-

SOLUTIONS

MANUFACTURER

NETWORKPERFORMANCEProactive network management to connect today’s consumers with automotive more efficiently.

SALESPERFORMANCEUncover what really impacts daily performance to grow market share.

AFTERSALESPERFORMANCEBring customers back to increase service retention and build long-term loyalty.

MARKETINGPERFORMANCEScientific precision to make every marketing dollar work harder.

- INSIGHT LAB

FEATURED

April 22nd, 2024Shades of Change: How Color Preferences could influence EV adoption.March 12th, 2024Charging ahead: navigating the dynamic evolution of the UK’s electric vehicle market in 2024February 21st, 2024Urban Science: U.S. automotive dealer count held steady as throughput hits post-pandemic high in 2023 - NEWSROOM

- ABOUT US

- CAREERS

- EVENTS

Urban Science Annual Index:

how omnichannel retailing can be a “win-win” for OEMs and dealers

This piece is the third in a series of Urban Science articles driven by 2023 Dealership Transformation Index research conducted alongside The Harris Poll.

July 27th, 2023

Navigating the changing automotive landscape with the power of science

Online retailing is hot – and it’s only getting hotter. According to Automotive News, “the nation’s public dealership groups say they saw continued digital sales growth in the third quarter, with some retailers selling thousands of vehicles through online sales platforms and others reporting at least half of their transactions involved some online activity.”1 Just this month, a major OEM expanded its digital retailing suites (mainstream and luxury) to include F&I operations.2

Sophisticated digital retailing has joined in-dealership visits as an integral part of the modern omnichannel vehicle-purchase journey. When done right, omnichannel retailing helps dealers guide consumers from consideration to conversion smoothly and efficiently across online and offline channels. When done wrong, however, it can lead to disjointedness and dissatisfaction within the sales funnel that ultimately leads to lost opportunities and wasted time and resources.

Exploring changing auto-buyer and dealer sentiments

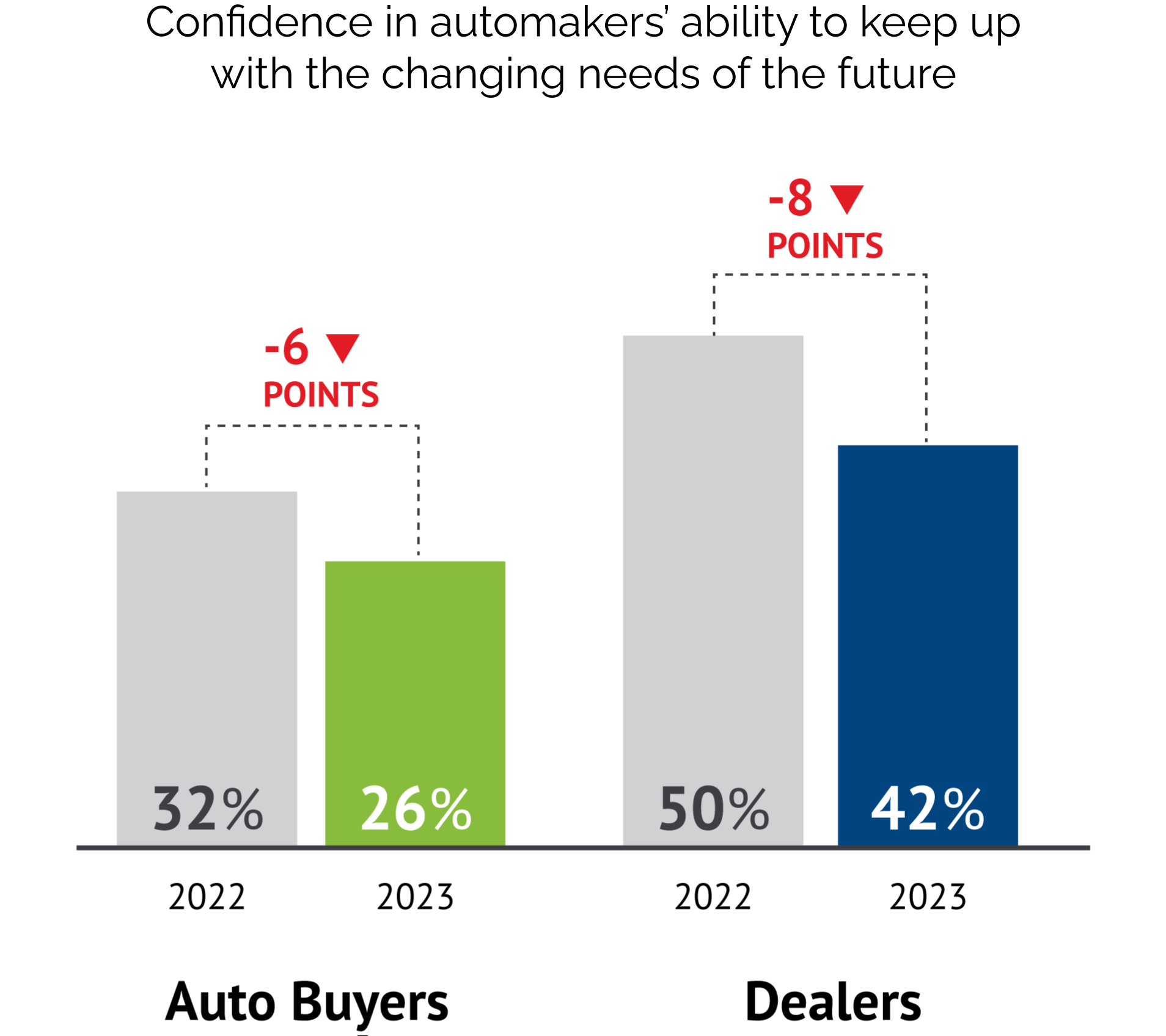

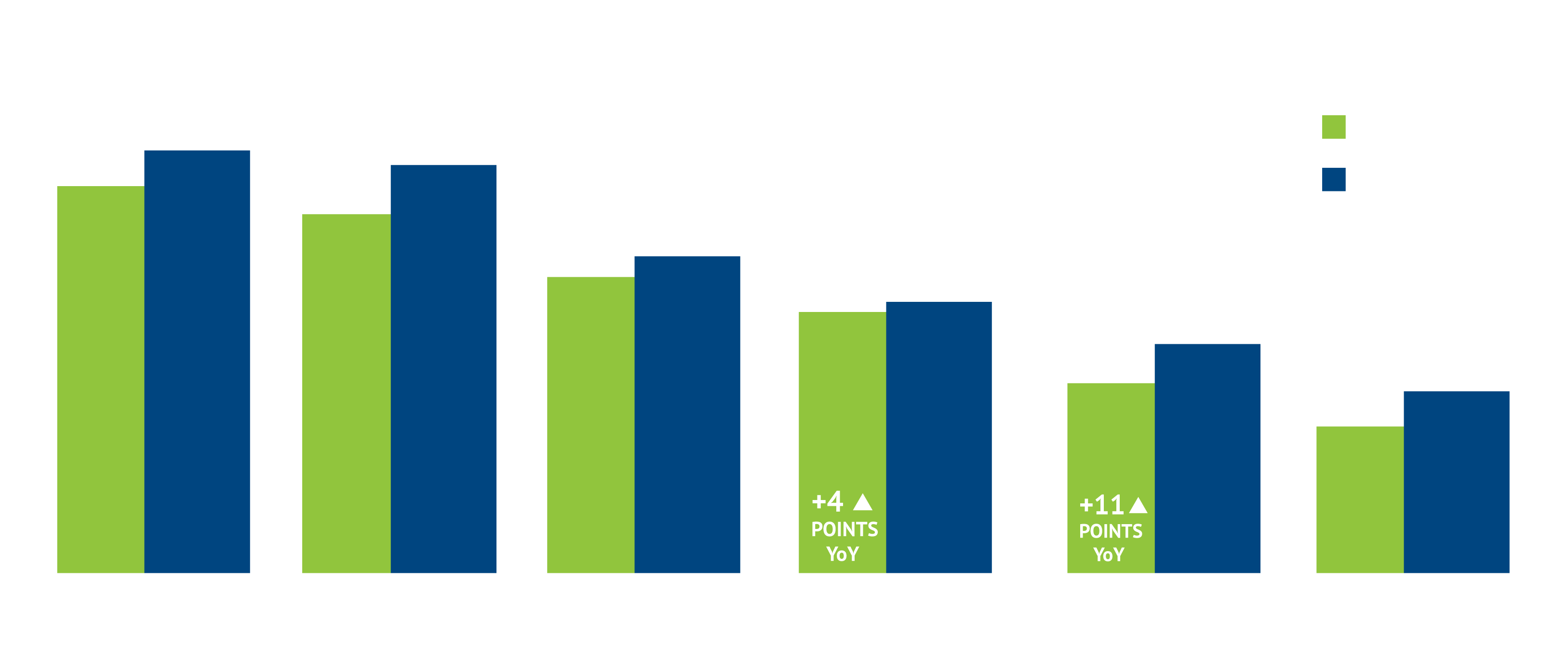

According to our DTI study,3 there’s been a significant year-over-year (YoY) decline in auto-buyer confidence in automakers’ collective ability to keep up with changing future needs, dropping from 32% last year to 26% in 2023. Dealers are also expressing less confidence in automakers’ collective ability to keep up, with figures falling from 50% in 2022 to 42% this year.

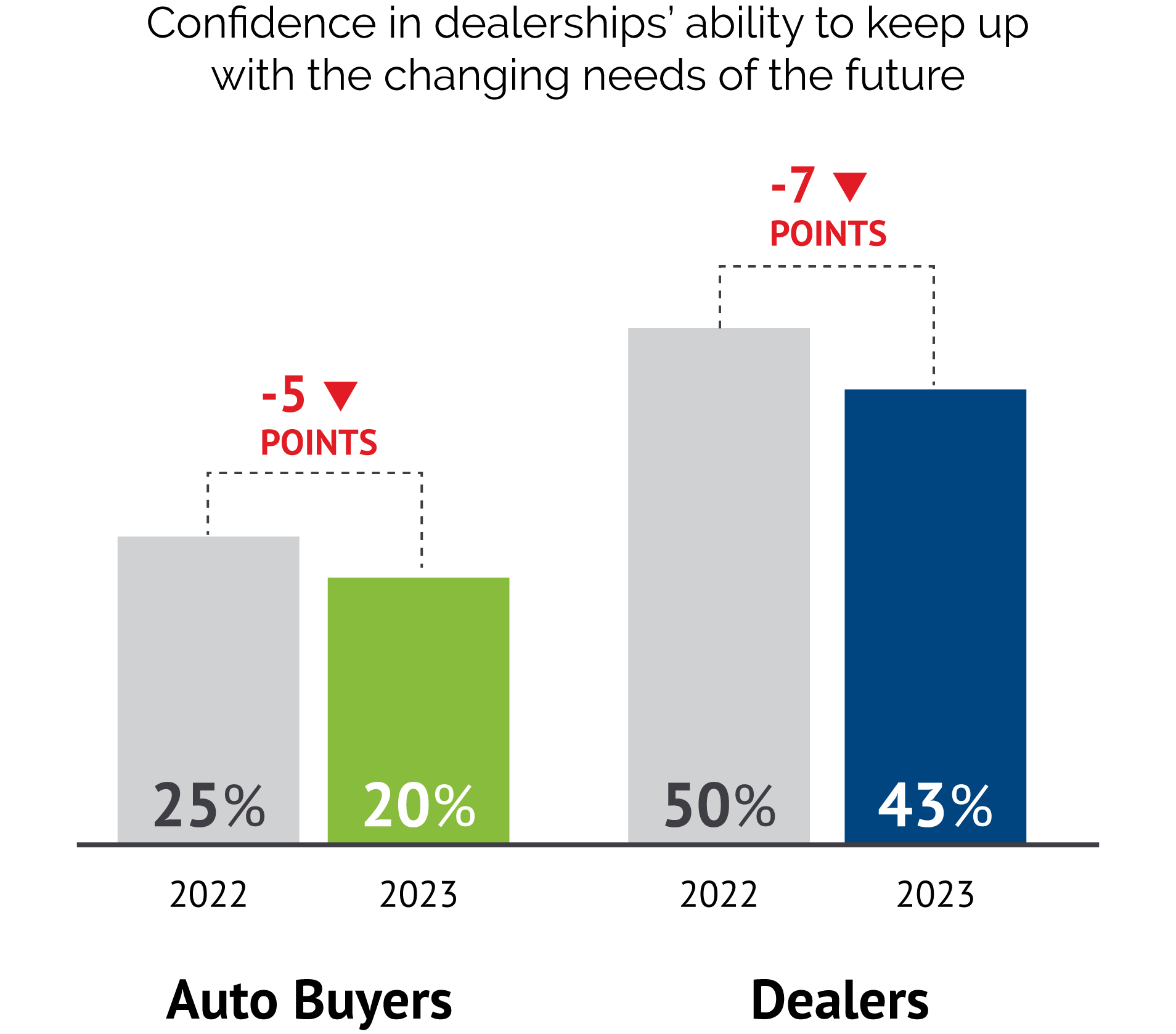

But it’s not just perceptions of automakers that are declining. Auto buyers’ confidence in car dealerships’ ability to keep up has decreased from 25% last year to 20% in 2023, while dealer confidence in themselves (in this regard) has declined from 50% to 43% during the same period.

Diving deeper into the data shows millennials play a significant role in driving overall auto-buyer declines in confidence. Across this key vehicle-buying demographic – which will continue to be the foundation of industry success for the foreseeable future – confidence in auto manufacturers dropped by 11 percentage points YoY, while confidence in car dealerships declined by 13 percentage points during the same period. To address this challenge and reverse the downslide, it’s critical that automakers and dealers alike heed these warning signals and sharpen their collective focus on innovative strategies and solutions that align with the evolving demands of their key target demographics, particularly millennials.

It’s worth noting, for instance, that millennials span a mixed base of buyers, from seasoned lessees to first timers or those purchasing additional, more lifestyle-oriented vehicles. This generation – which grew up with technology and online services quite literally in hand – demands convenience; delivering on its expectations is only feasible through a combination of a convenient physical network complemented with digital automotive-buying services.

Dealers grapple with industry shifts and path to future growth

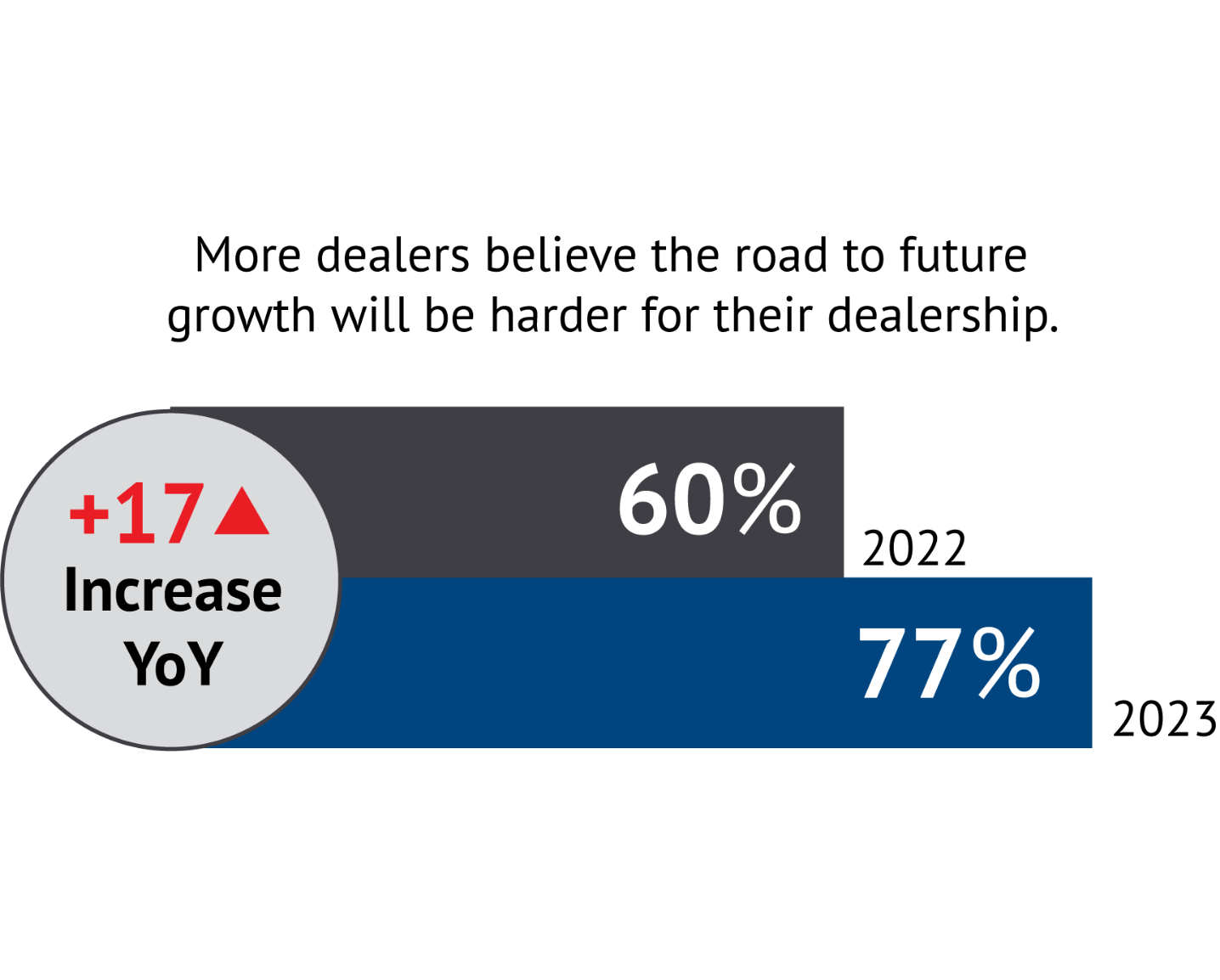

In 2023, dealers have expressed concerns about the challenges they face in achieving future growth for their stores. In fact, our data indicates dealer apprehension regarding future growth is surging. The number of dealers who believe the road to future growth is harder moving forward increased by 17 percentage points this year compared to 2022.

Three major areas dealers identified as having the most immediate impact on their business operations are 1) the rise of non-traditional dealers (e.g., CarMax and Carvana); 2) the industry’s rapid transition to electric vehicles; and 3) the increasing prevalence of nontraditional purchase models (e.g., digital retailing), which necessitates significant investments at the dealership level.

Striking a balance:

auto-buyers’ preference for brick and mortar in the digital age

The idea of fully digital retailing is gaining popularity in the automotive industry, but recent data indicates auto buyers are still somewhat hesitant to fully embrace this model. While digital retailing offers convenience and flexibility, there are still concerns among buyers regarding the lack of personal interaction and the inability to physically see and test drive a vehicle before making a purchase, among other key in-person interactions they see as valuable experiences.

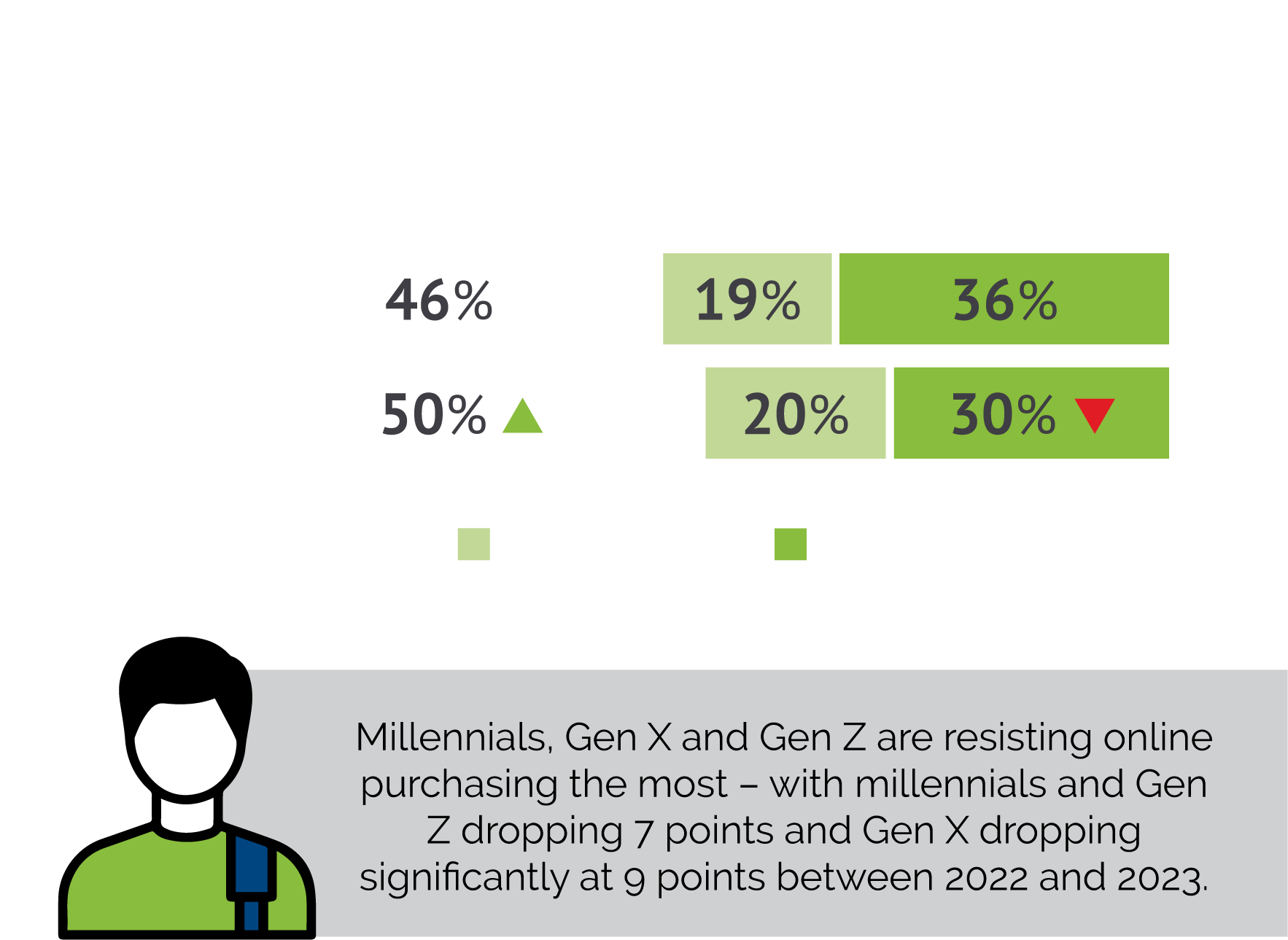

According to our research, auto-buyer openness to fully online purchases declined sharply YoY. Respondents who strongly agreed with the statement, “I’m open to purchasing a vehicle fully online” fell from 36% to 30%. This downward trend was driven primarily by Gen X respondents, whose strong agreement fell by nine percentage points. Millennials and Gen Z respondents’ openness declined by seven percentage points each, while boomers’ relative resistance to fully online purchases remained stable.

Beyond the showroom: guiding shoppers to conversion with seamless shopping experiences

Despite the preference for physical dealerships when purchasing a vehicle, our research also indicates the majority of auto buyers engage in some form of online research before making a purchase. This highlights the importance of having a strong online presence and providing relevant information to potential buyers before they shift from digital to physical interactions with a brand or store.

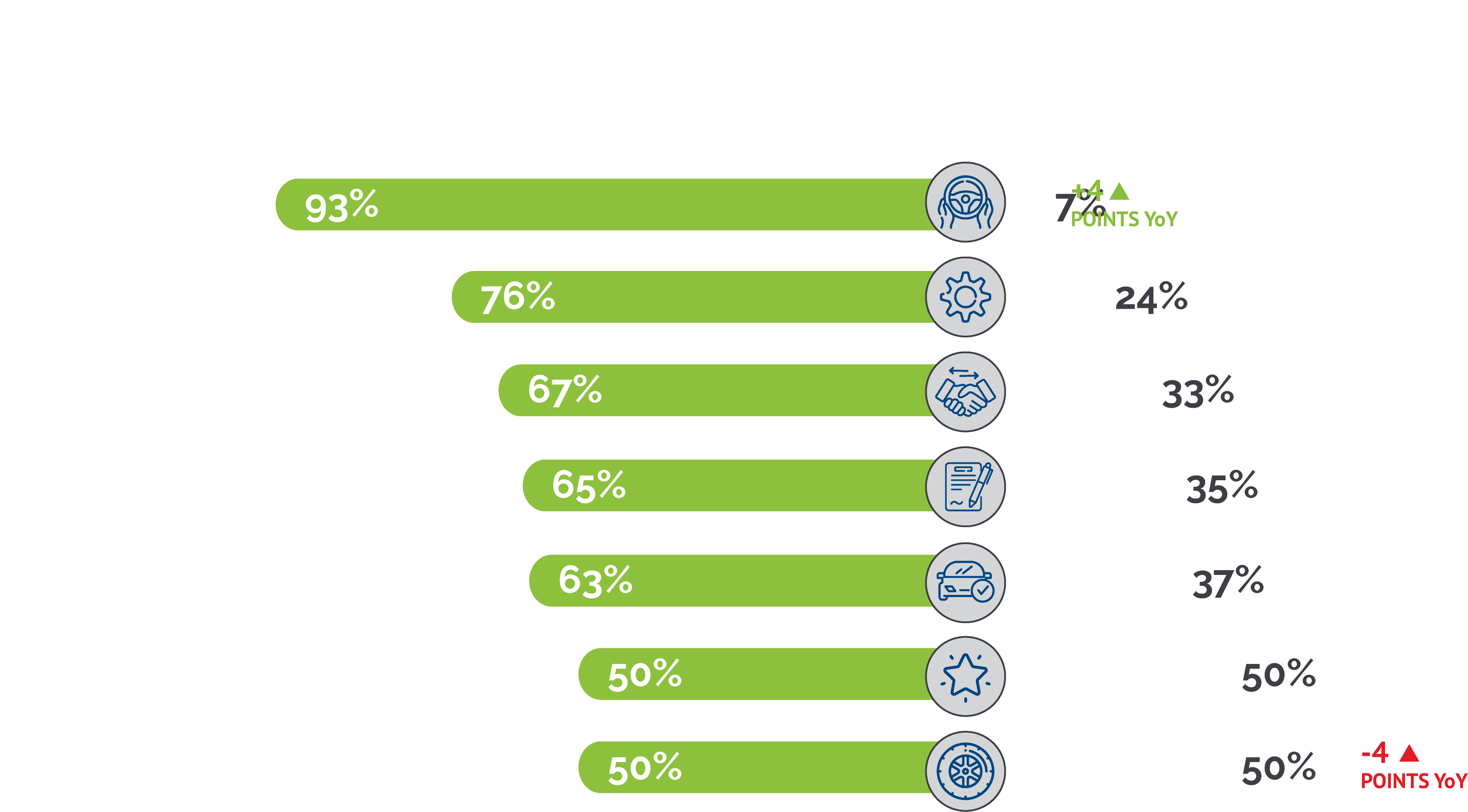

According to our research, auto buyers value in-person engagements to varying degrees along the shopping and purchase journey with an overwhelming 93% insisting on touching and feeling a vehicle through an in-person test drive.

New omnichannel touchpoints continue to emerge as channels to help OEMs and dealers meet customers where they are – and where they want to be. That includes digital tools that enhance the shopping experience, such as virtual reality, augmented reality displays, fully online ordering and at-home delivery services.

Experiences that aim to provide a more seamless and customer-centric experience, combining the advantages of digital and physical channels, go a long way in nurturing consumers along the marketing and sales funnels. At the transactional level, auto buyers increasingly expect dealers to provide online experiences that deliver convenience and efficiency.

Providing valuable in-person engagements outside the traditional dealership

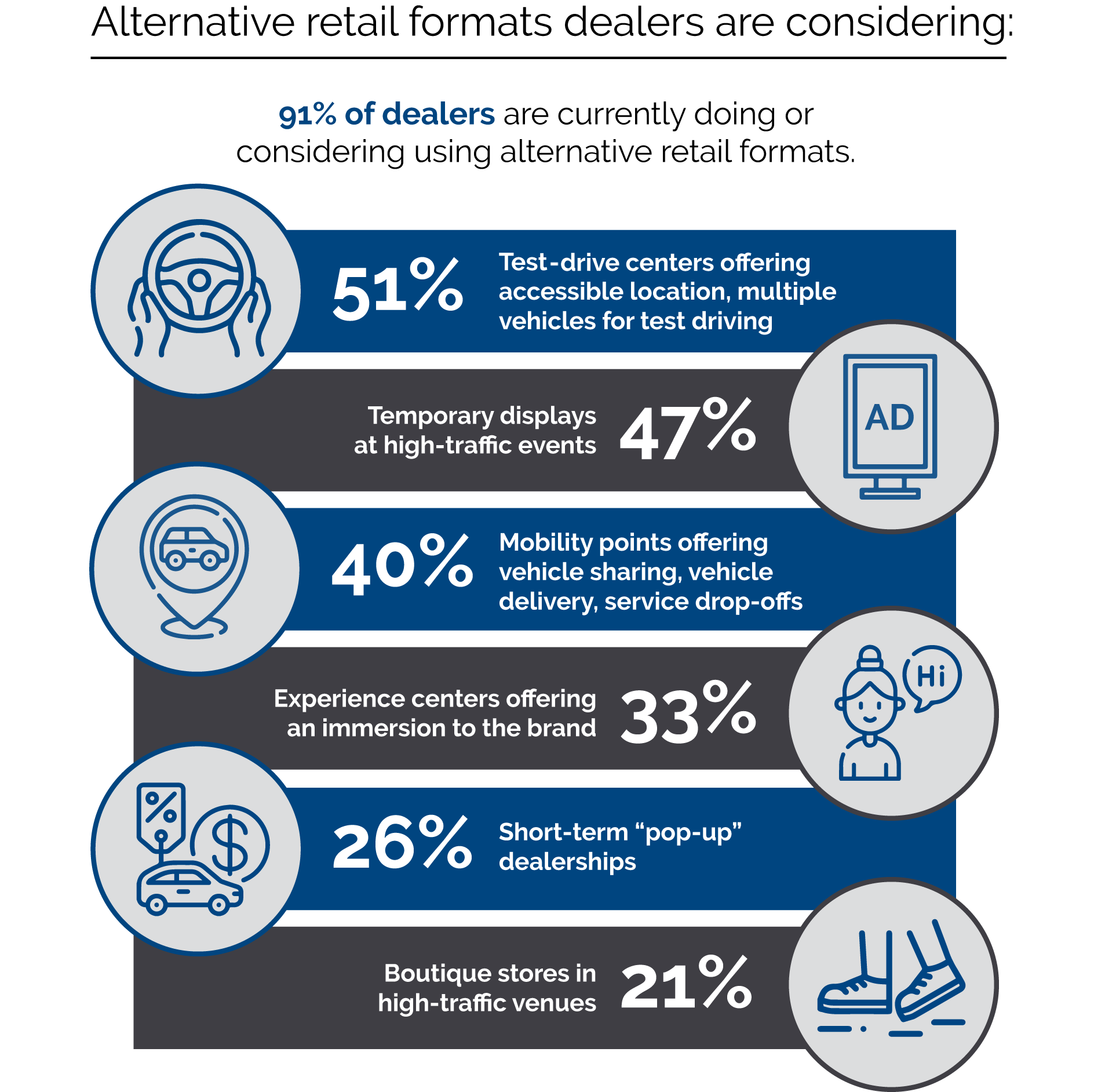

Alternative retail formats are becoming more popular as dealers look for new ways to engage consumers. Of the dealers we surveyed, 91% are currently doing or considering alternative retail formats. And among those dealers, the top-three formats are test-drive centers (51%), temporary displays at high-traffic events (47%), and mobility points offering vehicle sharing, vehicle delivery and service drop-offs (40%).

Outside the top three, there are additional emerging formats dealers are considering, including “brand experience centers,” through which auto manufacturers create immersive and interactive spaces for consumers to explore their brand(s) and products. These centers often feature virtual reality experiences, test drives and product showcases, allowing buyers to engage with the brand(s) on a deeper level.

Another growing format is the “pop-up store” model, typically opened in temporary retail spaces at high-traffic locations (e.g., shopping malls or city centers), to attract potential buyers. Pop-up stores offer a unique opportunity for brands to create a buzz, generate interest and engage with customers in a more casual and relaxed setting to qualify them, and build a rapport, prior to engaging them in more formal sales workflows. Additionally, some dealerships are adopting a “store within a store” approach, collaborating with other retailers to create a shared space that offers a diverse range of products and services. This allows dealerships to tap into different customer bases and provide a more holistic shopping experience.

These incremental, convenient retail locations function well as lead generators for sales. Decisions, however, such as whether the location is semi-permanent or temporary should be rooted in science and near-real-time industry sales data, as these retail shopping areas can be costly to implement and maintain.

Fast-tracking customers from omnichannel interactions to closed sales

The most successful dealers continue to forge ahead on their paths to create seamless, meaningful connections with those in need (or likely to be in need) of their services. By creating a seamless omnichannel experience, dealers and OEMs can guide auto buyers across channels to ensure a smooth car-buying experience from initial contact to final sale.

Key considerations in creating new retail journeys that drive engagement, conversions, loyalty and profitability:

- Embrace and continue to push forward with – digital retailing while remaining focused on current customer wants and needs

- Continue to activate new channels, processes and best practices that close gaps between existing channels

- Invest in processes, tools and technology to ensure seamless omnichannel opportunities that provide choices and convenience for all customers and a wide range of preferences

- Drive continued collaboration and alignment between OEMs and dealerships to avoid missteps that can create costly issues during the online purchase process (e.g., OEM trade-in overvalues a vehicle, resulting in a dealer losing money or disappointing the customer)

Science as a solution

Since our founding over 45 years ago, our unrivaled near-real-time industry sales data and consulting and technology offerings have driven innovation, efficiency and profitability into every corner of the automotive industry. Our capabilities and solutions help OEMs and dealers, and the advertising technology firms that support them, to stay ahead of industry trends and achieve business certainty in even the most chaotic market conditions.

This article is one in a series on our DTI research, revealing additional auto-buyer and dealer insights that can guide OEMs and dealers to science-driven strategies that will improve performance. Going forward, look for our insights regarding dealership service, consumer purchase behaviors and dealership performance measurement.

In the meantime, if you’d like to talk to someone at Urban Science about how you can achieve new levels of efficiency and profitability across your dealership sales model throughout unmatched data and industry expertise – or if you have any questions about the information included in this article – please contact us now.

Read next article

1. “A Digital Shift: Dealer Groups Adjust as More Customers Turn to Omnichannel Sales,”

https://www.autonews.com/retail/car-dealers-adjust-customers-turn-omnichannel-sales

2. “Toyota’s SmartPath to Close Big Hole in Process with Digital F&I,”

https://www.autonews.com/finance-insurance/toyota-lexus-digital-retail-software-moves-online-fi-office

3. This survey was conducted online by The Harris Poll on behalf of Urban Science among 3,022 US adults aged 18+ who currently own or lease or plan to purchase or lease a new or used vehicle in the next 12 months (referred to in this report as “auto-buyers” or “auto-buying public”), and 250 U.S. OEM automotive dealers, whose titles were Sales Manager, General Manager, or Principal/VP/Owner.

The auto-buying public survey was conducted from January 26 to February 15, 2023. Data are weighted where necessary by age by gender, race/ethnicity, region, education, marital status, household size, household income, and propensity to be online to bring them in line with their actual proportions in the population. The dealer survey was conducted January 26 to February 17, 2023. Results were not weighted and are only representative of those who completed the survey.

Respondents for this survey were selected from among those who have agreed to participate in our surveys. The sampling precision of Harris online polls is measured by using a Bayesian credible interval. For this study, the sample data is accurate to within +2.6 percentage points for auto-buyers and +6.2 percentage points for dealers using a 95% confidence level. This credible interval will be wider among subsets of the surveyed population of interest.

All sample surveys and polls, whether or not they use probability sampling, are subject to other multiple sources of error which are most often not possible to quantify or estimate, including, but not limited to coverage error, error associated with nonresponse, error associated with question wording and response options, and post-survey weighting and adjustments.