-

SOLUTIONS

MANUFACTURER

NETWORKPERFORMANCEProactive network management to connect today’s consumers with automotive more efficiently.

SALESPERFORMANCEUncover what really impacts daily performance to grow market share.

AFTERSALESPERFORMANCEBring customers back to increase service retention and build long-term loyalty.

MARKETINGPERFORMANCEScientific precision to make every marketing dollar work harder.

- INSIGHT LAB

FEATURED

October 20th, 2025Urban Science To Relocate Global Headquarters To One Campus MartiusOctober 14th, 2025Q3 EV Retail Sales ReportOctober 9th, 2025Urban Science Discusses Why EV Demand Won’t Collapse Despite End of Federal Tax Credits - NEWSROOM

- ABOUT US

- CAREERS

- EVENTS

June 20th, 2024

Driving towards an electric future:

challenges and progress in the UK’s EV infrastructure

In April 2024, the landscape of the electric vehicle (EV) charging infrastructure in the UK showcased significant growth, boasting a total of 61,232 charging points spread across 32,697 locations – a remarkable 45% increase since April 2023. However, this expansion comes amid a backdrop of evolving consumer sentiments and governmental mandates. While the UK has set a bold target for all vehicles to be zero-emission by 2035, a recent Urban Science survey alongside the Harris Poll1 reveals a disconnect between this ambitious goal and consumer readiness to accept only EV options when shopping for a vehicle. Only 57% of auto buyers will be ready to embrace solely EV models by the mandated deadline and currently, 35% report feeling uncertain or resistant to the transition, indicating a nuanced journey toward widespread adoption.

UK Readiness to Accept Only Electric Vehicle Options When Purchasing a Car

Among survey respondents, varying timelines emerge:

Our research also reveals key concerns voiced by consumers worldwide, including those in the UK, revolve around the limitations of current EV technology, notably the range per charge. Additionally, a significant barrier persists in the accessibility and convenience of charging infrastructure, underscoring the need for continued investment and innovation in this crucial facet of EV adoption. As the automotive industry navigates this pivotal juncture, addressing these challenges will be paramount in accelerating the transition to a sustainable EV future.

Unpacking preferences and concerns

In the UK, the preferences and concerns of auto buyers will shape the trajectory of the transition. While personal home EV charging emerges as the most favored method among UK consumers, with 61% expressing a preference for it over alternatives like Fast-DC charging or public charging stations,2 significant challenges hinder widespread adoption. Surprisingly, despite this preference, around 25% of households in the UK have no access to off-street parking, rendering home charging installations impractical for many potential customers. Moreover, only 37% of current EV owners and a mere 22% of internal combustion engine (ICE) vehicle owners perceive home charging installations as feasible within their current budgetary constraints.3 Beyond the realm of personal home charging, UK auto buyers exhibit a preference for charging at convenient locations near their residence, workplace, or regular activities, such as shopping centers, supermarkets, cinemas or restaurants. However, looming large are concerns regarding the reliability and adequacy of the EV charging infrastructure. Chief among these concerns is the shortage of charging stations, identified as the primary apprehension among auto buyers in the UK. A significant 65% of auto buyers cite insufficient charging stations as their top concern,4 underscoring the pressing need for infrastructure expansion and enhancement to support the growing demand for electric vehicles.

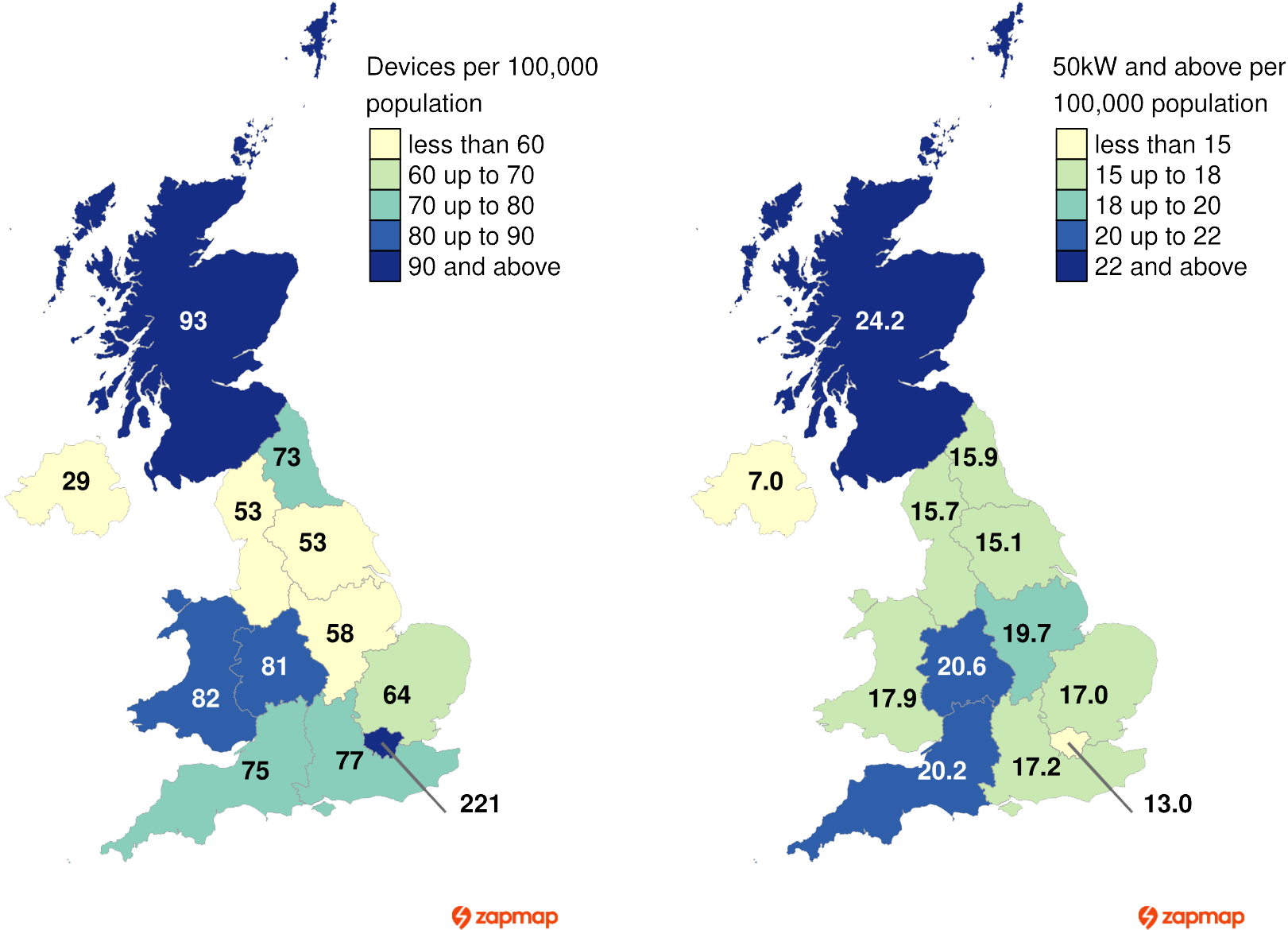

Total / 50kW and above public charging devices

per 100,000 of population by UK region 1 April 20245

A significant 65% of auto buyers cite insufficient charging stations as their top concern

Additional worries center on various aspects of infrastructure, including the lengthy duration required for charging (58%), the potential for long queues at charging stations (43%), difficulties in accessing or reaching charging stations (44%), the cost of installing home chargers (49%), high costs associated with charging (46%), charging stations not in working order (37%) and concerns about power outages (27%).6

The vital link between charging

infrastructure and consumer readiness

The global landscape of EV adoption readiness underscores the critical role of charging infrastructure perception in supporting an EV future. In the UK, only 15% of auto buyers anticipate the infrastructure being prepared to meet the needs of consumers within the next three years (by 2027), with Germany lagging even further behind at 13%. In contrast, China, India and Mexico present a more optimistic outlook, with a substantial proportion of consumers – 57%, 54% and 36% respectively – expressing high confidence in the infrastructure’s capability to meet consumer needs within the same timeframe.

When juxtaposed with their readiness to accept only EV options when purchasing a vehicle, one can infer a clear connection between auto buyer EV adoption readiness and perceptions of charging infrastructure readiness. For example, China (66%) and India (59%) lead in current readiness to accept only EV options by the end of 2025, with Mexico not far behind at 40%, while both the UK and Germany sit at a mere 13% and 10%. These insights underscore the need for targeted strategies to address infrastructure concerns and accelerate the transition towards an EV future and sustained mobility.

In the UK, only 15% of auto buyers anticipate the infrastructure being prepared to meet the needs of consumers within the next three years (by 2027)

Accelerating infrastructure development for EV growth

In paving the path toward widespread EV adoption, it’s imperative to address prevailing perceptions regarding costs and operational ease. The key lies in bolstering trust and accessibility within the charging infrastructure network, essential for nurturing an environment conducive to EV growth. Accurate forecasting of EV sales demand emerges as a pivotal tool, guiding the strategic expansion of charging infrastructure to meet evolving needs effectively. Recent strides in charging station installations reflect a promising endeavor to bridge the infrastructure gap. However, the current disparity is glaring when it comes to charging speed: out of 1,924 rapid or ultra-rapid charging devices (50kW of power or above) scattered across 5,287 charging locations in the UK, only a little over 19% of the infrastructure boasts rapid charging capabilities. This gap underscores the pressing need for accelerated infrastructure development. Despite progress, as evidenced by the addition of 315 net new rapid or ultra-rapid charging devices last month, there remains a significant challenge in matching supply with the burgeoning demand for EVs.

Moreover, key themes need to be addressed with the public to ensure the growth in EV sales and progress towards a zero-emissions future, regardless of the country. Barriers to purchase vary little by market in terms of priority and focus. One of the main barriers for auto buyers identified throughout the research is the length of time it takes to charge. With the continued development of ultra-fast charging solutions across markets, the potential to revolutionize charging by significantly reducing charging times to minutes rather than hours is no longer a thing of the past. “Range anxiety,” a common term heard in relation to EVs, is another crucial concern. The fear that your car will run out of battery when traveling between point A and point B persists. However, battery range continues to increase in new EVs coming to market, with many achieving circa 400 miles. Additionally, more charging stations are being developed, reducing any perceived anxiety among electric vehicle drivers.

Finally, charging at home is more convenient and usually cheaper than filling up at your local petrol station. However, more innovative solutions are required to support the adoption of EVs for those without access to charging at home.

Empowering all decision-makers to drive the shift to EV

The path to widespread EV adoption in the UK combines progress and obstacles. Although charging infrastructure has grown, challenges like consumer preferences, infrastructure differences and lingering concerns remain. Industry leaders need to invest and innovate to tackle these hurdles. Meanwhile, consumers also have a role to play, requiring careful thought and action to overcome adoption barriers. Here are some key considerations for all decision-makers:

Automakers

In response to ZEV mandates, manufacturers will need to ramp up marketing efforts toward consumers who express hesitancy in fully embracing EVs. Understanding and addressing consumer concerns will be paramount. Moreover, tailoring messaging to align with local market needs and preferences will be crucial for successful adoption. For example, a suburb-dweller is likely to charge predominantly at home, meaning that the cost advantage to “re-fuel” can be played heavily in marketing messages. Contrast to a typical city-dweller, whose decision to buy an EV could be influenced heavily by news of new rapid-charging infrastructure installations or local low-emission zoning.

Retailers

An in-depth comprehension of the current and projected charging infrastructure within their local territory is imperative. Local geographies where EV uptake has been slow so far may be forecasted to become hotspots as overall EV share increases, EV pricing becomes more competitive and local charging infrastructure expands. Moreover, being able to clearly communicate the return on investment (ROI) to consumers considering home charging installations is essential. Identifying the mileage threshold at which the expense of charger installation becomes economically advantageous is crucial for consumer decision-making. Additionally, customizing marketing strategies according to demographics and dwelling types is fundamental for maximizing engagement.

Charging network providers

Understanding the necessary investments needed to bolster charging infrastructure and keep pace with demand for EVs is critical. There are still considerable growth prospects in areas where forecasted EV sales are high, but charger density remains low, particularly in regions characterized by a prevalence of multi-unit dwellings. Pinpointing such underserved areas and tailoring strategies to bridge this gap will help facilitate the seamless adoption of EVs.

Consumers

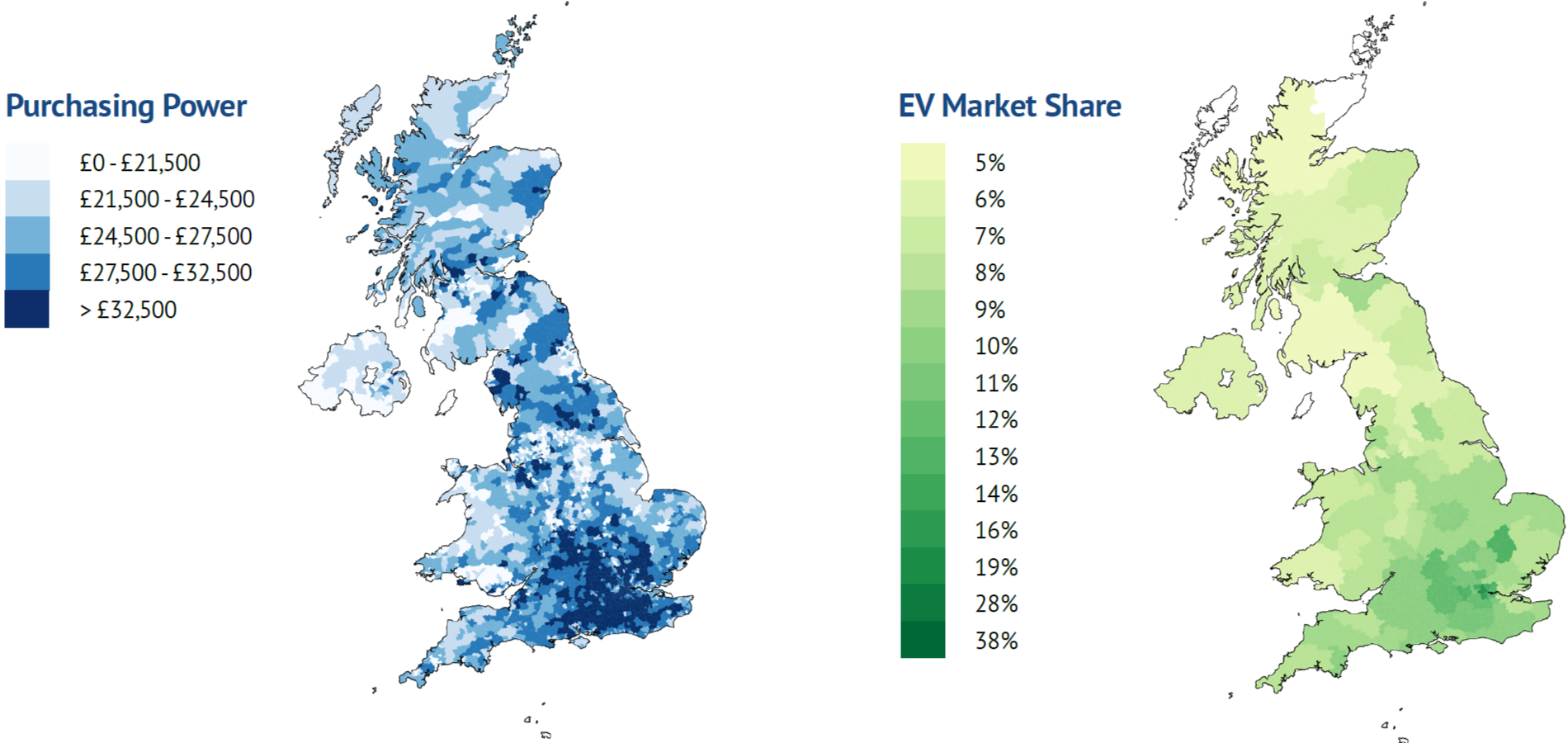

Consumers need to know the full cost of owning an EV and where they’ll charge away from home most often, and how frequently. They should understand which EV range suits their needs best based on their personal use cases. Currently, auto buyers in the UK and Germany are willing to pay small premiums of 26% and 18% respectively over the cost of comparable petrol vehicles, which is below the global average of 29%. Lowering the initial purchase cost of an electric vehicle will change the current trend of high EV market share occurring in areas with higher purchasing power.

UK Purchasing Power vs. EV Market Share 20237

The Objective Power of Science

Since our founding over 45 years ago, our proven, scientific approach to retailer planning has continued to improve and evolve. It’s an approach that stays ahead of the technological curve to help improve the performance of retailer networks – and it continues to be the industry standard.

Get in touch if you’d like to talk about your EV strategy

and how we can apply the power of science to your business.

Graeme Beveridge

Graeme Beveridge

Account Executive

gbeveridge@urbanscience.com

+44 7770 605982

1, 2, 3, 4, 6. Source: Urban Science Online Consumer and Dealer Studies, February 2024. These surveys were conducted by The Harris Poll on behalf of Urban

Science among 3,005 U.S., 1,006 Australia, 1,000 China, 1002 Germany, 1,000 India, 1,009 Mexico, and 1,006 UK adults aged 18+.

5. EV charging statistics 2024 – Zapmap

7. Public Electric Vehicle Charging Infrastructure. Deliberative and quantitative research with drivers without access to off-street parking. Research report.