-

SOLUTIONS

MANUFACTURER

NETWORKPERFORMANCEProactive network management to connect today’s consumers with automotive more efficiently.

SALESPERFORMANCEUncover what really impacts daily performance to grow market share.

AFTERSALESPERFORMANCEBring customers back to increase service retention and build long-term loyalty.

MARKETINGPERFORMANCEScientific precision to make every marketing dollar work harder.

- INSIGHT LAB

FEATURED

April 22nd, 2024Shades of Change: How Color Preferences could influence EV adoption.March 12th, 2024Charging ahead: navigating the dynamic evolution of the UK’s electric vehicle market in 2024February 21st, 2024Urban Science: U.S. automotive dealer count held steady as throughput hits post-pandemic high in 2023 - NEWSROOM

- ABOUT US

- CAREERS

- EVENTS

August 24th, 2023

In the race to connect with EV shoppers, data is in the driver’s seat.

Auto buyers are putting the automotive world on notice: They’re serious about the EV future, and what only yesterday was a fringe market, today is going mainstream – and fast. By next year, U.S. auto buyers will have more than 130 EV models to choose from.1 How will they decide? It’s a question digital marketers will have to answer if they want to capture the attention (and sales) the growing EV audience represents.

It’s 2023. Do you know where your EV shoppers are?

According to a recent study by The Harris Poll,2 commissioned by Urban Science, more than a quarter of auto buyers (26%) say they will be ready to accept “only EV options” by 2025. That number swells to 50% by 2035.

Do you know where these buyers are, what will motivate them to act and – importantly – where they will go to purchase an EV? The Urban Science® Dealership Transformational Index™ sheds important light on the subject. It shows a year-over-year drop in auto buyers’ attitudes toward dealer relevance. The data surrounding that metric raises critical questions for today’s digital marketers. What messages are resonating with EV shoppers who increasingly find dealerships less relevant in their shopping journey? What will motivate them to go to a dealership as part of their shopping process? What “triggering terms” will get them to act? How can you know that the people you’re marketing to today haven’t already purchased from a competitive brand yesterday?

A brand’s (and dealership’s) best chance at winning the fight for awareness, consideration – and the ultimate measure of success, sales – requires taking action now. It all starts with better EV marketing, which depends on having better data at every touchpoint: from campaign design to execution and through measurement. In order to get the most out of your EV marketing, consider the following data-driven strategies:

Know where your EV market is growing – let data be your GPS.

Although BEV growth is 30-50% across all states, those numbers can be misleading, since that growth is not spread evenly. For example, New York is experiencing a +48% YoY change, while Los Angeles recorded the highest volume change (+900k units) in that same period.3 The key is to be sure you’re not wasting dollars in markets that don’t have the potential you’re looking for.

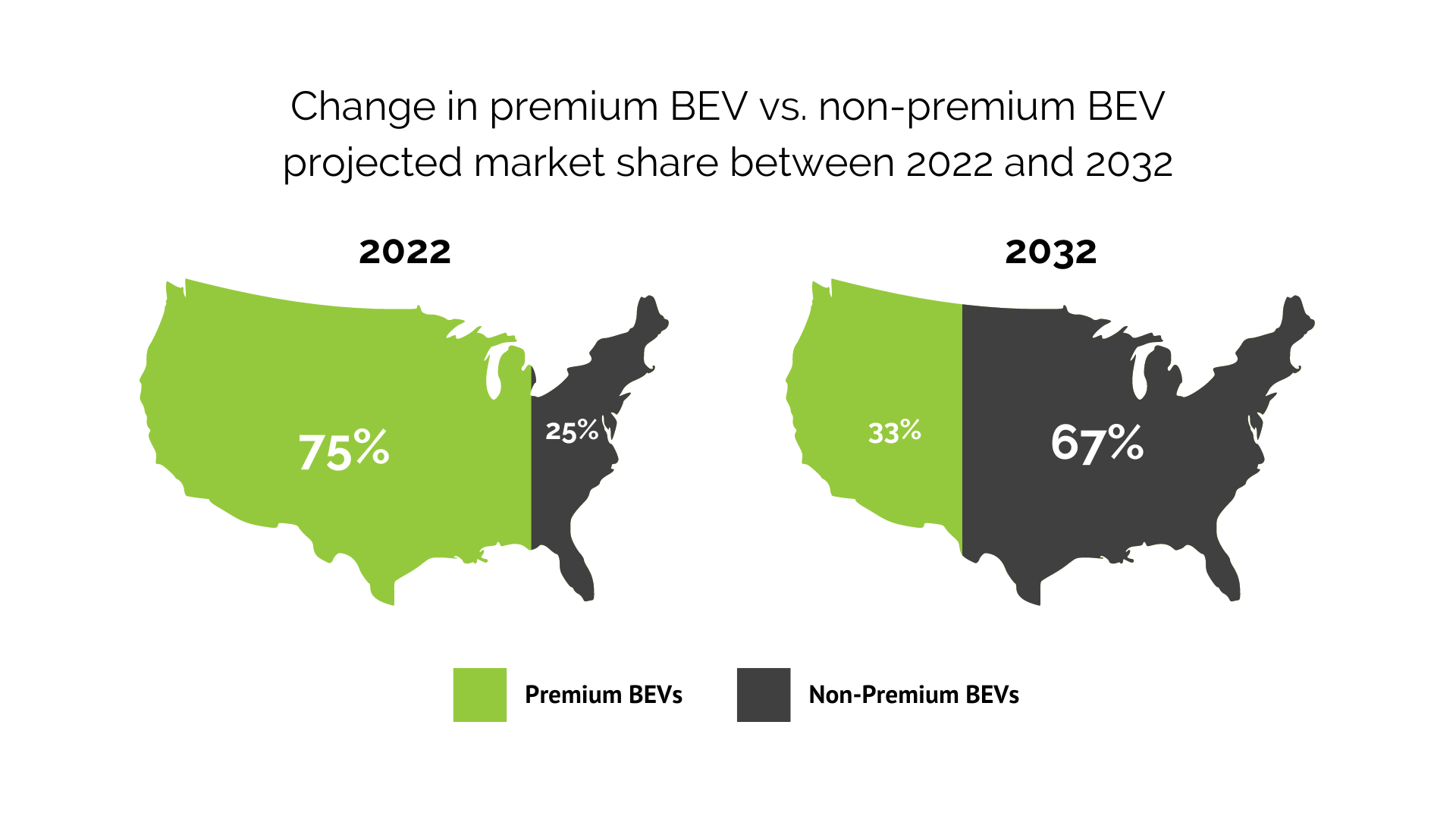

The graph to the right shows the past, present and projected future regarding where EV segmentation has been and where it’s going. Over the next decade, EV segmentation will begin to step dramatically away from high-end luxury and become concentrated in non-luxury vehicles. Today’s digital marketers need to augment those types of macro-level facts with data that can identify EV in-market shoppers with unique specificity. Only then, can you be confident that you are targeting your messaging so that it is both effective and efficient.

Knowing is only half the battle – data ignites your marketing.

Beyond understanding geographic and consumer opportunities, marketers are still faced with the challenge of actually reaching EV audiences. While that may sound simple, when it comes to the EV market, that’s actually a more complex proposition than it first appears to be. That’s because the EV market is rapidly changing from catering to luxury and early adopters to focusing on more affordably priced options.

Since there isn’t much historical data regarding EV buyers, the best approach is to rely on partners with rich experience in automotive and data science. Find partners utilizing years of daily lead-level sales data and data-enriched predictive modeling. Many brands are enjoying an increase in first-time buyers of EVs, but it’s important that you don’t become complacent. Many first-time EV buyers are early adopters and/or those with higher household incomes than those who will buy EVs in the future. It’s critical to work with a partner who has engine-level data that can then be leveraged to create EV audience segments that take all these behaviors into account. That allows confidently marketing to target households that are predicted to be in-market for an electric vehicle or plug-in hybrid in the next 90 days.

Let the data drive you forward.

The number of variables impacting the EV shopping and buying equation are many – and ever-changing. Digital marketing efforts need to be every bit as flexible. They must understand and embrace cross-shopping dynamics, where and why shoppers are leaving one brand and gravitating to another, and the critical interception messages and media that need to be put in place to affect desired purchase behavior.

A common mistake is to rely on marketing efforts that formed the bedrock of early digital attempts to analyze where shoppers were going, such as looking solely at clicks, traffic and builds when evaluating a campaign. Today, it’s critically important to also leverage the power of data to identify off-line sales. Only with this combination of metrics can you begin to understand the effectiveness of your EV advertising fully and accurately and how to optimize it for an even greater positive impact on your EV sales.

With shoppers at the crossroads of ICE and EVs, it’s essential to go beyond simply counting sales to also analyzing the type of sales your marketing is bringing in. Of the sales that were made, how many stayed within your brand? How many purchased an ICE vehicle versus an EV? If they purchased an EV, what patterns emerged across your creative messaging and targeting? Perhaps most importantly, did you lose them to an EV alternative? Properly segmenting these customers and knowing who to suppress and target is critical.

The more you measure and the deeper you dig, the greater intelligence you can apply to your future digital marketing efforts. By using data as an ally in your campaigns, the learnings you discover can feed into a cycle of continuous improvement – one worth repeating to create the EV sales you’re after.

Science as a solution

Since our founding over four decades ago, our proven, scientific approach to automotive retailing has continued to improve and evolve. It’s an approach that stays ahead of the technological curve to help improve marketing, sales and service performance – and continues to be the industry standard – giving you the best opportunity for success.

Urban Science is continuously working to help auto marketers unlock EV insights for Sales Matching to exposures in a multitude of major platforms, helping them put their campaigns in drive. We have the tools and solutions to help automotive marketers better target EV customers and attribute sales. Our DataHub™ contains daily, lead-level data to help you find exactly who is in-market to increase the potential of your advertising spend.

Let us show you how we can help you out-compete the competition. If you’d like to talk to someone at Urban Science about how you can achieve EV sales leadership through smarter, science-based marketing, call or email me.

Carl Matter

Director, AdTech Performance

cwmatter@urbanscience.com

+1 313-748-7525

1. “The Number of EV Models will Double by 2024,” visualcapitalist.com/the-number-of-ev-models-will-double-by-2024

2. This survey was conducted online from January 26 to February 15, 2023, by The Harris Poll on behalf of Urban Science among 3,022 US adults aged 18+ who currently own or lease or plan to purchase or lease a new or used vehicle in the next 12 months. Data are weighted where necessary by age by gender, race/ethnicity, region, education, marital status, household size, household income, and propensity to be online to bring them in line with their actual proportions in the population.

Respondents for this survey were selected from among those who have agreed to participate in our surveys. The sampling precision of Harris online polls is measured by using a Bayesian credible interval. For this study, the sample data is accurate to within +2.6 percentage points for auto-buyers. This credible interval will be wider among subsets of the surveyed population of interest. All sample surveys and polls, whether or not they use probability sampling, are subject to other multiple sources of error which are most often not possible to quantify or estimate, including, but not limited to coverage error, error associated with nonresponse, error associated with question wording and response options, and post-survey weighting and adjustments.

3. LMC Automotive, March 2022, and Urban Science Ensemble Modeling Distribution