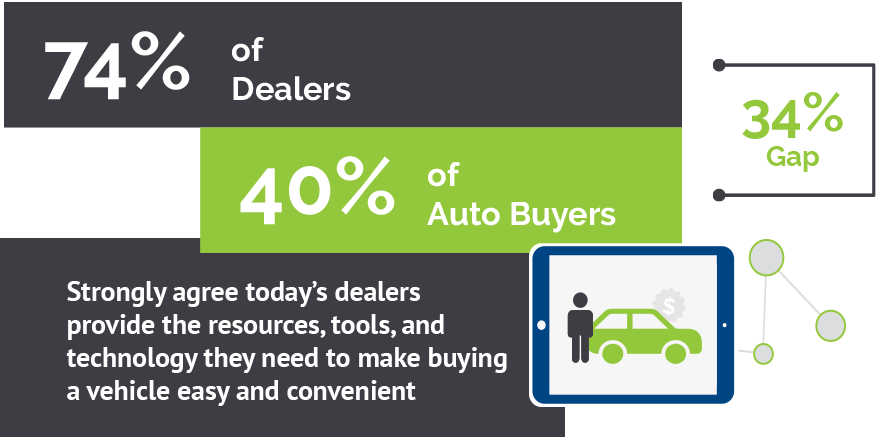

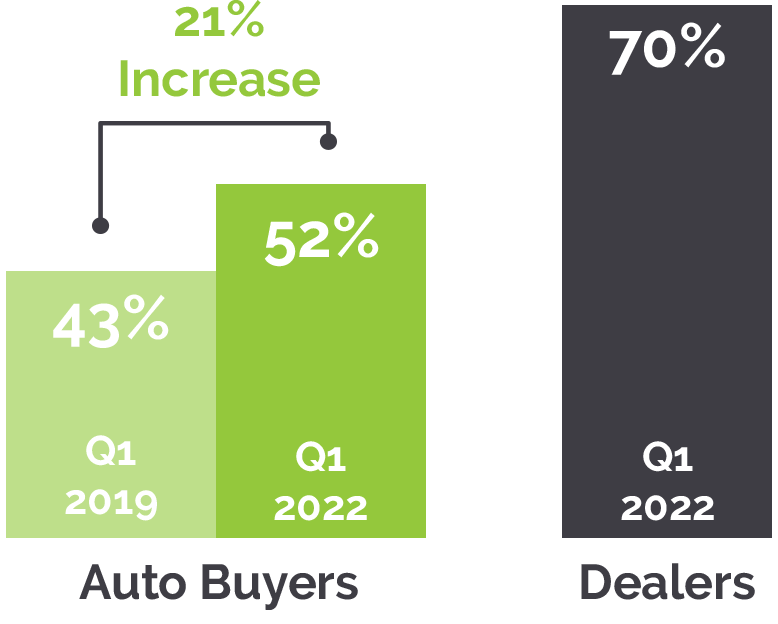

Auto buyers question the traditional dealership format.

Dealers are riding the wave of several seismic shifts in the industry and continue to react to address the new demands of the market and the automotive buyer, whose preferences are changing faster and more significantly than ever. As a result, the gap between auto buyers’ collective perception of dealer relevance and dealers’ collective perception of their own relevance continues to widen.

The industry must heed warnings about auto-buyer perceptions of dealership relevance and how prepared dealers are for the future.

Key takeaways

Auto buyers are not convinced dealers are relevant in their buying journey or putting in the effort to become so. Dealers need to acknowledge auto-buyer perceptions and evolve to meet their expectations. We’ve identified some key areas of focus to help dealers and OEMs create relevant, convenient and future-proof brand experiences for their customers to drive efficiency and profitability now and in the future.

CONTINUE TO THE EV FUTURE

Urban Science will continue to release new data and insights fueled by our DTI research, conducted with the Harris Poll, to help guide OEMs and dealers to certain, science-driven business outcomes — even in the most ambiguous market conditions.

The EV future

Prepare to meet growing demand while you still can.

The impact of EVs on the future of the automotive industry can’t be overstated. Both auto buyers and dealers recognize and agree electrification has the greatest potential to change the future of the auto industry in the coming years. Preparation and optimization for increasing EV-related sales and service needs is critical – and it all starts with dealer and auto-buyer education.

![]()

Industry impact

Across a variety of emerging automotive technology and trends, dealers and auto buyers agree EVs are most likely to change the auto industry a great deal/a lot.

Percentage who think EVs will change the auto industry a great deal/a lot

Dealer preparedness

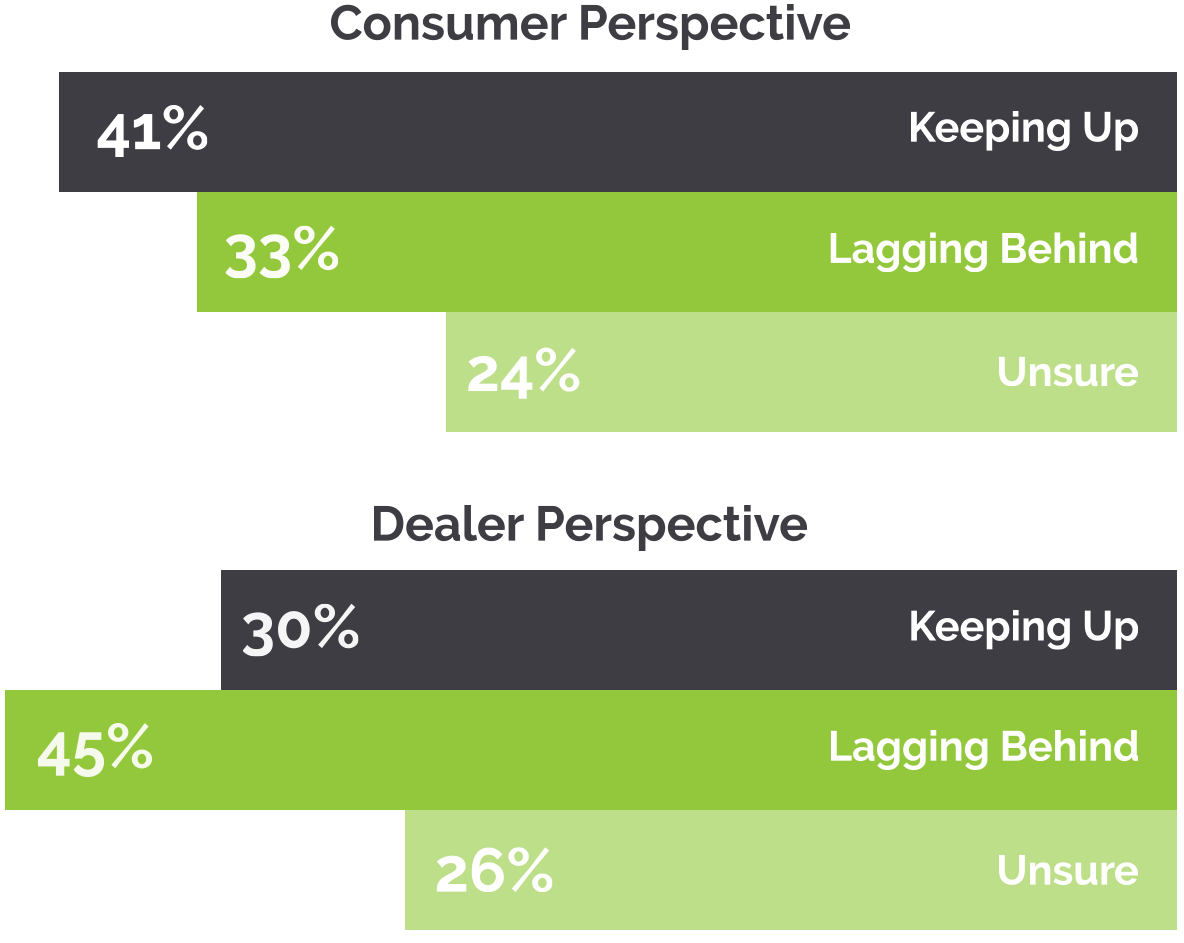

While it’s clear EVs are catalysts for significant industry change, whether dealers are prepared to understand and advise the marketplace on electric vehicles is unclear.

When comparing auto-buyer and dealer perceptions, dealers are more likely to say they are lagging behind. This strong opinion is likely rooted in dealers’ knowledge and understanding of the resources and effort needed to prepare for the EV shift.

Are dealers prepared to understand and advise the marketplace on EVs?

Consumer Familiarization

Significant opportunity lies with buyers unsure of a dealer’s ability to address their EV needs. To seize this lucrative revenue stream, creating opportunities for auto buyers to experience EVs firsthand is key. In fact, in a recent J.D. Power study*, one-third of survey respondents said their reason for not considering an EV was a lack of knowledge. Taking into consideration only 50% of the car-buying population has been inside an EV, it’s clear there’s much work left to do.

Getting consumers inside electric vehicles is critical; in fact, once an auto buyer gains firsthand experience in an EV, they’re about three times as likely to purchase one.

Consumer Motivation

Tap into the power of science-driven, targeted incentives to efficiently motivate potential buyers to familiarize themselves with EVs and in turn, energize their consideration for cleaner, greener offerings. According to our research, when comparing different incentive levels, a $250 incentive only marginally increases a potential buyer’s motivation to test-drive an EV above a $35 incentive.

Percentage of auto buyers who would be somewhat/extremely motivated to test-drive an EV

Key takeaways

Now that you know what auto buyers think about EVs and those who sell them, let’s dive into some considerations to help better postion dealerships – and dealers – to be relevant, meaningful contributors in buyers’ sales and service journeys.

Urban Science will continue to release new data and insights fueled by our DTI research, conducted with the Harris Poll, to help guide OEMs and dealers to certain, science-driven business outcomes — even in the most ambiguous market conditions.

Opportunity for OEMs

- Understand where and when EV demand is likely to rise geographically and how to evolve your network to capture the opportunity, including preparing for the required charging infrastructure.

- Empower dealers to understand the evolving local EV segment preferences to anticipate customer needs before the competition can.

- Ensure a seamless transition between digital-to-physical experiences as consumers progress through the omni-channel buying process.

- Use location intelligence to raise consumer awareness and make it easy for them to experience an EV through both targeted marketing and the consideration of alternative retail formats.

- Invest in education for both dealers and consumers. Education is a key factor in a consumer’s willingness to purchase an EV and a dealer’s ability to effectively sell an EV – and educate their customers.

Opportunity for Dealers

- Adapt your facilities to ensure a flawless hands-on experience, from having a fleet of EVs charged for test drives to ensuring fast DC charging is available for aftersales customers.

- Take advantage of OEM education programs. Consumer confidence is low when it comes to a dealer’s ability to advise them on an EV purchase. Many are doing their own research, so dealers must do everything they can to stay ahead of the EV consumer.

- Evolve the traditional sales value proposition for EVs to go beyond traditional F&I consideration by bundling EVs with home charging installation to remove any potential barriers to purchase.

- Getting consumers to experience EVs firsthand is essential, so double down on getting consumers to test-drive through targeted incentives. Even small incentives motivate action.

- Empower your customers with knowledge; ensure you’re aware of all local incentives and become an expert on the location, capacity and (charging) speed of all public charging stations.

Dealership Transformation Index research was conducted online by The Harris Poll on behalf of Urban Science among 250 U.S. OEM automotive dealers, whose titles were Sales Manager, General Manager, or Principal/VP/Owner, and 1500 US adults aged 18+ who currently own or lease or plan to purchase or lease a new or used vehicle in the next 12 months (referred to in this report as “auto-buying public” or “auto-buyers”).

The dealer survey was conducted December 23, 2021, through January 26, 2022. Results were not weighted and are only representative of those who completed the survey. The auto-buying public survey was conducted from December 23, 2021, to January 4, 2022. Data are weighted where necessary by age, gender, race/ethnicity, region, education, marital status, household size, employment, and household income and propensity to be online to bring them in line with their actual proportions in the population.

Respondents for these surveys were selected from among those who have agreed to participate in our surveys. Because the sample is based on those who agreed to participate in the online panel, no estimates of theoretical sampling error can be calculated.

*JD Power Suggest Outreach and Education to Build EV Demand, https://insideevs.com/news/504167/jd-power-ev-demand-education/