-

SOLUTIONS

MANUFACTURER

NETWORKPERFORMANCEProactive network management to connect today’s consumers with automotive more efficiently.

SALESPERFORMANCEUncover what really impacts daily performance to grow market share.

AFTERSALESPERFORMANCEBring customers back to increase service retention and build long-term loyalty.

MARKETINGPERFORMANCEScientific precision to make every marketing dollar work harder.

- INSIGHT LAB

FEATURED

April 22nd, 2024Shades of Change: How Color Preferences could influence EV adoption.March 12th, 2024Charging ahead: navigating the dynamic evolution of the UK’s electric vehicle market in 2024February 21st, 2024Urban Science: U.S. automotive dealer count held steady as throughput hits post-pandemic high in 2023 - NEWSROOM

- ABOUT US

- CAREERS

- EVENTS

March 12th, 2024

Charging ahead: navigating the dynamic evolution of the UK’s electric vehicle market in 2024

As we consider the 2023 surge in electric vehicle (EV) sales and their expanding market share, a crucial uncertainty lingers: When will private consumers align with the fleet market in adopting EVs? This unanswered question is central to understanding the trajectory towards sustainable mobility. Interestingly, 2023 saw a decline in private EV registrations in the UK, despite continued strong growth in fleet sales. New entrants are queuing up to challenge the established order, armed with a suite of products that have not only garnered positive reviews but also shown remarkable ability in engaging the mass market. This emergence prompts a pivotal question: Will this influx of fresh, positively received options persuade more consumers to invest their own finances into the realm of electric vehicles?

2023 finished with

350,439 EV sales in total – up 23% from 2022

The top 5 models predictably contained a clear volume win for the Tesla Model Y, but MG, Polestar and VW demonstrated the possibility of making significant inroads into their dominance:

Tesla Model Y 41,331

MG 4 23,202

Tesla Model 3 17,100

Polestar 2 12,593

Volkswagen ID.3 10,823

Within those market predictions lie some fascinating details. Forty-two models that registered no sales in 2023 are forecasted to surpass the 100-unit sales mark in 2024.

The market is poised for unprecedented levels of competition. With the integration of the Zero Emission Vehicle (ZEV) mandate, compelling all Original Equipment Manufacturers (OEMs) to comply, the upcoming year is shaping up to be a landmark period in the automotive industry.

According to GlobalData, the volume of EV sales in 2024 will grow by a further 36% to reach 476,804 sales in total.

Geographic nuances to success

In this dynamic landscape, it is evident that not all brands will achieve their aspirational levels of success. Securing a significant market share in this environment demands a profound understanding of the market nuances and the strategic agility to outperform rivals in capitalizing on the available opportunities.

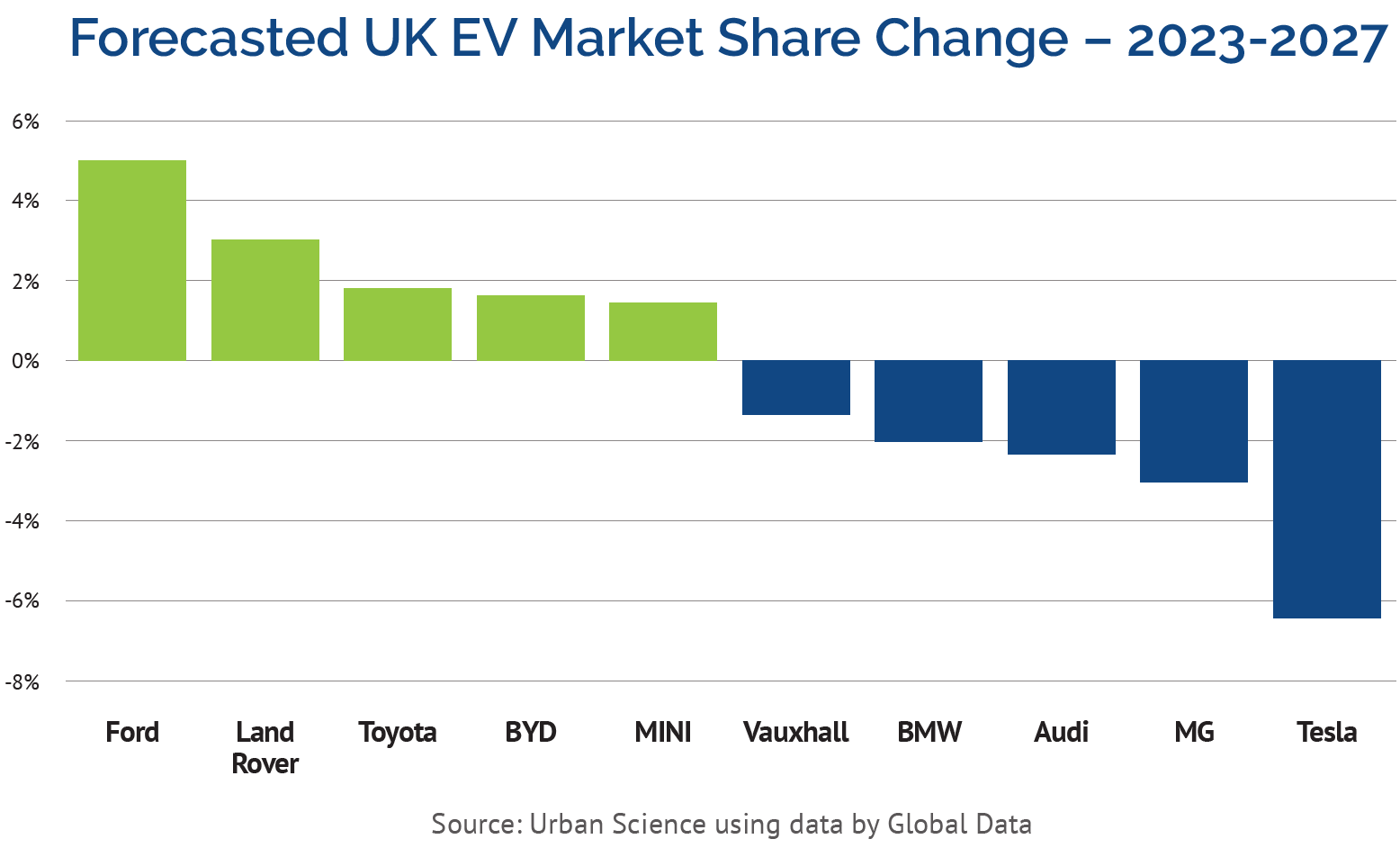

The predictions from GlobalData, looking further into the future, are clearly subject to much more uncertainty. But it is interesting to note their current view that brands such as Ford, Land Rover and Toyota could be the big winners – with established brands such as Tesla, MG and Audi expected to suffer most.

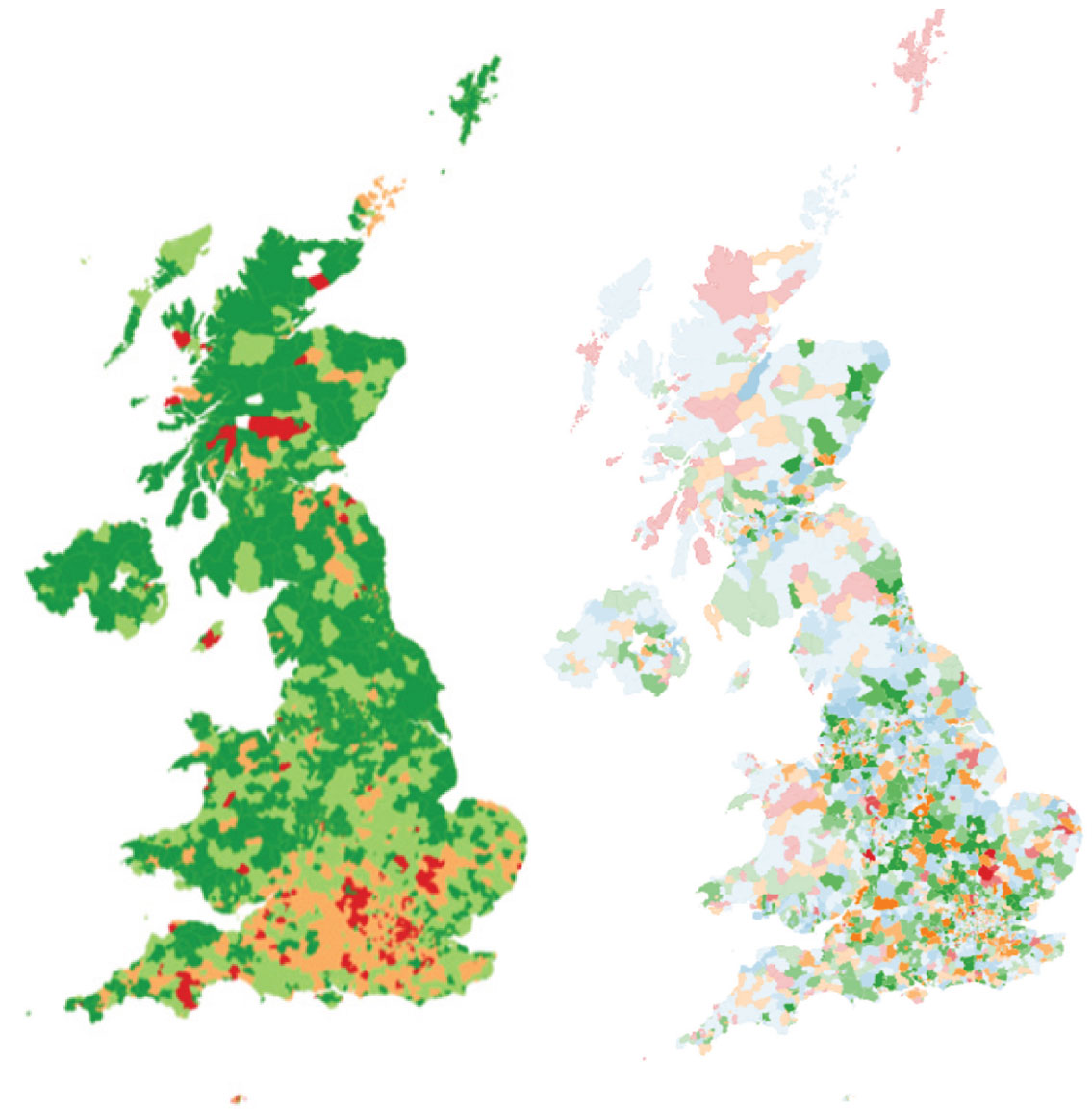

With consumer interest in EV outside of the fleet market still developing, there is an observable uneven distribution of demand across various regions. In the UK, certain areas emerge as hot spots where the market share of private EVs exceeds the national average. This is particularly noticeable and easy-to-understand in towns and cities like Cambridge and Exeter, where there are high levels of EV registrations. Factors such as local council strategies, investments in charging infrastructure and a substantial used EV market, especially in Exeter, contribute to this trend. The rate at which other areas adopt EVs will vary, influenced by local demographics, political decisions and investments in EV infrastructure and initiatives.

Challenges Facing 2024 Growth

The path to this growth is not without distinct challenges. A primary focus remains targeting and marketing to early adopters within the private buyer sector, who play a crucial role in driving positive sales trends. Another significant hurdle is overcoming dealership resistance. This requires a tactical approach that not only involves engaging early adopters physically but also encompasses providing comprehensive EV education and fostering a culture that embraces the future of electric vehicles.

Accurate forecasting of EV sales is pivotal in pinpointing potential and existing hot spots. This involves not just understanding where the market is currently thriving but also where it has the potential to grow. The expansion of EV market share relies on a multifaceted strategy that includes targeted marketing, precise sales forecasting, engaging advertising campaigns and potentially offering incentives such as test drives and experiential events.

For manufacturers, the role is evolving into that of a key orchestrator, where they are tasked with empowering dealerships through advanced digital marketing support, providing critical insights and supplying innovative tools. And together as a retail network, manufacturers and dealerships must adapt and collaborate to leverage these strategies effectively, ensuring they are well-positioned to meet the demands of a rapidly changing automotive landscape.

Science as a solution

Since our founding over 45 years ago, our proven, scientific approach to retailer planning has continued to improve and evolve. It’s an approach

that stays ahead of the technological curve to help improve the performance of retailer networks – and it continues to be the industry standard.

Let us show you how we can apply the power of science to your challenges. Call or email me.

Paul Dillamore

Paul Dillamore

Managing Director, UK

pmdillamore@urbanscience.com

+44 7770 605982