-

SOLUTIONS

MANUFACTURER

NETWORKPERFORMANCEProactive network management to connect today’s consumers with automotive more efficiently.

SALESPERFORMANCEUncover what really impacts daily performance to grow market share.

AFTERSALESPERFORMANCEBring customers back to increase service retention and build long-term loyalty.

MARKETINGPERFORMANCEScientific precision to make every marketing dollar work harder.

- INSIGHT LAB

FEATURED

April 22nd, 2024Shades of Change: How Color Preferences could influence EV adoption.March 12th, 2024Charging ahead: navigating the dynamic evolution of the UK’s electric vehicle market in 2024February 21st, 2024Urban Science: U.S. automotive dealer count held steady as throughput hits post-pandemic high in 2023 - NEWSROOM

- ABOUT US

- CAREERS

- EVENTS

Urban Science Annual Index:

from maintenance to excellence – preparing fixed ops to thrive in the EV future

Fourth in a series of Urban Science articles driven by our 2023 Dealership Transformation Index research conducted alongside The Harris Poll

In this article, we’ll explore findings regarding dealership service across the U.S. and share key insights OEMs and dealers should consider to drive profitability and business success across their stores now and down the road.

August 15th, 2023

Adapting to ongoing industry shifts and preparing for the EV future

Amid a dynamic automotive landscape, dealership service operations continue to play a vital role in driving stability and success for automotive retailers in the U.S. Strong, seamless service operations powered by loyal customers not only generate high-margin engagements on the back end, they also develop meaningful interactions and relationships that lead to long-term customer loyalty and future sales through a strong service-to-sales loop: a cornerstone of leading dealerships nationwide.

As the automotive industry undergoes a significant aftersales-related transition with an increasing number of electric vehicles (EVs) on the road, manufacturers and dealers must sharpen their focus on driving traffic and loyalty across dealership service operations to survive and thrive during and after this transition period. Dealerships must anticipate future trends, adapt to emerging technologies and position themselves at the forefront of the EV revolution to assume and maintain market leadership.

The power of positive (and convenient) service experiences in driving sales

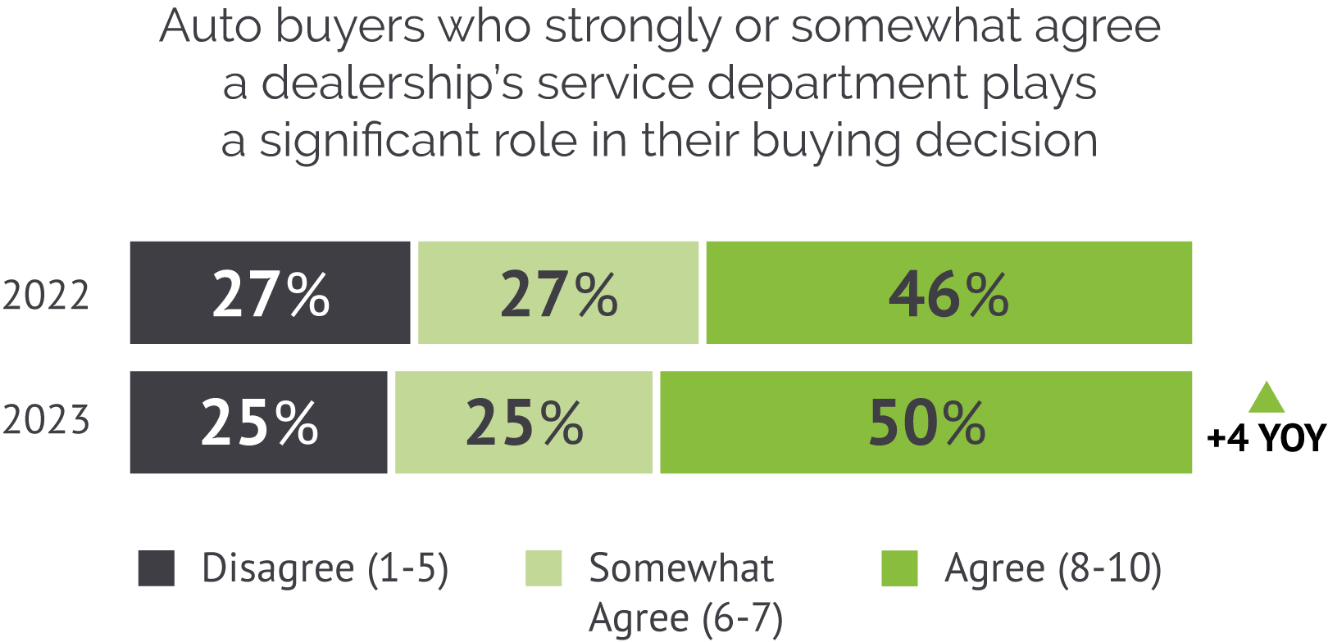

While dealership familiarity and convenience are essential elements of customer loyalty, impressions of a store’s service department hold significant – and increasing – influence over auto buyers’ purchasing decisions. In fact, this influence rose four percentage points since last year’s study.

Good impressions, however, only go so far. Our research reveals only 63% of vehicle owners return to the dealership where they made their initial vehicle purchase to get service, while 66% choose a servicing dealership based on its proximity to their home or office. As highlighted in our DTI insights regarding omnichannel retailing, reaching auto buyers who choose to service elsewhere requires a concerted effort across the various channels through which they engage.1 These findings highlight the value of building strong customer relationships, reaching out to customers through seamless omnichannel approaches and providing exceptional service experiences that align with customer expectations regarding convenience and familiarity.

By recognizing the influential role of service departments in driving success across their stores’ operations, dealers can better prioritize customer satisfaction, cultivate lasting connections and leverage their reputations to drive continued success – despite seismic industry shifts and ever-evolving customer preferences.

Building customer loyalty through service-to-sales integration

As mentioned previously, service departments are – and will continue to be – a driving force for healthy stores, especially as the average age of passenger vehicles on the road recently hit a record 12.5 years.2 Even with the increase of EVs on the road, the average internal combustion engine (ICE) vehicle sold today will need to be serviced through 2035. The greatest unrealized potential regarding prospective service interactions associated with these – and other – ICE vehicles often lies in building strong, long-term customer loyalty that positions dealerships to generate future sales through these touchpoints and the brand perception they create.

Positive service experiences play a pivotal role in driving repeat maintenance and repair visits – and in generating positive online reviews and ultimately, new sales. Leading dealerships recognize and measure the critical connection between service and sales, and work diligently to create a service-to-sales loop that drives loyalty, return visits and lower sales conversion costs.

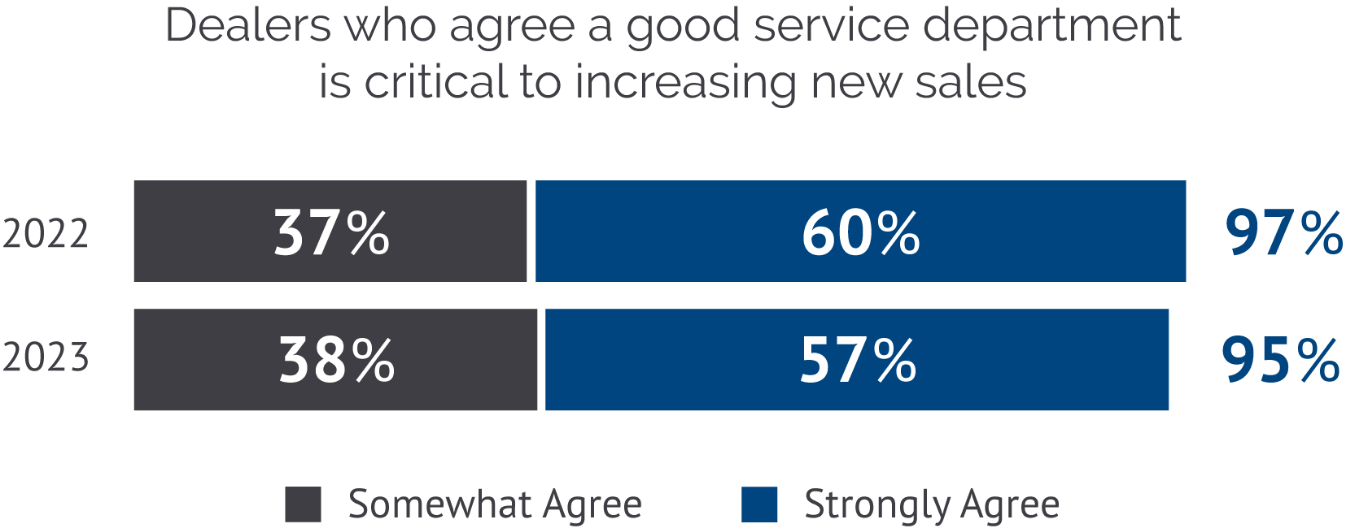

According to research from this year’s Urban Science Dealership Transformation Index™ (DTI), 95% of dealers acknowledge the significance of a good service department in promoting new-vehicle sales success at their dealership, albeit down slightly from 97% last year.3 At the same time, only 34% of dealers strongly agree their dealership “has the tools and analysis we need to understand the available opportunity for new-vehicle sales from our service lanes.” There are ways, however, to close that gap.

Overcoming perceived value challenges in service departments

Across the evolving automotive retail landscape, franchise dealership service departments face increasing challenges in terms of perceived value. How owners rate general repair shops compared to car dealerships depends highly on the type of service the vehicle needs. For installing original parts from the manufacturer, for instance, owners prefer car dealerships by a 3:1 ratio (75% to 25%). At the other end of the spectrum, owners prefer general repair shops for scheduled maintenance 54% to 46%.

Our research further revealed only 35% of U.S. auto buyers strongly agree franchise dealerships offer a distinctive value over general repair shops – a seven-percentage-point decline since 2022. The industry must take note of these warning bells because this collective auto-buyer perception poses a significant threat to dealership service operations and signals a greater – and urgent – need for dealerships to communicate with their customers and prospects in clear and focused ways.

To address these changing perceptions, dealerships must proactively reinforce the value they provide to customers. Failure to do so could result in further erosion of market share, ultimately impeding long-term business success.

Service-to-sales handoff

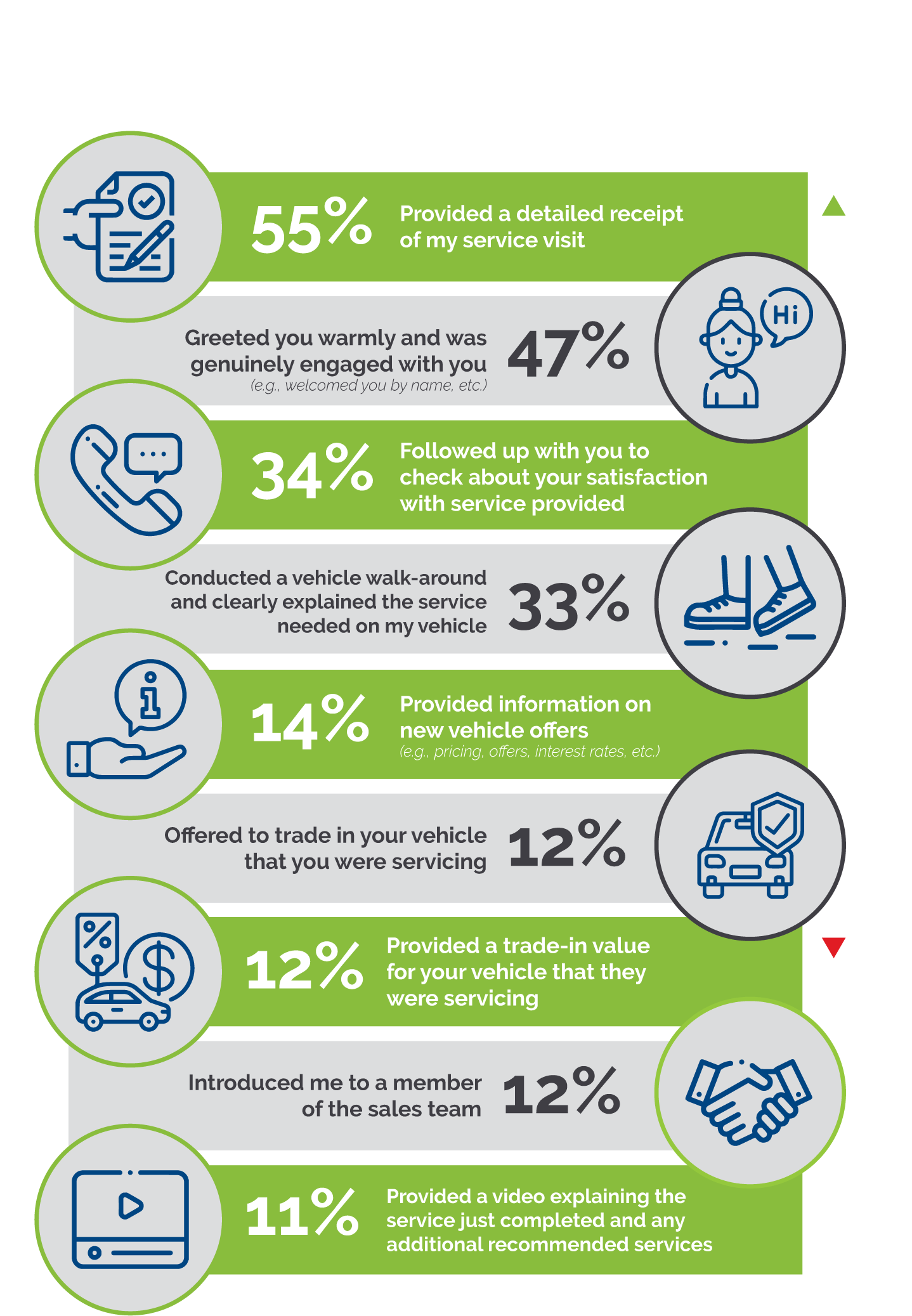

The phrase, “the sales department sells the first car and the service department sells the next 10” is a common refrain in the auto industry. And as we revealed last year, many dealers are able to increase the likelihood of new-vehicle sales by over threefold by using their service department as a driver of new-vehicle sales. There are two steps dealers need to take to increase service-to-sales effectiveness. First, increase the pool of service-loyal customers. Give them reasons to come back for service by providing an excellent experience at a competitive price. Second, engage customers and provide high-quality service in the present while planning for future sales potential by nurturing service-loyal customers through the marketing and sales funnels. Doing so is vital, as our findings of reported actions between auto buyers and service departments clearly show.

Accelerating customer engagement: the role of incentives in healthy service lanes (and showrooms)

Incentives continue to be a highly effective strategy for attracting customers to dealership service lanes. By offering incentives that customers view as desirable without breaking the bank, dealers can not only prompt customers to act, but also seize the opportunity to strengthen their relationships with customers that present growth potential – all within their allotted marketing budgets.

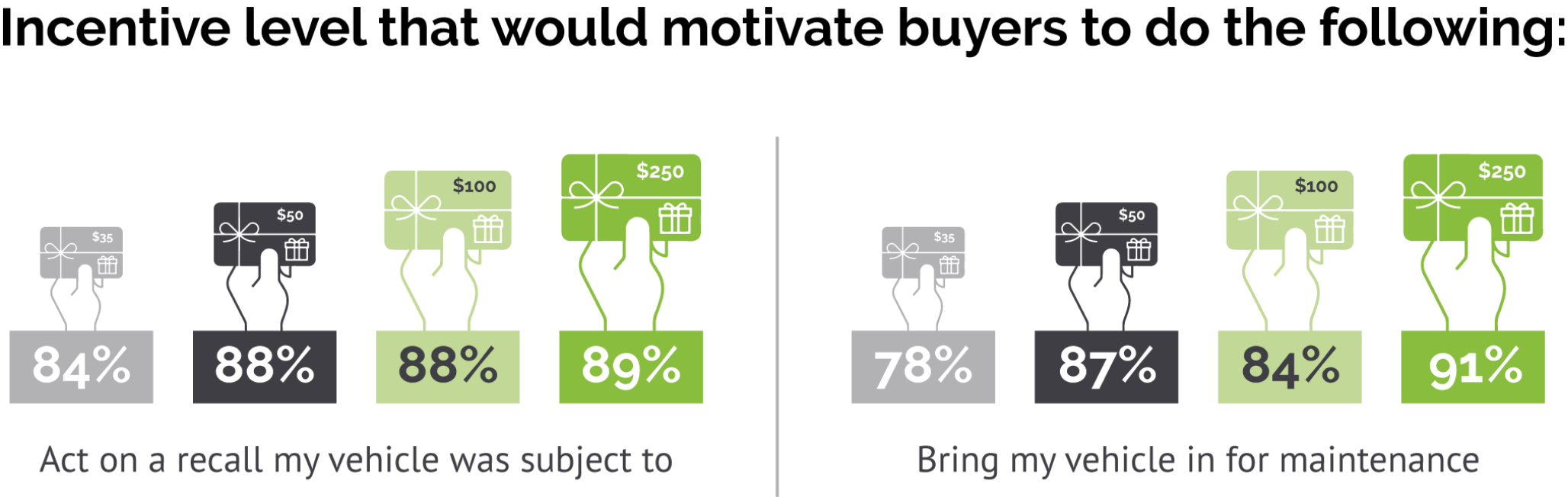

According to our research, auto buyers indicate a cash incentive as low as $35 would motivate them to both address a recall for their vehicle (84%), and bring their vehicle in for maintenance (78%). Regarding the aforementioned recall response insight, 84% of auto buyers saying they’d be motivated to address a recall represents a significant increase of eight percentage points compared to 2022. Considering recalls are often associated with safety concerns, it’s worth noting there’s minimal disparity in the effectiveness of relatively low ($35) incentives and higher incentive amounts ($250).

These findings highlight the continued significance of incentivization in driving customer action. Dealers can leverage targeted incentives to not only motivate customers to address recalls promptly, but also encourage them to prioritize general maintenance work. By utilizing strategic, targeted-incentivization strategies, dealerships can capitalize on these opportunities to strengthen customer relationships and enhance their service operations.

Opportunities for dealers

Dealership service – a crucial aspect of dealership operations – presents significant opportunities for those who are proactive and attentive to the needs of high-potential service customers (present and future). This year’s DTI data revealed untapped potential, and here’s how dealers can make the most of it:

- Close the service-to-sales loop – develop streamlined processes that capitalize on customer visits for service, leveraging the opportunity to convert them into potential sales when the time is right.

- Create a compelling value proposition – create an enticing value-to-cost proposition by bundling common repair services and promoting them through targeted marketing offers. Regain customers lost to independent repair facilities (IRFs), with a particular focus on millennials, who have a high potential for influence.

- Diagnose your service operations for success – dedicate time to analyze service and parts performance, identifying both short- and long-term opportunities. Gain insights into customer-retention challenges, enhance operational efficiency and uncover untapped potential in parts sales.

- Harness the power of recalls – utilize open recalls as an opportunity to reconnect with customers and establish long-term relationships. Deploy strategic, targeted incentives to engage current and prospective service customers, and to promote customer safety and satisfaction through recall completion and maintenance and repair.

Science as a solution

Since our founding over 45 years ago, our unrivaled near-real-time industry sales data and consulting and technology offerings have driven innovation, efficiency and profitability into every corner of the automotive industry. Our capabilities and solutions help OEMs and dealers, and the advertising technology firms that support them, to stay ahead of industry trends and achieve business certainty in even the most chaotic market conditions.

This article is one in a series on our DTI research, revealing additional auto-buyer and dealer insights that can guide OEMs and dealers to science-driven strategies that will improve performance. Going forward, look for our insights regarding consumer purchase behaviors and dealership performance measurement.

In the meantime, if you’d like to talk to someone at Urban Science about how you can achieve new levels of efficiency and profitability across your dealership sales model through our unmatched data and industry expertise – or if you have any questions about the information included in this article – please contact us now.

Read next article

1. “How omnichannel retailing can be a “win-win” for both OEMs and dealers,”

https://urbanscienceppd.usaitechdev.com/insightlab/omnichannel-retailing-win-win-oems-dealers/

2. “Amid High Prices, Americans Holding On To Their Cars Longer Than Ever,”

https://www.ny1.com/nyc/all-boroughs/news/2023/05/15/americans-hold-on-to-their-cars-longer-than-ever

3. This survey was conducted online by The Harris Poll on behalf of Urban Science among 3,022 US adults aged 18+ who currently own or lease or plan to purchase or lease a new or used vehicle in the next 12 months (referred to in this report as “auto-buyers” or “auto-buying public”), and 250 U.S. OEM automotive dealers, whose titles were Sales Manager, General Manager, or Principal/VP/Owner.

The auto-buying public survey was conducted from January 26 to February 15, 2023. Data are weighted where necessary by age by gender, race/ethnicity, region, education, marital status, household size, household income, and propensity to be online to bring them in line with their actual proportions in the population. The dealer survey was conducted January 26 to February 17, 2023. Results were not weighted and are only representative of those who completed the survey.

Respondents for this survey were selected from among those who have agreed to participate in our surveys. The sampling precision of Harris online polls is measured by using a Bayesian credible interval. For this study, the sample data is accurate to within +2.6 percentage points for auto-buyers and +6.2 percentage points for dealers using a 95% confidence level. This credible interval will be wider among subsets of the surveyed population of interest.

All sample surveys and polls, whether or not they use probability sampling, are subject to other multiple sources of error which are most often not possible to quantify or estimate, including, but not limited to coverage error, error associated with nonresponse, error associated with question wording and response options, and post-survey weighting and adjustments.

4. “DataHub Stats,” Urban Science® DataHub™