-

SOLUTIONS

MANUFACTURER

NETWORKPERFORMANCEProactive network management to connect today’s consumers with automotive more efficiently.

SALESPERFORMANCEUncover what really impacts daily performance to grow market share.

AFTERSALESPERFORMANCEBring customers back to increase service retention and build long-term loyalty.

MARKETINGPERFORMANCEScientific precision to make every marketing dollar work harder.

- INSIGHT LAB

FEATURED

October 20th, 2025Urban Science To Relocate Global Headquarters To One Campus MartiusOctober 14th, 2025Q3 EV Retail Sales ReportOctober 9th, 2025Urban Science Discusses Why EV Demand Won’t Collapse Despite End of Federal Tax Credits - NEWSROOM

- ABOUT US

- CAREERS

- EVENTS

June 21st, 2023

Network Sales Report | China

Examining China’s Volatile Network Development

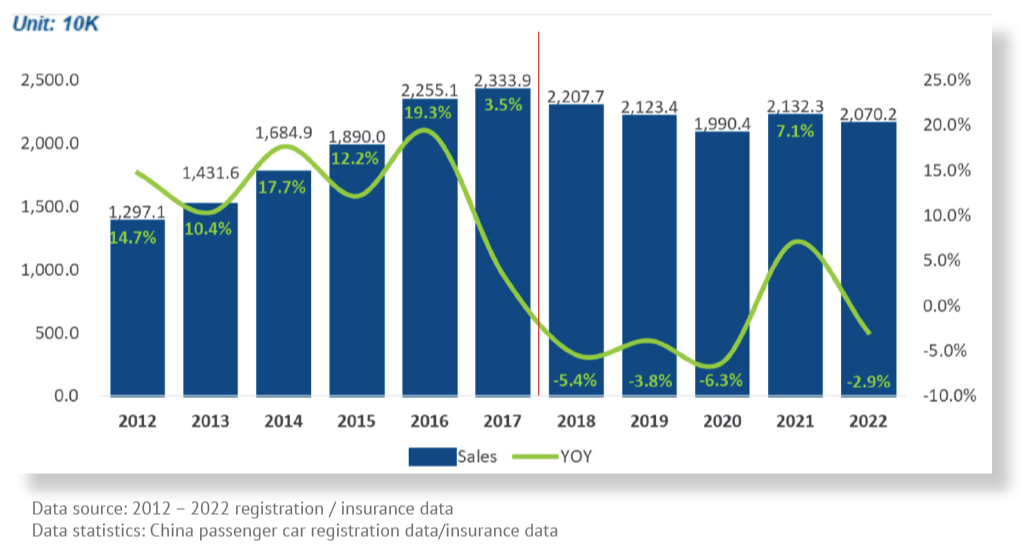

China has remained the world’s largest automotive manufacturing country and automotive market since 2009. The growth in China’s auto market was stimulated by the reduction of the auto purchase tax policy in 20161. Up to 2017, the Chinese auto market enjoyed a relatively stable year-over-year (YoY) growth trend, but in 2018 the Chinese passenger car market ended years of steady growth by marking the first sales decline in 20 years. Driving this decline was the imposition of the China VI2 vehicle emissions standards and saturation of the market. The new car sales market’s downturn was exacerbated by the Covid-19 pandemic outbreak, reaching its lowest point in 2020. In 2021, overall sales began to come back and reverse the trend. Due to strong demand for new energy vehicles, sales increased 7.1% YoY. 2022 saw another small (2.9%) decline compared to previous year with passenger vehicle sales topping out at 20.7 million.

The outbreak of COVID-19 in Jilin, Shanghai, and other areas in mid-to-late March 2020, seriously impacted China’s auto industry supply chain and resulted in the total suspension of the auto industry in Shanghai and surrounding areas in April. For example, the production and sales of SAIC, whose many subsidiaries have plants in Shanghai, fell by more than 60%. Come June,3 Shanghai gradually began to resume production. It is worth noting that in 2022, China’s NEV4 sales of 6.887 million units increased 93.4% YoY, accounting for 61.2% of global sales.

By the end of 2022, the number of sales network outlets increased by 18.6% when compared to 2019.

China’s auto franchise outlets grew 6.3% in 2022:

The China Automobile Dealers Association (CADA) stated that by the end of 2022, there were 33,594 franchise outlets in China — a 6.3% YoY increase. Urban Science executed a study analyzing the changes in sales network data for a three-year period from the end of 2019 to the end of 2022. Our analysis included 40 mainstream brands, which accounted for 84.1% of total passenger car sales in China in 2022. Of those included, there was a mixture of Chinese-owned brands and joint-venture-owned brands. The data below represents the number of outlets selling vehicles.

Urban Science findings:

- Compared to the previous year, the growth of China’s auto sales outlets has gradually slowed down. Nonetheless, it still maintains a growth trend in 2022 driven primarily by Chinese-owned brands, especially new-energy vehicles (NEV) brands.

- Currently, NEV brands are the leaders in network development by utilizing many different sales models to reach consumers and grow market share.

- Chinese-brands are incorporating a mixture of traditional storefronts and alternative retail formats —such as stores within shopping malls.

- Among the joint-venture brands, retail networks have shrunk by varying degrees and are more focused on optimizing their existing networks.

Among the 40 brands in our study, the number of outlets increased by 6.8% YoY at the end of 2022. Compared to the end of 2019, the number of outlets by the end of 2022 increased by 18.6% from 20,598 to 24,423.

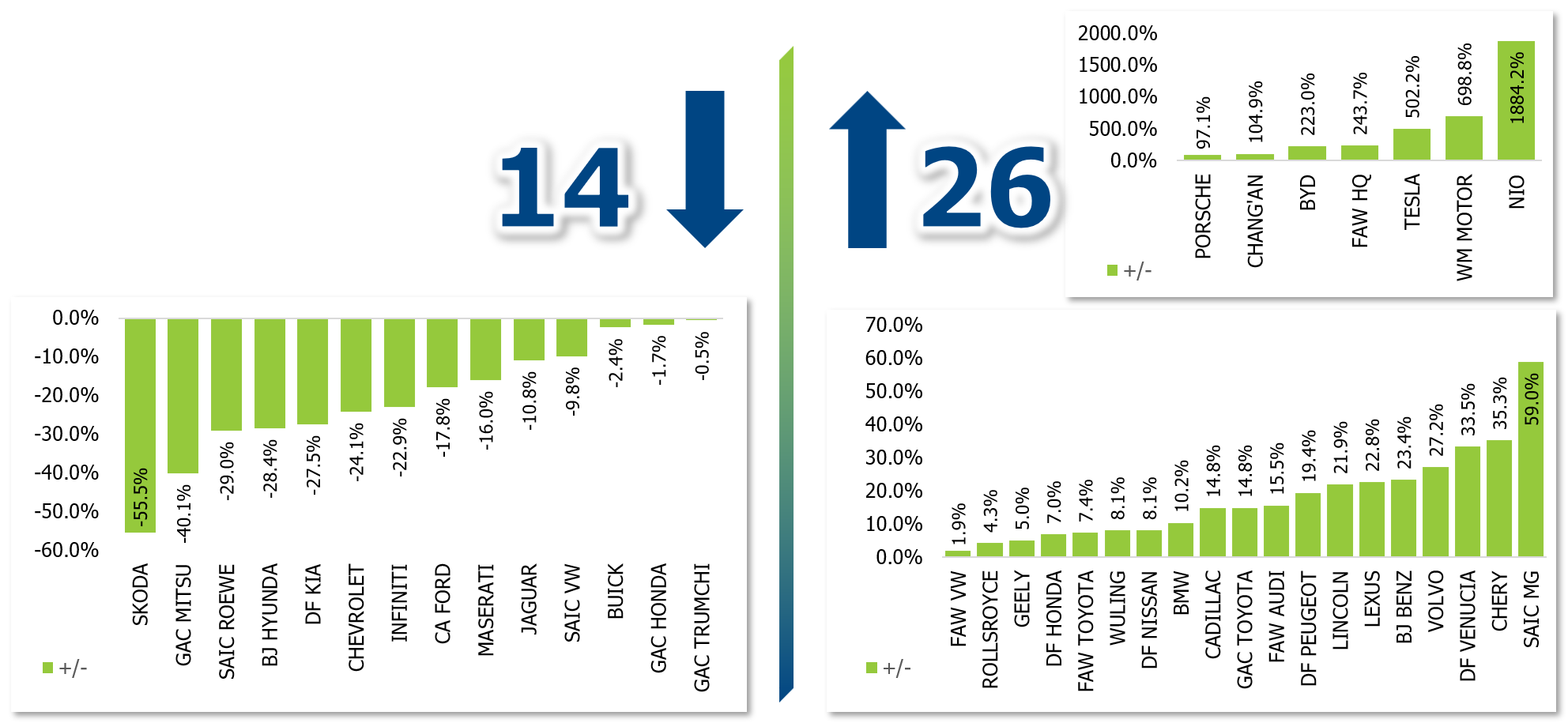

As shown in the above chart, 14 brands have reduced the size of their networks by varying degrees. Our research found among those reducing their network size, there is a prevalence of joint-venture brands, with nine out of the 15 joint-venture brands having decreased their size over the three-year period. While some brands may be shrinking due to a branding crisis, others may simply be optimizing their sales networks.

The remaining 26 brands underwent significant network expansion over the three-year period, with startup brands growing the fastest. However, growth in the number of outlets does not necessarily translate to growth in sales, and some brands have not succeeded in increasing sales in line with increasing outlet numbers. This further illustrates the importance of a network planning strategy that ensures the right number of outlets are in the right places to promote consumer convenience.

Growth in the number of outlets does not

necessarily translate to growth in sales.

Although China’s auto retail network did not grow as fast as as it did in the previous decade, the growth rate in the past three years is still remarkable. In 2022, the number of sales outlets in second- and third-tier cities increased due to accelerated urbanization, rising income levels and the increase in NEV sales change. We expect growth among third- or lower-tier cities to continue until 2025, with channel sinking, a strategy that launches low to medium price products into lower tier cities to accelerate penetration, and shopping mall outlets being the primary drivers.

As many single-brand storefronts continue to match the sales performance of their JV counterparts, it’s critical that automakers continue to tap the power of science to inform their network planning decisions to ensure short- and long-term profitability, said Chee-Kiang Lim, managing director, Urban Science China. “Developing certainty-based network plans is critical for automakers to enhance customer convenience, prevent oversaturation, and safeguard throughput and profitability. In today’s ambiguous market conditions, it is imperative for automakers to prioritize certainty over speculation to ensure their success.”

Avoiding over-saturation of retail outlets is essential to the continued profitability of both manufacturers and dealers.

Leverage the right data and the power of science to drive network performance

Urban Science China has maintained our China Dealer Census since 2014. It spans over 80 passenger car brands and includes a list of all vehicle dealership information. Complied on a monthly basis, our census is the most reliable source of dealership statistics, delivering over 20 parameters for more than 300 Chinese prefecture level cities. Our database is the solid foundation on which we deliver our network planning expertise.

The Urban Science Network Planning solution helps collect data through research and applies our unique scientific analysis methods to achieve an accurate and optimal network configuration. For example, we can comprehensively calculate and evaluate each planned open city using data such as city population, GDP, market capacity, consumption level, sales forecast, etc., and determine the ideal channel network planning. We also analyze and evaluate the impact of relocation and conduct market research and strategic development suggestions based on the future development trend of the NEW market and new retail and national policies.

About Urban Science

Urban Science is a leading automotive consultancy and technology firm that serves automotive original equipment manufacturers (OEMs) and dealers and the advertising technology companies that support them around the world. Headquartered in Detroit and operating in 20 office locations globally, Urban Science taps the power of its science – and its unrivaled data, solution offerings, and industry expertise –to create clarity and business certainty for clients in even the most chaotic market conditions. Visit UrbanScience.com for more information about how Urban Science helps automotive manufacturers and dealers gain competitive edges by taking the guesswork out of critical business decisions and, in turn, drives improved efficiency and profitability industrywide.

For more information, please reach out to: marketing_cn@urbanscience.com.

1. http://szs.mof.gov.cn/zhengcefabu/201509/t20150930_1484040.htm

2. New emission standard replacing all previous versions. Vehicle models that do not meet the new standards can only be “disposed of,” effectively decreasing their value. Additionally, the cost of buying a car may increase for consumers. Emission reduction will also affect fuel consumption and power performance. For an OEM, continuously upgrading emissions treatment becomes increas-ingly complex and drives research and development and production costs potentially twice as high.

3. http://www.saicgroup.com/english/latest_news/saic_motor/57762.shtml

4. NEV is defined as BEV, HEV, PHEV, FCEV