-

SOLUTIONS

MANUFACTURER

NETWORKPERFORMANCEProactive network management to connect today’s consumers with automotive more efficiently.

SALESPERFORMANCEUncover what really impacts daily performance to grow market share.

AFTERSALESPERFORMANCEBring customers back to increase service retention and build long-term loyalty.

MARKETINGPERFORMANCEScientific precision to make every marketing dollar work harder.

- INSIGHT LAB

FEATURED

April 22nd, 2024Shades of Change: How Color Preferences could influence EV adoption.March 12th, 2024Charging ahead: navigating the dynamic evolution of the UK’s electric vehicle market in 2024February 21st, 2024Urban Science: U.S. automotive dealer count held steady as throughput hits post-pandemic high in 2023 - NEWSROOM

- ABOUT US

- CAREERS

- EVENTS

February 19th, 2024

Navigating the Roads of Change: A Look Into the Future of the Electric Vehicle Market in 2024 and Beyond

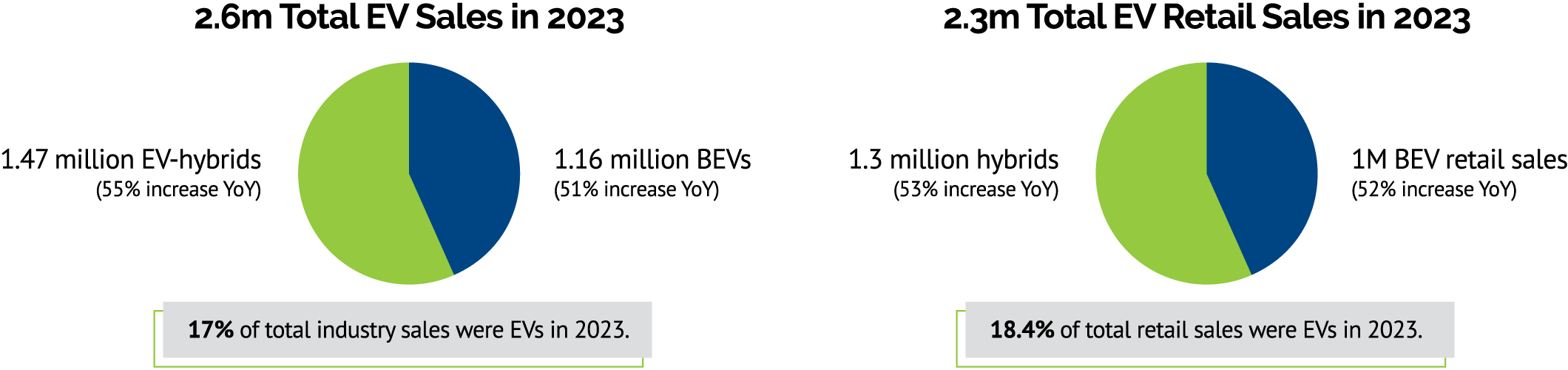

As we reflect on electric vehicle (EV) sales and market share growth in 2023, it’s clear that we’re witnessing the acceleration of a transformative era in the automotive industry. In the rearview mirror, 2023 was a landmark year for EVs, with unprecedented sales and market share growth. Both battery-electric (BEV) and hybrids (PHEVs and Gas-electric hybrids) soared over the one million mark, and together represented 17% of total vehicles sales in 2023.

Diving more specifically into Retail sales, which is a better reflection of the actual consumer sales driving EV adoption, we see both BEV and hybrid segments increasing in year-over-year (YoY) sales by over 50% and capturing 18.4% of total retail sales for 2023.

Tesla finished 2023 as the seventh largest retail sales brand in the U.S., according to our estimates, with a full-year 5% retail market share. That being said, Tesla’s domination of the ZEV market is waning, sliding from 63% in January 2022 down to only 41% by December 2023. While Tesla had warned of lower production levels due to factory upgrades and new vehicle launches, this considerable slowdown is leaving more opportunity on the table for other manufacturers to increase their share of the ZEV market.

The surge in electric vehicle adoption is setting the stage for a dynamic landscape in 2024 and beyond.

Non-Tesla EV volume was up over 80%

EV Growth and Trends for 2024

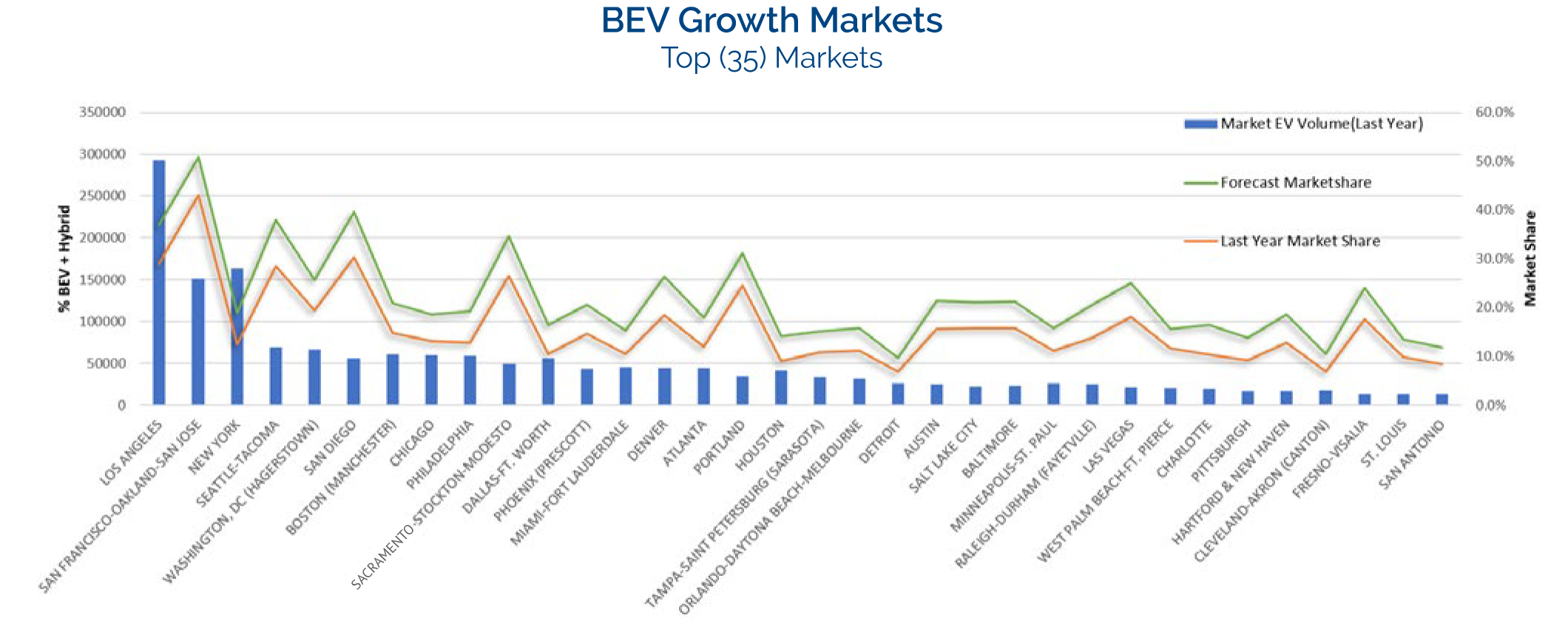

In the automotive industry nationwide, we’re still in the early adopters’ phase, where about 15% of the population, often higher-income, urban and influential individuals, has the ability to embrace new technology, like electric vehicles, and the means to navigate the various positives and negatives associated with it. While more of these early adopters are found in places like Silicon Valley than in Cleveland, they are present everywhere. The key for automakers lies in understanding the market intricacies.

As we progress in 2024, EV sales are anticipated to remain highly geographically clustered, leading to diverse experiences for dealers depending on their specific locations. The key to successful planning lies in accurate forecasting, where the identification of specific types and quantities of EVs, coupled with related services, becomes essential to effectively meet the demands of consumers. OEMs and Dealers must tailor their strategies based on the unique dynamics of each market, recognizing that success in this evolving landscape requires a nuanced and adaptable approach.

While the spotlight often shines on major urban or progressive markets, sleeper markets, like Honolulu and Las Vegas, are quietly becoming crucial hubs for EV growth. These regions present unique opportunities and challenges, making accurate market analysis and strategic planning crucial for sustained success.

Challenges Facing 2024 Growth

In a recent study by The Harris Poll,1 commissioned by Urban Science, 26% of auto buyers anticipate being ready for “only EV options” by 2025, a figure projected to surge to 50% by 2035. However, the path to this growth is not without its set of distinct challenges.

Challenge #1: Capturing early adopters and shaping public perceptions

A primary focus is on targeting and marketing to early adopters, the key drivers of positive sales trends and essential contributors to the building of a tangible EV market presence that will help dealers believe more in the potential of EV and help the majority of customers start to see them as less risky. Dealers wield considerable influence over early adopters, making it imperative to educate and engage them in buying EVs. Aligning with dealer interests and attracting early adopters requires a strategic approach that involves physically going to the places where early adopters gather, exposing them to EV education, and increasing awareness and consideration for electric vehicles. Accurate EV sales forecasting becomes critical for identifying these locations.

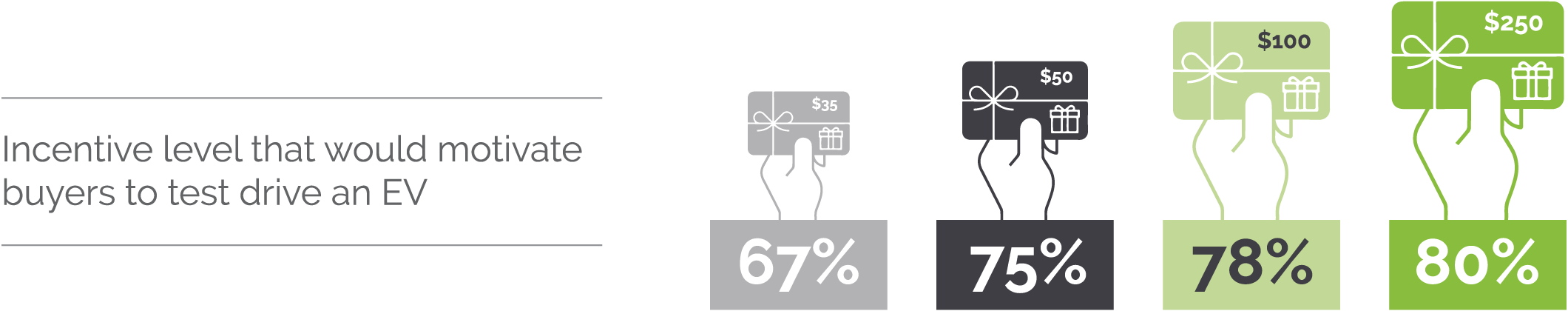

Yet, manufacturers face another challenge. To effectively engage the target audience and amplify EV sales, manufacturers must navigate the complexities of marketing in an evolving EV landscape with precision and innovation. Understanding the influence of advertising on early adopters is paramount, and key to this is recognizing their unique behaviors and preferences. Studies indicate that this demographic appreciates active engagement, preferring to be “in the know” to make educated and confident decisions. Utilizing a dual strategy that combines data-driven targeting specific to EV interests with the allure of test-drive incentives is critical for motivating this demographic.

Data-driven targeting

Effective collaboration with partners armed with accurate daily industry-wide sales data and data-enriched predictive modeling is indispensable for accurately targeting potential EV buyers. While many brands are enjoying an increase in first-time buyers of EVs, it’s important to not become complacent. Many first-time EV buyers are early adopters and/or those with higher household incomes than those who will buy EVs in the future. It’s critical to work with a partner who has engine-level data that can then be leveraged to create EV audience segments that take all these behaviors into account. That allows for confident marketing to target households that are predicted to be in-market for an electric vehicle or plug-in hybrid in the next 90 days.

Test-drive incentives

In addition to targeting strategies, brands should also consider private, precisely-tailored test drive incentives as a means of creating exposure to EV models and reinforcing early adopters’ purchase confidence. According to our research, conducted alongside The Harris Poll,2 over 67% of auto-buyers indicate that a cash incentive as small as $35 would motivate them to test drive an EV.

In essence, the success of EV market share growth hinges on a multi-faceted approach that involves targeted exposure, accurate forecasting, engaging advertising and incentivizing experiences, all aimed at winning over the influential early adopter segment and creating a more positive perception of EVs among the broader customer base. Manufacturers must become the key orchestrators in facilitating proactive dealer integration into this transformative era by empowering their success. Access to cutting-edge digital marketing support, essential insights and innovative tools for identifying emerging EV patterns in their designated marketing areas (DMAs) can help drive sales opportunities in the door, but the key to long-term sustainability and success will lie in strategically navigating charging infrastructure challenges to ensure your EV customer base can conveniently power their vehicles.

Challenge #2: Overcoming infrastructure hurdles for sustained success

While the future of widespread EV adoption may seem distant, the reality is that infrastructure planning is a time-consuming endeavor. Looking ahead, a significant challenge emerges in the form of Multi-Unit Dwellings (MUD), particularly in residential and urban settings. A recent 2022 California Energy Commission study found that – at most – only 33% of multi-family dwelling residents could ever potentially have home charging access, which means 67% of multi-family residents will never have access to home charging in California, even under the most optimistic scenario.3

The importance of convenient charging infrastructure cannot be overstated; encouraging EV adoption without convenient charging solutions can have lasting negative impacts on brand loyalty and reputation, both for dealers and consumers. It’s essential to recognize that the ownership experience of an EV should not only be good initially but must persist as a positive and convenient journey for sustained success. Successfully addressing this challenge demands foresight and proactive strategies to ensure the seamless integration of EVs into these environments.

The automotive industry’s journey toward EV adoption stands at a crossroads of opportunity and obstacle. While the appetite for EVs is forecasted to continue growing in 2024, there are significant challenges that must be navigated with strategic acumen. Capturing early adopters, aligning with dealer interests and effectively marketing EVs are at the forefront, while the issue of charging infrastructure looms in the background. By tackling these challenges head-on through innovative, data-driven marketing strategies that resonate with potential buyers and ensuring the accessibility of charging for sustained EV use, the industry can facilitate a smoother path to widespread EV adoption, foster long-term brand loyalty and establish a sustainable, electrified future.

67% of multi-family residents will never have access to home charging in California

Science as a solution

Since our founding over 45 years ago, our proven, scientific approach to retailer planning has continued to improve and evolve. It’s an approach that stays ahead of the technological curve to help improve the performance of retailer networks – and it continues to be the industry standard.

If you’d like to talk to someone at Urban Science about the topics discussed in this article, including learning about ServiceView™ – our aftersales tool that optimizes the service-alert handling process and helps identify and quantify incremental revenue opportunity delivered via telematics – call or email me.

To learn more about the future of EVs and access cutting-edge insights, don’t hesitate to reach out today.

Tom Kondrat

Tom Kondrat

Global Lead, Advanced Analytics

tlkondrat@urbanscience.com

1. Source: Urban Science® DataHub™ | Sales

2. Source: Urban Science Online Consumer and Dealer Studies, February 2023. These surveys were conducted by The Harris Poll on behalf of Urban Science among 3,022 U.S. adults aged 18+ and 250 U.S. automotive dealers.

3. “Home Charging Access in California,” energy.ca.gov