-

SOLUTIONS

MANUFACTURER

NETWORKPERFORMANCEProactive network management to connect today’s consumers with automotive more efficiently.

SALESPERFORMANCEUncover what really impacts daily performance to grow market share.

AFTERSALESPERFORMANCEBring customers back to increase service retention and build long-term loyalty.

MARKETINGPERFORMANCEScientific precision to make every marketing dollar work harder.

- INSIGHT LAB

FEATURED

April 22nd, 2024Shades of Change: How Color Preferences could influence EV adoption.March 12th, 2024Charging ahead: navigating the dynamic evolution of the UK’s electric vehicle market in 2024February 21st, 2024Urban Science: U.S. automotive dealer count held steady as throughput hits post-pandemic high in 2023 - NEWSROOM

- ABOUT US

- CAREERS

- EVENTS

August 7th, 2023

On all fronts, dealers are sharpening their focus on driving sales loyalty.

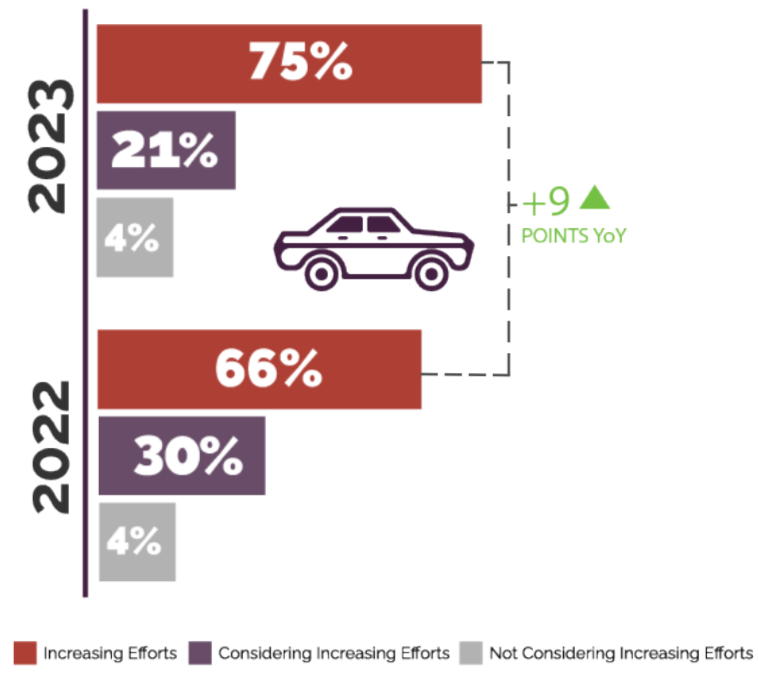

While new vehicle sales are returning to more normal levels in the coming year, intense competition for vehicle sales remains a constant. As a result, dealers are sharpening their focus on keeping previous buyers loyal. That includes contacting them more frequently than they may have before for everything — sales, leases and service. In a recent study by The Harris Poll,1 commissioned by Urban Science, dealers reported increasing efforts or are considering increasing their efforts to keep previous buyers loyal.

The hard evidence is in the data.

Dealer efforts to keep previous buyers loyal:

Service departments continue to play a critical role

in customer loyalty.

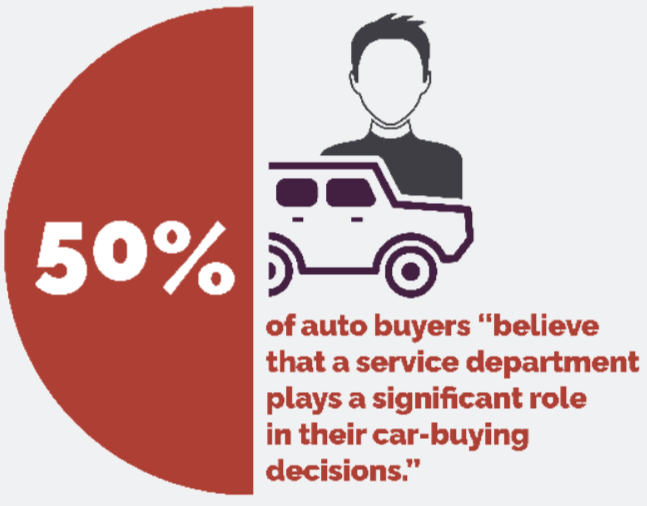

Service departments continue to drive profitability for dealerships and, more importantly, remain the primary source to build strong, long-term loyalty with customers.

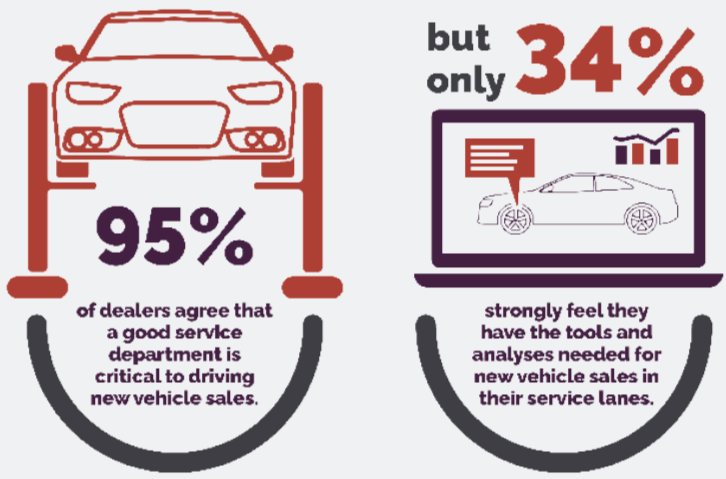

While the vast majority of dealers agree that a good service department is critical to driving new vehicle sales, fewer believe they have the tools and analyses needed to understand the opportunity for new vehicle sales in their service lanes.

With competition knocking on the back door, OEMS and their dealers need a solution that leans into service departments to drive future vehicle sales.

Accurate service-to-sales analysis can zero in on sales opportunities waiting in service lanes.

Our ServiceView™: Service-to-Sales Analysis is the industry’s first and only conversion analysis that empowers OEMs and dealers to better measure and drive sales across service-loyal customers. We tap the power of our near-real-time industry sales data to better understand the importance of where service-loyal customers purchase their next vehicles – including competitive-brand stores – and the value of cultivating service department-customer relationships. Additionally, our analysis highlights strategic ways to capture more service opportunities, efficiency and profitability for automakers and dealerships alike.

If you’d like to talk to someone at Urban Science about how we can leverage the power of science to create a robust service strategy that helps dealerships better close the loop on new vehicle sales, call or email me.

Piermichele Robazza

Global Practice Director, Aftersales Solutions, Urban Science, Inc.

pmrobazza@urbanscience.com

+1-248-231-1218

1. This survey was conducted online by The Harris Poll on behalf of Urban Science among 3,022 US adults aged 18+ who currently own or lease or plan to purchase or lease a new or used vehicle in the next 12 months (referred to in this report as “auto-buyers” or “auto-buying public”), and 250 U.S. OEM automotive dealers, whose titles were Sales Manager, General Manager, or Principal/VP/Owner. The auto-buying public survey was conducted from January 26 to February 15, 2023. Population. The dealer survey was conducted January 26 to February 17, 2023.